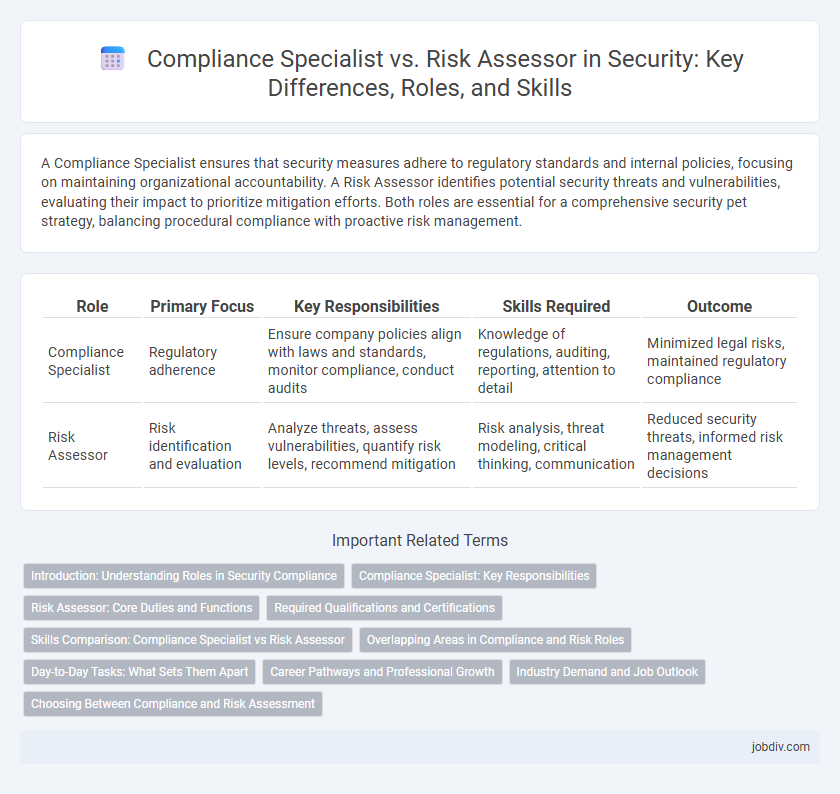

A Compliance Specialist ensures that security measures adhere to regulatory standards and internal policies, focusing on maintaining organizational accountability. A Risk Assessor identifies potential security threats and vulnerabilities, evaluating their impact to prioritize mitigation efforts. Both roles are essential for a comprehensive security pet strategy, balancing procedural compliance with proactive risk management.

Table of Comparison

| Role | Primary Focus | Key Responsibilities | Skills Required | Outcome |

|---|---|---|---|---|

| Compliance Specialist | Regulatory adherence | Ensure company policies align with laws and standards, monitor compliance, conduct audits | Knowledge of regulations, auditing, reporting, attention to detail | Minimized legal risks, maintained regulatory compliance |

| Risk Assessor | Risk identification and evaluation | Analyze threats, assess vulnerabilities, quantify risk levels, recommend mitigation | Risk analysis, threat modeling, critical thinking, communication | Reduced security threats, informed risk management decisions |

Introduction: Understanding Roles in Security Compliance

A Compliance Specialist ensures organizational adherence to laws, regulations, and internal policies by developing and implementing compliance programs that mitigate legal and regulatory risks. A Risk Assessor identifies, evaluates, and prioritizes potential threats to security infrastructure through systematic risk analysis, enabling informed decision-making and resource allocation. Both roles play critical parts in strengthening an organization's security posture by addressing different facets of risk management and regulatory compliance.

Compliance Specialist: Key Responsibilities

Compliance Specialists ensure organizations adhere to legal regulations and industry standards by developing, implementing, and monitoring compliance programs. They conduct regular audits, provide employee training on regulatory requirements, and prepare detailed reports for regulatory bodies. Their expertise helps prevent legal penalties and enhances organizational integrity in fields such as finance, healthcare, and cybersecurity.

