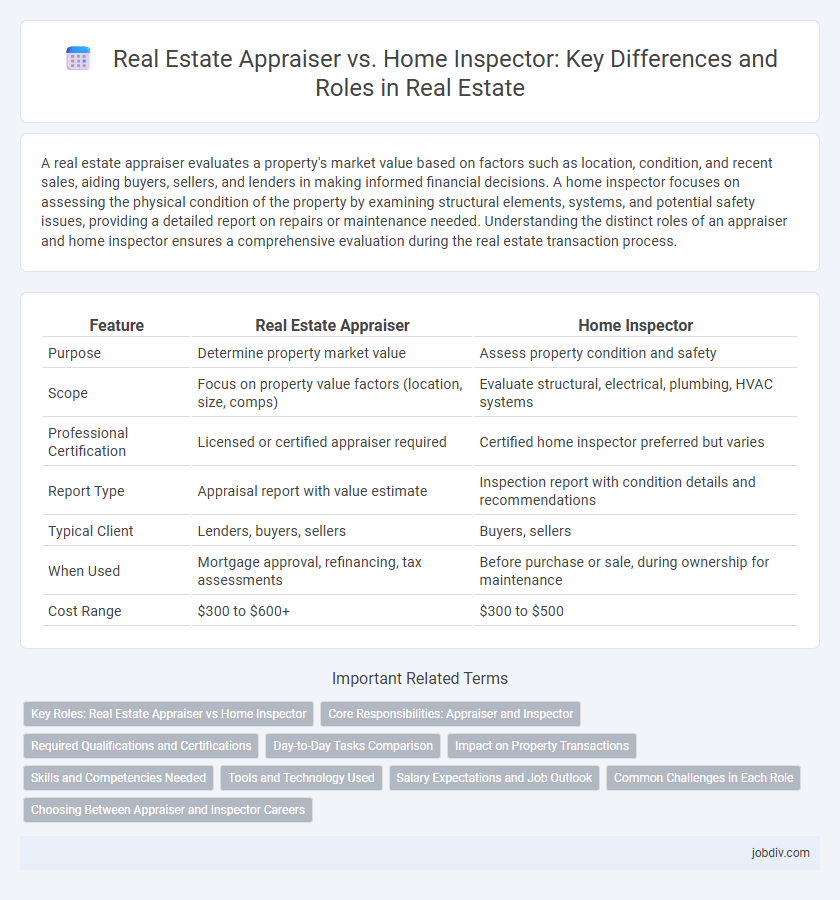

A real estate appraiser evaluates a property's market value based on factors such as location, condition, and recent sales, aiding buyers, sellers, and lenders in making informed financial decisions. A home inspector focuses on assessing the physical condition of the property by examining structural elements, systems, and potential safety issues, providing a detailed report on repairs or maintenance needed. Understanding the distinct roles of an appraiser and home inspector ensures a comprehensive evaluation during the real estate transaction process.

Table of Comparison

| Feature | Real Estate Appraiser | Home Inspector |

|---|---|---|

| Purpose | Determine property market value | Assess property condition and safety |

| Scope | Focus on property value factors (location, size, comps) | Evaluate structural, electrical, plumbing, HVAC systems |

| Professional Certification | Licensed or certified appraiser required | Certified home inspector preferred but varies |

| Report Type | Appraisal report with value estimate | Inspection report with condition details and recommendations |

| Typical Client | Lenders, buyers, sellers | Buyers, sellers |

| When Used | Mortgage approval, refinancing, tax assessments | Before purchase or sale, during ownership for maintenance |

| Cost Range | $300 to $600+ | $300 to $500 |

Key Roles: Real Estate Appraiser vs Home Inspector

Real estate appraisers provide a detailed valuation of a property's market value based on factors like location, condition, and comparable sales, which is crucial for financing and investment decisions. Home inspectors assess the physical condition of a property's systems and structures, identifying potential defects or safety issues that could affect its livability and maintenance costs. Understanding the distinct roles helps buyers and lenders make informed decisions by combining accurate price estimation with thorough property condition analysis.

