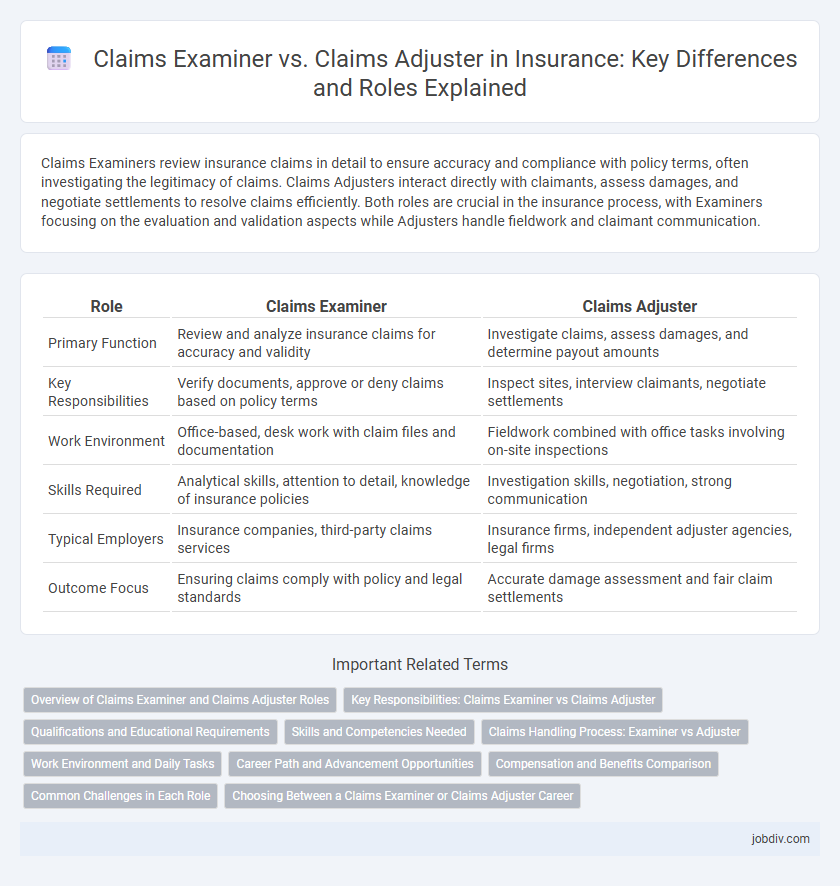

Claims Examiners review insurance claims in detail to ensure accuracy and compliance with policy terms, often investigating the legitimacy of claims. Claims Adjusters interact directly with claimants, assess damages, and negotiate settlements to resolve claims efficiently. Both roles are crucial in the insurance process, with Examiners focusing on the evaluation and validation aspects while Adjusters handle fieldwork and claimant communication.

Table of Comparison

| Role | Claims Examiner | Claims Adjuster |

|---|---|---|

| Primary Function | Review and analyze insurance claims for accuracy and validity | Investigate claims, assess damages, and determine payout amounts |

| Key Responsibilities | Verify documents, approve or deny claims based on policy terms | Inspect sites, interview claimants, negotiate settlements |

| Work Environment | Office-based, desk work with claim files and documentation | Fieldwork combined with office tasks involving on-site inspections |

| Skills Required | Analytical skills, attention to detail, knowledge of insurance policies | Investigation skills, negotiation, strong communication |

| Typical Employers | Insurance companies, third-party claims services | Insurance firms, independent adjuster agencies, legal firms |

| Outcome Focus | Ensuring claims comply with policy and legal standards | Accurate damage assessment and fair claim settlements |

Overview of Claims Examiner and Claims Adjuster Roles

Claims Examiners specialize in reviewing and analyzing insurance claims to determine coverage and eligibility based on policy terms and medical or legal documentation. Claims Adjusters investigate claims by verifying facts, assessing damage, and negotiating settlements directly with claimants or third parties. Both roles are essential in ensuring accurate claims processing, with Examiners focusing on policy compliance and Adjusters handling on-the-ground claim evaluations.