Risk Assessor: Core Duties and Functions

Risk assessors analyze potential threats and vulnerabilities within an organization's systems, identifying risks that could impact data security and operational continuity. They conduct regular risk assessments, develop mitigation strategies, and ensure compliance with industry standards such as ISO 27001 and NIST frameworks. Their role is critical in prioritizing security controls and supporting incident response planning to safeguard organizational assets.

Required Qualifications and Certifications

Compliance Specialists typically hold certifications such as Certified Compliance and Ethics Professional (CCEP) or Certified Regulatory Compliance Manager (CRCM), with strong knowledge of regulatory frameworks like GDPR, HIPAA, and SOX. Risk Assessors often require certifications like Certified Risk Manager (CRM), Certified Information Systems Auditor (CISA), or ISO 31000 Lead Risk Manager, emphasizing expertise in risk analysis, mitigation strategies, and threat identification. Both roles demand a solid foundation in security principles, legal requirements, and industry-specific standards to ensure organizational adherence and risk minimization.

Skills Comparison: Compliance Specialist vs Risk Assessor

Compliance Specialists excel in regulatory knowledge, policy development, and audit management, ensuring organizations meet legal and industry standards effectively. Risk Assessors demonstrate strong analytical skills, risk identification, and mitigation strategies, focusing on evaluating and minimizing potential threats to business operations. Both roles require expertise in data analysis and communication, but Compliance Specialists prioritize adherence to regulations while Risk Assessors emphasize proactive risk management.

Overlapping Areas in Compliance and Risk Roles

Compliance Specialists and Risk Assessors share overlapping responsibilities in identifying regulatory requirements and evaluating organizational controls to mitigate potential risks. Both roles conduct audits and assessments to ensure adherence to industry standards such as ISO 27001 and GDPR, enhancing overall corporate governance. Collaboration between these professionals strengthens risk management frameworks by combining compliance monitoring with proactive risk identification and mitigation strategies.

Day-to-Day Tasks: What Sets Them Apart

Compliance Specialists monitor organizational adherence to regulations and policies, conducting regular audits and preparing detailed compliance reports to ensure legal standards are met. Risk Assessors identify potential security threats by analyzing vulnerabilities, evaluating the likelihood and impact of risks, and recommending mitigation strategies to minimize exposure. Their day-to-day tasks differ as Compliance Specialists focus on regulatory alignment, while Risk Assessors emphasize proactive risk detection and management within security frameworks.

Career Pathways and Professional Growth

Compliance Specialists focus on ensuring organizations adhere to legal regulations and internal policies, often progressing into roles such as Compliance Manager or Chief Compliance Officer, which emphasize regulatory expertise and organizational governance. Risk Assessors analyze and evaluate potential threats to organizational assets, with career trajectories leading to Risk Manager or Chief Risk Officer positions, highlighting skills in risk mitigation and strategic planning. Both pathways demand continuous professional development, including certifications like Certified Compliance & Ethics Professional (CCEP) for Compliance Specialists and Certified Risk Manager (CRM) for Risk Assessors, fostering growth through specialized knowledge and leadership capabilities.

Industry Demand and Job Outlook

Compliance Specialists and Risk Assessors both play critical roles in the security sector, with strong industry demand driven by increasing regulatory requirements and cyber threats. Compliance Specialists are in high demand for ensuring organizations adhere to laws like GDPR, HIPAA, and SOX, particularly in finance, healthcare, and tech industries. Risk Assessors focus on identifying vulnerabilities and mitigating threats, which makes their job outlook robust amid rising cybersecurity investments and digital transformation initiatives.

Choosing Between Compliance and Risk Assessment

Choosing between a Compliance Specialist and a Risk Assessor depends on organizational priorities: Compliance Specialists ensure adherence to regulations such as GDPR, HIPAA, and SOX, focusing on policy enforcement and audit readiness. Risk Assessors identify, analyze, and mitigate potential security threats by conducting vulnerability assessments and risk analyses aligned with frameworks like NIST and ISO 27001. Companies prioritizing regulatory compliance benefit from Compliance Specialists, while those emphasizing proactive threat management gain from Risk Assessors.

Compliance Specialist vs Risk Assessor Infographic

jobdiv.com

jobdiv.com