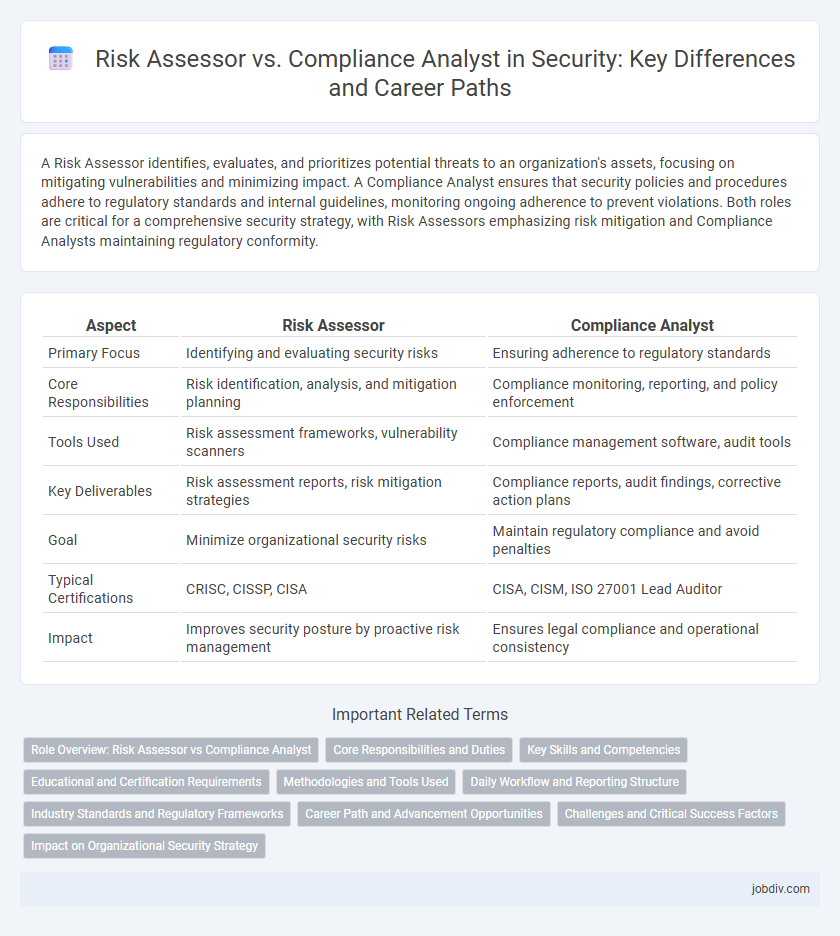

A Risk Assessor identifies, evaluates, and prioritizes potential threats to an organization's assets, focusing on mitigating vulnerabilities and minimizing impact. A Compliance Analyst ensures that security policies and procedures adhere to regulatory standards and internal guidelines, monitoring ongoing adherence to prevent violations. Both roles are critical for a comprehensive security strategy, with Risk Assessors emphasizing risk mitigation and Compliance Analysts maintaining regulatory conformity.

Table of Comparison

| Aspect | Risk Assessor | Compliance Analyst |

|---|---|---|

| Primary Focus | Identifying and evaluating security risks | Ensuring adherence to regulatory standards |

| Core Responsibilities | Risk identification, analysis, and mitigation planning | Compliance monitoring, reporting, and policy enforcement |

| Tools Used | Risk assessment frameworks, vulnerability scanners | Compliance management software, audit tools |

| Key Deliverables | Risk assessment reports, risk mitigation strategies | Compliance reports, audit findings, corrective action plans |

| Goal | Minimize organizational security risks | Maintain regulatory compliance and avoid penalties |

| Typical Certifications | CRISC, CISSP, CISA | CISA, CISM, ISO 27001 Lead Auditor |

| Impact | Improves security posture by proactive risk management | Ensures legal compliance and operational consistency |

Role Overview: Risk Assessor vs Compliance Analyst

Risk Assessors identify, evaluate, and prioritize potential security threats to minimize organizational vulnerabilities by conducting thorough risk analyses and implementing mitigation strategies. Compliance Analysts ensure that company policies and operations adhere to relevant laws, regulations, and standards, performing audits and monitoring compliance frameworks to prevent legal and regulatory breaches. Both roles are critical in maintaining a secure and lawful business environment but differ in focus, with Risk Assessors emphasizing threat management and Compliance Analysts concentrating on regulatory adherence.