Key Responsibilities: Claims Examiner vs Claims Adjuster

Claims Examiners analyze insurance claims to determine policy coverage, validate claim accuracy, and authorize payments based on detailed investigations and compliance with regulatory standards. Claims Adjusters assess, investigate, and negotiate claim settlements by evaluating damages, interviewing claimants and witnesses, and coordinating with legal and medical professionals. Both roles are essential in the insurance claims process, with Examiners focusing on verification and approval, while Adjusters handle the factual assessment and settlement negotiations.

Qualifications and Educational Requirements

Claims examiners typically require a bachelor's degree in fields such as insurance, finance, or business administration, along with certifications like the AIC (Associate in Claims). Claims adjusters often enter the profession with a high school diploma or equivalent, gaining qualifications through on-the-job training and state licensing exams. Both roles benefit from strong analytical skills and knowledge of insurance policies, but claims examiners usually have more formal education and specialized training.

Skills and Competencies Needed

Claims Examiners require strong analytical skills, attention to detail, and expertise in evaluating insurance policies to determine claim validity and ensure regulatory compliance. Claims Adjusters need excellent negotiation abilities, interpersonal communication skills, and thorough knowledge of investigation techniques to assess damages and settle claims fairly. Both roles demand proficiency in data analysis, risk assessment, and familiarity with relevant legal and industry standards to efficiently process claims.

Claims Handling Process: Examiner vs Adjuster

Claims examiners and claims adjusters play distinct roles in the insurance claims handling process, with examiners primarily responsible for reviewing claims for accuracy, policy coverage, and compliance, while adjusters conduct investigations, assess damages, and determine claim validity on-site. Examiners analyze submitted documentation and verify the legitimacy of claims to ensure proper payouts, whereas adjusters interact with claimants and witnesses, inspect property or injury reports, and negotiate settlements. Both roles are critical in streamlining claims management, reducing fraud, and ensuring timely, fair resolution of insurance claims.

Work Environment and Daily Tasks

Claims Examiners typically work in office settings where they analyze insurance claims for accuracy, verify policy coverage, and determine claim legitimacy, often using specialized software to process documentation. Claims Adjusters frequently visit accident sites or insured properties to assess damages firsthand, interview claimants and witnesses, and gather evidence to evaluate claim validity. Both roles require strong attention to detail, but Examiners focus more on documentation review, while Adjusters engage in field investigations and direct assessments.

Career Path and Advancement Opportunities

Claims examiners typically focus on evaluating insurance claims for accuracy and coverage compliance, offering a structured career path with potential advancement into senior examiner or claims manager roles. Claims adjusters often engage more directly with policyholders and field investigations, leading to opportunities as senior adjusters, supervisors, or independent adjusters with specialized expertise. Both roles provide foundational experience in insurance claims, but claims adjusters may have broader career versatility due to their investigative and negotiation skills.

Compensation and Benefits Comparison

Claims Examiners typically receive higher compensation than Claims Adjusters due to their specialized skills in evaluating and investigating complex claims, with average salaries ranging from $55,000 to $75,000 annually. Claims Adjusters, who often handle on-site assessments and negotiate settlements, earn between $45,000 and $65,000 per year, with variations based on experience and location. Benefits for both roles commonly include health insurance, retirement plans, and performance bonuses, though Claims Examiners may have access to more comprehensive professional development programs.

Common Challenges in Each Role

Claims examiners and claims adjusters both face challenges related to accurately assessing insurance claims, including dealing with incomplete or conflicting information and ensuring compliance with policy terms. Claims examiners often grapple with verifying the legitimacy of complex claims and managing high volumes of paperwork, while claims adjusters commonly encounter difficulties in negotiating settlements and assessing damages on-site under time constraints. Both roles require balancing thorough investigation with efficient resolution to prevent fraud and reduce company losses.

Choosing Between a Claims Examiner or Claims Adjuster Career

Claims Examiners analyze and evaluate insurance claims for validity and compliance, often working within insurance companies to approve or deny claims based on detailed policy review. Claims Adjusters investigate claims by inspecting damage, interviewing witnesses, and negotiating settlements, typically spending more time in the field assessing property or injury claims. Choosing between these careers depends on whether you prefer office-based analytical work as a Claims Examiner or hands-on investigative duties and client interaction typical for a Claims Adjuster.

Claims Examiner vs Claims Adjuster Infographic

jobdiv.com

jobdiv.com