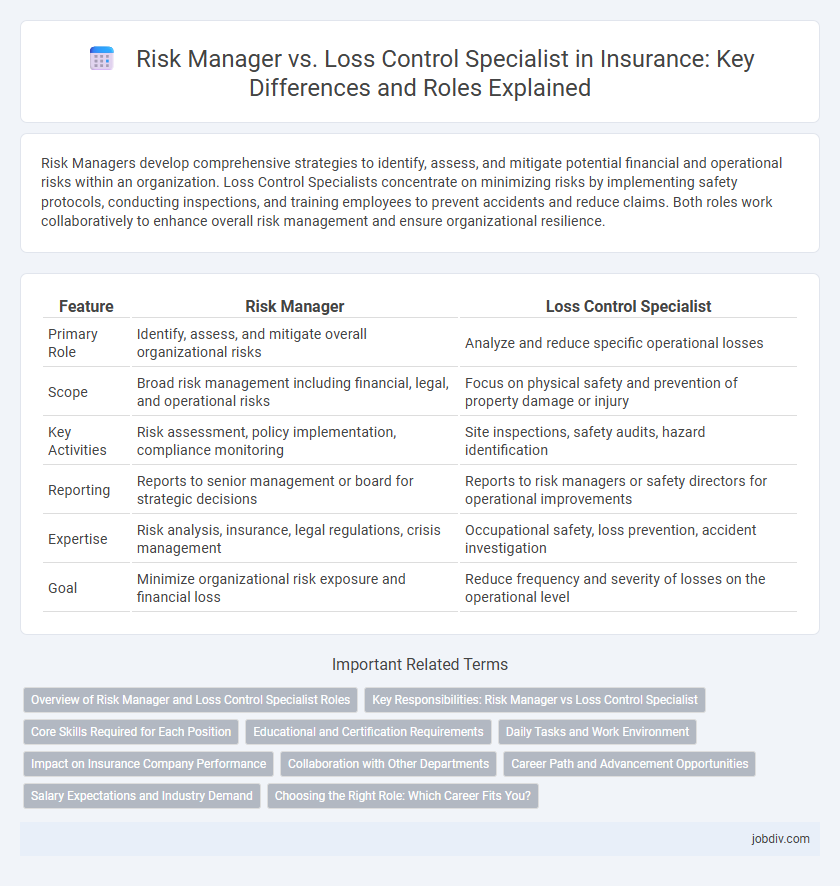

Risk Managers develop comprehensive strategies to identify, assess, and mitigate potential financial and operational risks within an organization. Loss Control Specialists concentrate on minimizing risks by implementing safety protocols, conducting inspections, and training employees to prevent accidents and reduce claims. Both roles work collaboratively to enhance overall risk management and ensure organizational resilience.

Table of Comparison

| Feature | Risk Manager | Loss Control Specialist |

|---|---|---|

| Primary Role | Identify, assess, and mitigate overall organizational risks | Analyze and reduce specific operational losses |

| Scope | Broad risk management including financial, legal, and operational risks | Focus on physical safety and prevention of property damage or injury |

| Key Activities | Risk assessment, policy implementation, compliance monitoring | Site inspections, safety audits, hazard identification |

| Reporting | Reports to senior management or board for strategic decisions | Reports to risk managers or safety directors for operational improvements |

| Expertise | Risk analysis, insurance, legal regulations, crisis management | Occupational safety, loss prevention, accident investigation |

| Goal | Minimize organizational risk exposure and financial loss | Reduce frequency and severity of losses on the operational level |

Overview of Risk Manager and Loss Control Specialist Roles

Risk managers assess and mitigate potential risks to an organization's assets, ensuring compliance with regulatory standards and developing strategies to minimize financial loss. Loss control specialists focus on identifying hazards and implementing safety procedures to prevent accidents and reduce claims, often conducting site inspections and training programs. Both roles aim to protect the company from financial and operational risks, but risk managers take a broader strategic approach while loss control specialists concentrate on on-the-ground risk prevention.

