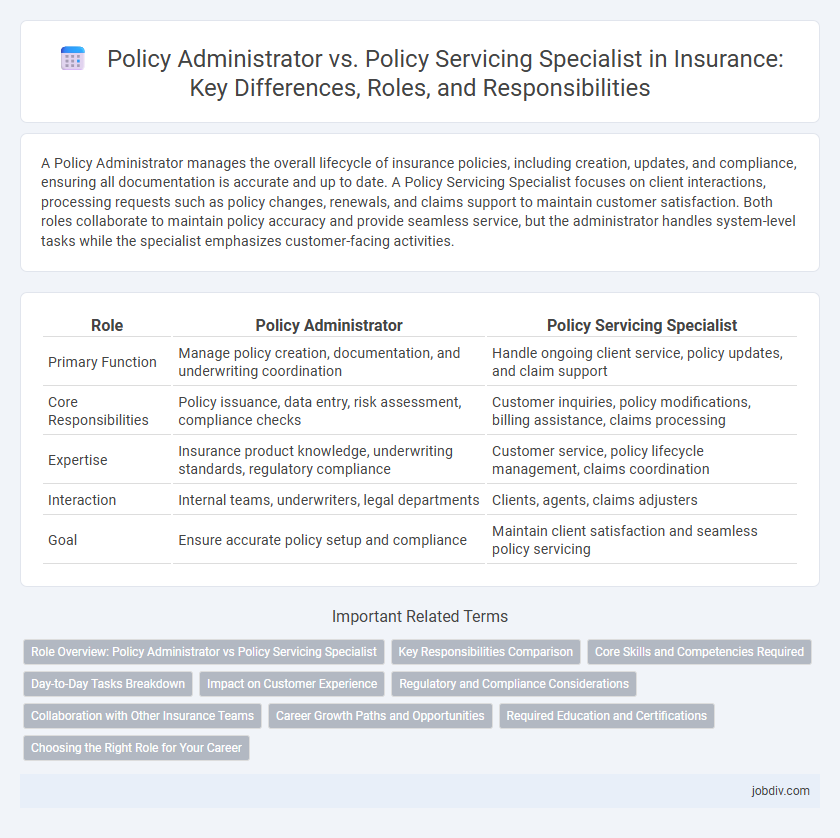

A Policy Administrator manages the overall lifecycle of insurance policies, including creation, updates, and compliance, ensuring all documentation is accurate and up to date. A Policy Servicing Specialist focuses on client interactions, processing requests such as policy changes, renewals, and claims support to maintain customer satisfaction. Both roles collaborate to maintain policy accuracy and provide seamless service, but the administrator handles system-level tasks while the specialist emphasizes customer-facing activities.

Table of Comparison

| Role | Policy Administrator | Policy Servicing Specialist |

|---|---|---|

| Primary Function | Manage policy creation, documentation, and underwriting coordination | Handle ongoing client service, policy updates, and claim support |

| Core Responsibilities | Policy issuance, data entry, risk assessment, compliance checks | Customer inquiries, policy modifications, billing assistance, claims processing |

| Expertise | Insurance product knowledge, underwriting standards, regulatory compliance | Customer service, policy lifecycle management, claims coordination |

| Interaction | Internal teams, underwriters, legal departments | Clients, agents, claims adjusters |

| Goal | Ensure accurate policy setup and compliance | Maintain client satisfaction and seamless policy servicing |

Role Overview: Policy Administrator vs Policy Servicing Specialist

A Policy Administrator manages the lifecycle of insurance policies, ensuring accurate documentation, policy issuance, and compliance with regulatory standards. The Policy Servicing Specialist focuses on handling policyholder requests, processing endorsements, claims adjustments, and customer inquiries to maintain policy accuracy and customer satisfaction. Both roles require strong knowledge of insurance products but differ in their emphasis on administrative operations versus direct client service and policy maintenance.

