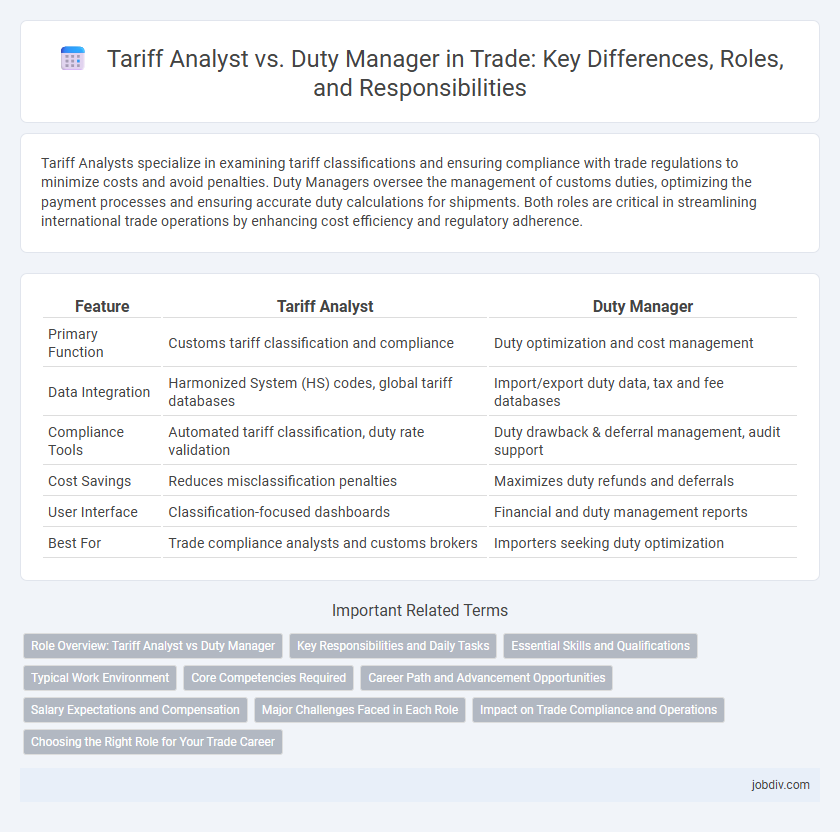

Tariff Analysts specialize in examining tariff classifications and ensuring compliance with trade regulations to minimize costs and avoid penalties. Duty Managers oversee the management of customs duties, optimizing the payment processes and ensuring accurate duty calculations for shipments. Both roles are critical in streamlining international trade operations by enhancing cost efficiency and regulatory adherence.

Table of Comparison

| Feature | Tariff Analyst | Duty Manager |

|---|---|---|

| Primary Function | Customs tariff classification and compliance | Duty optimization and cost management |

| Data Integration | Harmonized System (HS) codes, global tariff databases | Import/export duty data, tax and fee databases |

| Compliance Tools | Automated tariff classification, duty rate validation | Duty drawback & deferral management, audit support |

| Cost Savings | Reduces misclassification penalties | Maximizes duty refunds and deferrals |

| User Interface | Classification-focused dashboards | Financial and duty management reports |

| Best For | Trade compliance analysts and customs brokers | Importers seeking duty optimization |

Role Overview: Tariff Analyst vs Duty Manager

Tariff Analysts specialize in researching, interpreting, and classifying goods under the correct tariff codes to ensure accurate customs compliance and optimal duty rates. Duty Managers oversee the overall management of import and export duties, ensuring timely payment, regulatory adherence, and cost control within supply chain operations. Both roles are critical for minimizing trade costs and navigating complex international trade regulations effectively.

Key Responsibilities and Daily Tasks

Tariff Analysts focus on classifying goods according to tariff codes, ensuring accurate duty calculations, and maintaining compliance with customs regulations. Duty Managers oversee the payment and optimization of import/export duties, manage audits, and implement strategies to minimize tariff costs. Both roles require collaboration with customs brokers, analyzing trade agreements, and staying updated on tariff changes to facilitate efficient international trade operations.