Key Responsibilities: Risk Manager vs Loss Control Specialist

Risk Managers analyze and mitigate potential financial risks by developing comprehensive risk management strategies and policies to protect organizational assets, while Loss Control Specialists focus on identifying hazards, conducting safety inspections, and implementing preventive measures to reduce workplace injuries and losses. Risk Managers coordinate with senior leadership to integrate risk assessment into business operations, whereas Loss Control Specialists engage directly with employees to promote compliance with safety standards and regulatory requirements. Both roles aim to minimize financial exposure, but Risk Managers emphasize strategic risk oversight and loss control centers on operational safety improvements.

Core Skills Required for Each Position

Risk Managers require expertise in risk assessment, strategic planning, and regulatory compliance to effectively identify, evaluate, and mitigate potential risks within an organization. Loss Control Specialists focus on in-depth knowledge of safety protocols, hazard identification, and incident investigation to implement preventive measures and reduce claims frequency. Both roles demand strong analytical abilities and communication skills but differ in their emphasis on strategic oversight versus operational safety management.

Educational and Certification Requirements

A Risk Manager typically requires a bachelor's degree in risk management, finance, or business administration, with certifications such as Certified Risk Manager (CRM) or Associate in Risk Management (ARM) enhancing career prospects. A Loss Control Specialist usually holds a degree in occupational safety, engineering, or a related field and benefits from certifications like Certified Safety Professional (CSP) or Associate Safety Professional (ASP). Both roles demand continuous education to stay current with regulatory standards and industry best practices, ensuring effective risk reduction and safety management in insurance.

Daily Tasks and Work Environment

Risk Managers analyze potential threats by assessing financial, operational, and compliance risks to develop strategic mitigation plans, often collaborating with senior executives in corporate office environments. Loss Control Specialists perform on-site inspections to identify hazards, recommend safety improvements, and ensure compliance with regulatory standards, frequently working in industrial, construction, or manufacturing settings. Both roles require strong analytical skills and expertise in risk assessment, but Risk Managers focus more on strategic planning while Loss Control Specialists emphasize hands-on risk reduction activities.

Impact on Insurance Company Performance

Risk Managers enhance insurance company performance by identifying and mitigating potential financial exposures, leading to more accurate underwriting and reduced claim payouts. Loss Control Specialists contribute by implementing safety protocols and risk reduction strategies at insured sites, decreasing the frequency and severity of claims. Together, their roles synergistically lower overall risk, improving profitability and operational stability for the insurance firm.

Collaboration with Other Departments

Risk Managers collaborate closely with underwriting and claims departments to assess and mitigate potential exposures, ensuring comprehensive risk evaluation and strategic response. Loss Control Specialists work alongside safety, operations, and compliance teams to implement preventive measures that reduce the frequency and severity of incidents. Effective collaboration between these roles enhances organizational resilience by aligning risk assessment with proactive loss prevention strategies.

Career Path and Advancement Opportunities

Risk Managers typically follow a career path leading to senior leadership roles such as Chief Risk Officer or Director of Risk Management, emphasizing strategic decision-making and enterprise-wide risk assessment. Loss Control Specialists often advance by gaining technical expertise and certifications, progressing to senior loss control consultant or safety manager positions focused on mitigating risks through hands-on prevention strategies. Both paths offer advancement through developing industry-specific knowledge, but Risk Managers generally encounter broader organizational influence and higher executive opportunities.

Salary Expectations and Industry Demand

Risk Managers in the insurance industry typically command higher salary expectations, with median annual earnings ranging from $90,000 to $130,000, reflecting their strategic role in assessing and mitigating organizational risks. Loss Control Specialists generally earn between $60,000 and $85,000 per year, focusing on implementing safety measures to reduce claims and losses. Industry demand for Risk Managers is rising due to increased regulatory complexities and enterprise risk needs, while Loss Control Specialists remain essential for underwriting support and claims reduction in sectors like manufacturing and construction.

Choosing the Right Role: Which Career Fits You?

Risk Managers analyze comprehensive risk portfolios to develop strategic mitigation plans, often working closely with executive leadership to align risk tolerance with business objectives. Loss Control Specialists focus on identifying potential hazards through on-site assessments and implement safety measures to reduce claim frequency and severity. Choosing between these roles depends on your preference for strategic planning and enterprise-wide risk oversight versus hands-on safety inspections and operational risk reduction.

Risk Manager vs Loss Control Specialist Infographic

jobdiv.com

jobdiv.com