Key Responsibilities Comparison

Policy Administrators manage the overall lifecycle of insurance policies, including issuance, amendments, renewals, and cancellations, ensuring compliance with regulatory standards. Policy Servicing Specialists focus on handling customer inquiries, processing policy changes, and maintaining accurate policy records to enhance client satisfaction. Both roles require detailed knowledge of insurance products, but Policy Administrators emphasize governance and operational oversight, while Policy Servicing Specialists prioritize customer support and transaction processing.

Core Skills and Competencies Required

Policy Administrators require strong organizational abilities and in-depth knowledge of insurance policies to effectively manage policy lifecycles, including drafting, issuing, and documenting contracts. Policy Servicing Specialists excel in customer service skills, claims processing, and policy amendments, ensuring accurate and timely updates while maintaining regulatory compliance. Both roles demand proficiency in insurance software systems, attention to detail, and strong communication skills to handle policyholder inquiries and resolve discrepancies efficiently.

Day-to-Day Tasks Breakdown

Policy Administrators manage the entire lifecycle of insurance policies, including issuing new policies, updating policy details, and ensuring compliance with regulatory standards. Policy Servicing Specialists focus on handling customer inquiries, processing payments, policy changes, and claims support on a daily basis. While Administrators oversee policy documentation and system updates, Servicing Specialists emphasize direct client interaction and routine transaction processing.

Impact on Customer Experience

Policy Administrators play a crucial role in ensuring accurate policy management and compliance, directly enhancing customer trust and satisfaction by preventing errors and delays. Policy Servicing Specialists focus on handling inquiries, updates, and claims efficiently, providing personalized support that improves responsiveness and customer convenience. Together, their collaboration optimizes the customer journey, reducing friction and fostering long-term loyalty in the insurance experience.

Regulatory and Compliance Considerations

Policy Administrators oversee the creation and ongoing management of insurance policies, ensuring strict adherence to regulatory requirements such as risk assessments and documentation standards mandated by state and federal insurance commissions. Policy Servicing Specialists focus on maintaining compliance through accurate policy record updates, claims processing, and customer communications, aligning with regulations like the Health Insurance Portability and Accountability Act (HIPAA) and Anti-Money Laundering (AML) laws. Both roles are critical in upholding compliance frameworks, reducing regulatory risks, and ensuring policies meet legal standards throughout their lifecycle.

Collaboration with Other Insurance Teams

Policy Administrators coordinate closely with underwriting, claims, and compliance teams to ensure accurate policy issuance and maintenance, fostering a seamless flow of information. Policy Servicing Specialists collaborate intensively with customer service, claims adjusters, and billing departments to promptly address client requests and resolve policy-related issues. Both roles emphasize cross-team communication to enhance policy accuracy, client satisfaction, and regulatory compliance in insurance operations.

Career Growth Paths and Opportunities

Policy Administrators typically oversee the entire lifecycle of insurance policies, offering broader managerial responsibilities that pave the way for advancement into leadership roles such as Claims Manager or Underwriting Supervisor. Policy Servicing Specialists focus on client interaction and policy maintenance, gaining specialized expertise that can lead to positions like Customer Service Manager or Sales Support Coordinator. Both careers provide foundational skills in insurance operations, with Policy Administrators often accessing higher-level strategic roles and Policy Servicing Specialists excelling in client relations and operational support.

Required Education and Certifications

Policy Administrators typically require a bachelor's degree in finance, business administration, or a related field, often supplemented with certifications such as Chartered Property Casualty Underwriter (CPCU) or Associate in Insurance Services (AIS). Policy Servicing Specialists usually need a high school diploma or associate degree, with industry-specific certifications like the Certified Insurance Service Representative (CISR) enhancing their qualifications. Both roles benefit from ongoing professional development to stay current with insurance regulations and policy management systems.

Choosing the Right Role for Your Career

Policy Administrators manage the entire lifecycle of insurance policies, ensuring compliance, renewals, and accurate documentation, making them ideal for professionals seeking broad operational oversight. Policy Servicing Specialists focus on customer interaction, claims processing, and addressing policyholder inquiries, suited for those who excel in communication and problem-solving. Selecting the right role depends on your preference for either comprehensive policy management or client-centered service within the insurance industry.

Policy Administrator vs Policy Servicing Specialist Infographic

jobdiv.com

jobdiv.com