Essential Skills and Qualifications

Tariff Analysts require strong analytical skills, in-depth knowledge of international trade regulations, and proficiency in data analysis software to accurately classify goods and determine applicable tariffs. Duty Managers must possess expertise in compliance management, risk assessment, and effective communication skills to oversee duty payments and ensure regulatory adherence across multiple jurisdictions. Both roles demand a solid understanding of customs laws, attention to detail, and experience with trade documentation systems.

Typical Work Environment

A Tariff Analyst typically operates in corporate offices, government agencies, or consulting firms where they analyze and classify goods for tariff compliance, often relying on databases and trade regulations. In contrast, a Duty Manager usually works within logistics companies, warehouses, or customs terminals, overseeing daily import/export operations and ensuring duty payments align with regulatory requirements. Both roles require collaboration with customs officials and cross-department coordination, but the Tariff Analyst emphasizes analytical tasks, whereas the Duty Manager focuses on operational management.

Core Competencies Required

Tariff Analysts must excel in interpreting and classifying tariff codes, understanding international trade regulations, and analyzing trade data to optimize cost efficiency. Duty Managers require expertise in overseeing import/export duties, ensuring compliance with customs regulations, and managing risk related to tariff payments. Both roles demand strong analytical skills, attention to detail, and in-depth knowledge of global trade policies to minimize financial liabilities and enhance supply chain performance.

Career Path and Advancement Opportunities

Tariff Analysts specialize in classifying goods and calculating customs duties, gaining expertise in international trade regulations and tariff schedules, which leads to roles such as Compliance Specialist or Trade Consultant. Duty Managers oversee the broader compliance and operational aspects of customs duties within organizations, managing teams and liaising with customs authorities, paving the way to senior management positions like Customs Compliance Director or Trade Operations Manager. Career advancement for Tariff Analysts often involves deepening technical knowledge and securing certifications like Certified Customs Specialist, while Duty Managers progress through leadership development and strategic trade management roles.

Salary Expectations and Compensation

Tariff Analysts typically earn between $60,000 and $85,000 annually, reflecting their expertise in classifying goods and analyzing customs tariffs to ensure compliance with trade regulations. Duty Managers command higher salaries, often ranging from $75,000 to $110,000, due to their broader responsibilities in managing import and export duties, optimizing duty payments, and overseeing compliance strategies. Compensation packages for both roles may include bonuses, benefits, and potential international travel allowances based on company policies and trade volume.

Major Challenges Faced in Each Role

Tariff Analysts face major challenges such as accurately classifying products under complex and frequently changing tariff codes, ensuring compliance with international trade regulations, and staying updated on global trade agreements to minimize duty costs. Duty Managers encounter difficulties in managing timely payment of import duties, coordinating with customs brokers to avoid clearance delays, and overseeing audits to prevent financial penalties from incorrect duty assessments. Both roles require deep knowledge of trade compliance, risk management, and data analysis to optimize cost-efficiency in global supply chains.

Impact on Trade Compliance and Operations

Tariff Analysts specialize in classifying goods and calculating applicable tariffs, directly influencing trade compliance by ensuring accuracy in duty payments and regulatory adherence. Duty Managers oversee the broader customs duty process, optimizing operations to minimize costs and prevent shipment delays through strategic duty management and liaising with customs authorities. Both roles are pivotal in maintaining seamless trade operations and mitigating risks associated with non-compliance and financial penalties.

Choosing the Right Role for Your Trade Career

Tariff Analysts specialize in interpreting and managing trade tariffs, ensuring accurate classification and compliance with international trade regulations. Duty Managers oversee the broader aspects of duties, including tariff assessments and operational logistics, focusing on reducing costs and streamlining customs processes. Choosing between these roles depends on whether you prefer a detailed analytical focus on tariff codes or a strategic managerial position handling overall duty operations in global trade.

Tariff Analyst vs Duty Manager Infographic

jobdiv.com

jobdiv.com