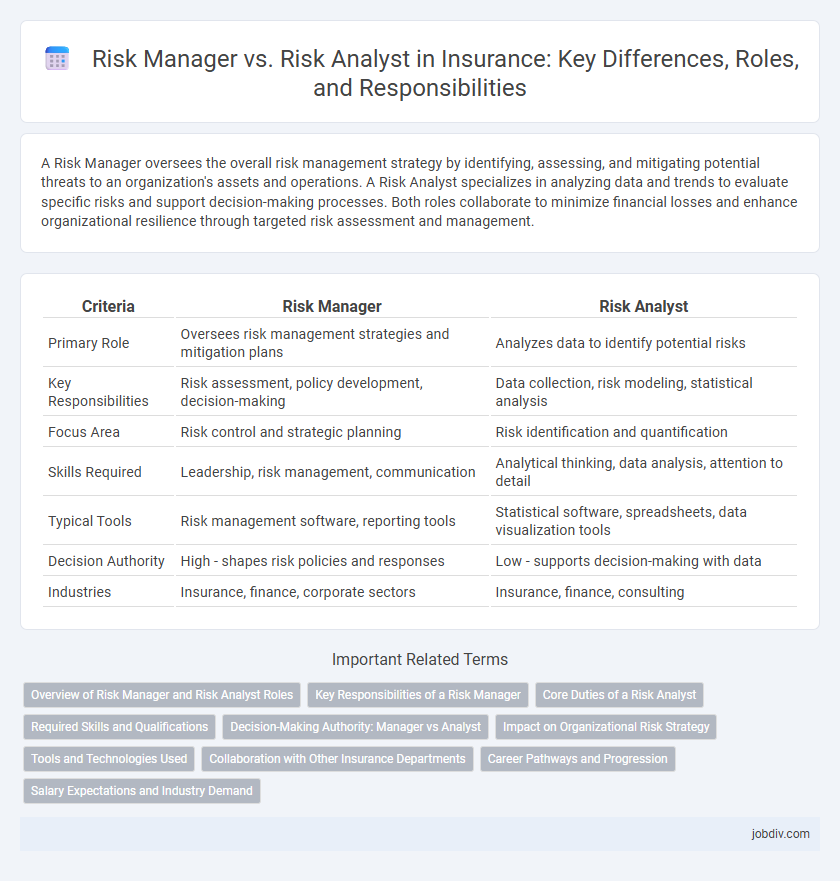

A Risk Manager oversees the overall risk management strategy by identifying, assessing, and mitigating potential threats to an organization's assets and operations. A Risk Analyst specializes in analyzing data and trends to evaluate specific risks and support decision-making processes. Both roles collaborate to minimize financial losses and enhance organizational resilience through targeted risk assessment and management.

Table of Comparison

| Criteria | Risk Manager | Risk Analyst |

|---|---|---|

| Primary Role | Oversees risk management strategies and mitigation plans | Analyzes data to identify potential risks |

| Key Responsibilities | Risk assessment, policy development, decision-making | Data collection, risk modeling, statistical analysis |

| Focus Area | Risk control and strategic planning | Risk identification and quantification |

| Skills Required | Leadership, risk management, communication | Analytical thinking, data analysis, attention to detail |

| Typical Tools | Risk management software, reporting tools | Statistical software, spreadsheets, data visualization tools |

| Decision Authority | High - shapes risk policies and responses | Low - supports decision-making with data |

| Industries | Insurance, finance, corporate sectors | Insurance, finance, consulting |

Overview of Risk Manager and Risk Analyst Roles

Risk Managers oversee the identification, assessment, and mitigation of potential risks that could impact an organization's financial stability and operational efficiency, ensuring compliance with regulatory requirements. Risk Analysts focus on collecting and analyzing data to evaluate the probability and impact of risks, providing insights that support decision-making and strategic planning. Both roles collaborate closely to enhance risk management frameworks and protect business assets.