Core Responsibilities and Duties

Risk Assessors identify, evaluate, and prioritize potential threats to an organization's assets by conducting risk analyses and vulnerability assessments, ensuring the implementation of appropriate mitigation strategies. Compliance Analysts monitor adherence to regulatory requirements and internal policies, manage audit processes, and develop compliance programs to prevent violations and legal penalties. Both roles are critical for organizational security but focus respectively on proactive risk management and regulatory compliance enforcement.

Key Skills and Competencies

Risk Assessors excel in identifying, evaluating, and mitigating potential threats through quantitative analysis, risk modeling, and vulnerability assessments, requiring strong analytical skills, attention to detail, and expertise in cybersecurity frameworks. Compliance Analysts specialize in ensuring organizational adherence to regulatory standards, conducting audits, policy reviews, and training programs, emphasizing knowledge of industry regulations, communication skills, and regulatory knowledge such as GDPR, HIPAA, or SOX. Both roles demand proficiency in risk management tools and an understanding of security principles, but Risk Assessors focus more on proactive risk identification while Compliance Analysts ensure regulatory compliance and governance.

Educational and Certification Requirements

Risk Assessors typically require a background in cybersecurity, information technology, or risk management, often holding certifications such as Certified Risk Manager (CRM) or Certified Information Systems Security Professional (CISSP). Compliance Analysts usually possess degrees in law, business administration, or information systems and often obtain certifications like Certified Information Systems Auditor (CISA) or Certified Compliance and Ethics Professional (CCEP). Both roles demand ongoing education to stay current with evolving regulations and industry standards.

Methodologies and Tools Used

Risk Assessors utilize methodologies such as quantitative risk analysis, threat modeling, and vulnerability assessments, employing tools like risk matrices, NIST Risk Management Framework, and FAIR (Factor Analysis of Information Risk) to systematically evaluate potential security threats. Compliance Analysts focus on regulatory frameworks such as GDPR, HIPAA, and ISO 27001, leveraging compliance management software, audit tracking tools, and policy management systems to ensure organizational adherence to legal and industry standards. Both roles rely on data analytics and reporting platforms to support informed decision-making and enhance an organization's overall security posture.

Daily Workflow and Reporting Structure

Risk Assessors conduct daily evaluations of potential threats and vulnerabilities, prioritizing risk mitigation strategies to minimize organizational exposure, while Compliance Analysts focus on monitoring adherence to regulatory requirements and company policies through continuous audit processes. Reporting structures differ as Risk Assessors typically present findings and risk ratings to security managers and executives to inform strategic decisions, whereas Compliance Analysts report compliance status and violations to regulatory affairs teams and internal audit committees. Both roles require precise documentation, but Risk Assessors emphasize risk impact assessments, whereas Compliance Analysts prioritize regulatory gap analyses and remediation tracking.

Industry Standards and Regulatory Frameworks

Risk Assessors evaluate potential threats by analyzing vulnerabilities and exposures in alignment with industry standards such as ISO 27001 and NIST frameworks. Compliance Analysts ensure that organizational policies and processes adhere strictly to regulatory frameworks like GDPR, HIPAA, and SOX, focusing on legal and formal compliance requirements. Both roles are essential for comprehensive security management, bridging risk identification with regulatory adherence to safeguard enterprise assets.

Career Path and Advancement Opportunities

Risk Assessors typically advance by gaining specialized expertise in threat analysis and vulnerability management, progressing toward senior risk management or cybersecurity strategist roles. Compliance Analysts often move into roles such as compliance manager or director, leveraging deep knowledge of regulatory frameworks and policy enforcement. Both career paths offer growth in leadership positions, but Risk Assessors tend to focus on technical risk mitigation while Compliance Analysts emphasize regulatory adherence and organizational governance.

Challenges and Critical Success Factors

Risk Assessors face challenges in accurately identifying potential threats and quantifying their impact, requiring deep knowledge of evolving cyber threats and risk modeling techniques. Compliance Analysts must navigate complex regulatory frameworks, ensuring that organizational policies align with legal standards, which demands continuous monitoring and detailed documentation skills. Critical success factors for both roles include staying current with industry regulations, effective communication with stakeholders, and leveraging advanced security tools to mitigate risks and maintain compliance.

Impact on Organizational Security Strategy

Risk Assessors evaluate potential threats and vulnerabilities to identify areas of exposure, directly influencing the prioritization of security measures within an organization. Compliance Analysts ensure adherence to regulatory requirements and internal policies, shaping the framework and governance controls that maintain organizational security standards. Together, their roles balance proactive threat identification with mandatory compliance, creating a comprehensive security strategy that mitigates risks while aligning with legal and industry standards.

Risk Assessor vs Compliance Analyst Infographic

jobdiv.com

jobdiv.com