Core Responsibilities: Appraiser and Inspector

Real estate appraisers determine a property's market value by analyzing recent sales, location, condition, and comparable properties, which is crucial for mortgage lending and investment decisions. Home inspectors evaluate the physical condition of a property, checking structural elements, systems, and safety hazards to ensure the home meets local building codes and is free from major defects. While appraisers focus on value assessment, inspectors prioritize identifying potential repairs and maintenance issues.

Required Qualifications and Certifications

Real estate appraisers must obtain state licensing or certification, typically requiring completion of specific education hours, passing a national exam, and gaining supervised experience to accurately determine property value. Home inspectors generally need a state-issued license or certification, which involves coursework, passing a standardized exam, and fulfilling continuing education requirements focused on identifying structural and system issues in homes. Both professions require adherence to regulatory standards, but appraisers focus on valuation guidelines while inspectors emphasize property condition assessments.

Day-to-Day Tasks Comparison

Real estate appraisers focus on evaluating property value through market analysis, inspection of property condition, and reviewing comparable sales data to provide accurate valuation reports. Home inspectors perform detailed assessments of a home's structural integrity, electrical systems, plumbing, and safety hazards, delivering comprehensive inspection reports to identify potential issues. While appraisers emphasize property valuation for transactions and financing, home inspectors prioritize identifying defects and maintenance needs for buyer awareness.

Impact on Property Transactions

Real estate appraisers determine the accurate market value of a property, directly influencing financing terms and sale prices during transactions. Home inspectors evaluate the condition and safety of the property, revealing potential issues that could impact negotiation or buyer confidence. Both roles are essential in ensuring transparent and informed property transactions, minimizing risks for buyers, sellers, and lenders.

Skills and Competencies Needed

A real estate appraiser requires strong analytical skills and expertise in property valuation, market trends, and regulatory compliance to determine accurate property values. Home inspectors need keen attention to detail, knowledge of building systems, and the ability to identify structural, electrical, and safety issues within residential properties. Both professions demand excellent communication skills to convey findings clearly to clients and stakeholders.

Tools and Technology Used

Real estate appraisers utilize advanced software for property valuation, including automated valuation models (AVMs), 3D laser scanning, and geographic information systems (GIS) to analyze market trends and property conditions. Home inspectors rely on specialized tools such as moisture meters, infrared cameras, gas detectors, and electrical testers to assess the physical condition of a property's structure, systems, and safety features. Both professionals integrate mobile applications and digital reporting platforms to enhance accuracy, streamline workflows, and provide detailed inspection and appraisal reports to clients.

Salary Expectations and Job Outlook

Real estate appraisers typically earn an average salary ranging from $55,000 to $75,000 annually, with senior appraisers or those in specialized markets commanding higher wages. Home inspectors have a similar salary range but often experience more variability based on certification level and geographic location, averaging between $45,000 and $70,000 per year. Both professions are expected to grow steadily, with demand driven by housing market activity and regulatory requirements, ensuring stable job outlooks over the next decade.

Common Challenges in Each Role

Real estate appraisers often face challenges in accurately assessing property values due to fluctuating market conditions and limited access to comparable sales data, which can impact lending and investment decisions. Home inspectors commonly encounter difficulties identifying hidden defects or structural issues within limited inspection timeframes, affecting the reliability of home condition reports. Both roles require balancing thorough evaluations with time constraints while ensuring compliance with industry standards and client expectations.

Choosing Between Appraiser and Inspector Careers

Real estate appraisers specialize in determining property value through market analysis and detailed inspections, making their expertise essential for mortgage lending and sales transactions. Home inspectors focus on assessing the physical condition of homes, identifying structural, electrical, and plumbing issues that influence buyer decisions and safety. Choosing between appraiser and inspector careers depends on your interest in financial valuation versus technical property evaluation, along with desired certification paths and job market demand in real estate sectors.

Real Estate Appraiser vs Home Inspector Infographic

jobdiv.com

jobdiv.com