Key Responsibilities of a Risk Manager

A Risk Manager oversees the identification, assessment, and mitigation of potential risks to an organization's assets, operations, and profitability. Their key responsibilities include developing risk management policies, coordinating risk control strategies, and ensuring compliance with regulatory standards. Risk Managers also lead cross-functional teams to implement risk reduction initiatives and monitor their effectiveness over time.

Core Duties of a Risk Analyst

A Risk Analyst in insurance primarily focuses on identifying, evaluating, and quantifying potential risks that could impact an organization's financial stability. They utilize data analytics, statistical models, and market research to assess risk exposure and support underwriting decisions. Their core duties include monitoring claims data, analyzing loss trends, and preparing detailed risk reports to aid in strategic risk mitigation.

Required Skills and Qualifications

Risk Managers require strong leadership skills, expertise in risk assessment techniques, and proficiency in regulatory compliance to develop and implement effective risk mitigation strategies. Risk Analysts need advanced analytical skills, proficiency in statistical software and data modeling, and the ability to interpret complex financial reports to identify potential risks. Both roles demand a solid understanding of insurance principles and risk management frameworks to support organizational decision-making.

Decision-Making Authority: Manager vs Analyst

Risk managers hold decision-making authority to implement risk policies and approve mitigation strategies, often influencing organizational risk posture at a strategic level. Risk analysts provide data-driven insights and risk assessments but typically lack authority to make final decisions or enforce actions. The distinction in decision-making power highlights the managerial role's responsibility for risk control versus the analyst's focus on risk evaluation.

Impact on Organizational Risk Strategy

Risk Managers develop and implement comprehensive risk strategies that align with the organization's objectives, directly influencing decision-making and resource allocation to mitigate potential losses. Risk Analysts support this process by gathering and analyzing data, identifying emerging risks, and providing actionable insights that enhance the accuracy and effectiveness of risk assessments. Together, their roles optimize the organization's ability to anticipate uncertainties and maintain financial stability through proactive risk management.

Tools and Technologies Used

Risk Managers typically utilize enterprise risk management software such as LogicManager and SAP GRC to oversee organizational risk frameworks and compliance tracking. Risk Analysts rely heavily on data analytics tools including SAS, R, and Excel for quantitative modeling, scenario analysis, and predictive risk assessment. Both roles increasingly integrate AI-driven platforms and real-time risk monitoring systems to enhance risk identification and mitigation capabilities in the insurance sector.

Collaboration with Other Insurance Departments

Risk Managers collaborate closely with underwriting, claims, and compliance teams to develop comprehensive risk mitigation strategies that align with organizational goals. Risk Analysts provide detailed data insights and predictive modeling to support these departments in assessing potential exposures and improving decision-making processes. Their combined efforts enhance risk identification, evaluation, and management across all insurance functions, fostering a proactive risk culture.

Career Pathways and Progression

Risk Managers typically advance to senior leadership roles such as Chief Risk Officer or Compliance Director, leveraging experience in strategic decision-making and risk mitigation across entire organizations. Risk Analysts often begin with data-focused responsibilities and can progress to specialized positions like Quantitative Analyst or Risk Consultant by developing expertise in data modeling and regulatory frameworks. Both career pathways emphasize continuous skill enhancement in risk assessment, but Risk Managers take on broader operational responsibilities while Risk Analysts delve deeper into analytical and technical risk evaluation.

Salary Expectations and Industry Demand

Risk Managers in the insurance industry typically earn higher salaries with average compensation ranging from $90,000 to $130,000 annually, reflecting their strategic role in mitigating organizational risks. Risk Analysts earn between $60,000 and $90,000 per year, focusing on data evaluation and risk assessment to support decision-making. Industry demand is strong for both roles due to increasing regulatory requirements and growing complexity in risk management, with Risk Managers experiencing faster salary growth driven by leadership responsibilities.

Risk Manager vs Risk Analyst Infographic

jobdiv.com

jobdiv.com