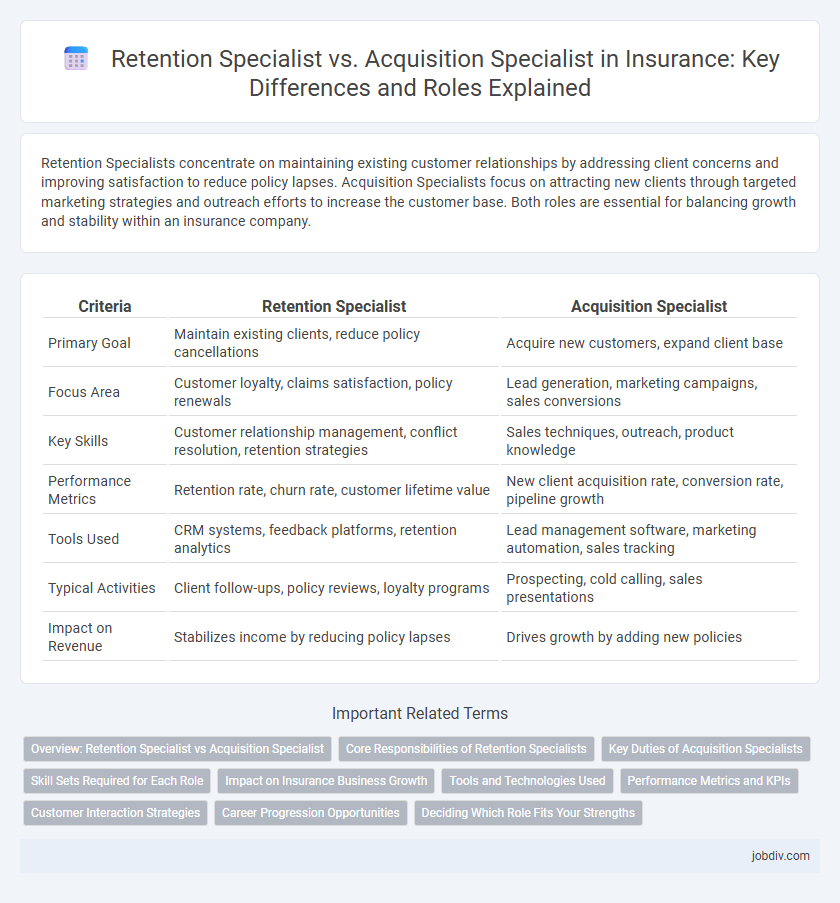

Retention Specialists concentrate on maintaining existing customer relationships by addressing client concerns and improving satisfaction to reduce policy lapses. Acquisition Specialists focus on attracting new clients through targeted marketing strategies and outreach efforts to increase the customer base. Both roles are essential for balancing growth and stability within an insurance company.

Table of Comparison

| Criteria | Retention Specialist | Acquisition Specialist |

|---|---|---|

| Primary Goal | Maintain existing clients, reduce policy cancellations | Acquire new customers, expand client base |

| Focus Area | Customer loyalty, claims satisfaction, policy renewals | Lead generation, marketing campaigns, sales conversions |

| Key Skills | Customer relationship management, conflict resolution, retention strategies | Sales techniques, outreach, product knowledge |

| Performance Metrics | Retention rate, churn rate, customer lifetime value | New client acquisition rate, conversion rate, pipeline growth |

| Tools Used | CRM systems, feedback platforms, retention analytics | Lead management software, marketing automation, sales tracking |

| Typical Activities | Client follow-ups, policy reviews, loyalty programs | Prospecting, cold calling, sales presentations |

| Impact on Revenue | Stabilizes income by reducing policy lapses | Drives growth by adding new policies |

Overview: Retention Specialist vs Acquisition Specialist

Retention Specialists focus on maintaining existing insurance policyholders by addressing their needs, resolving issues, and increasing customer satisfaction to reduce churn rates. Acquisition Specialists concentrate on attracting new clients through targeted marketing strategies, lead generation, and persuasive communication to expand the customer base. Both roles are crucial in balancing growth and stability within insurance companies, optimizing revenue streams through customer lifecycle management.

Core Responsibilities of Retention Specialists

Retention Specialists in insurance focus on maintaining existing client relationships by addressing policyholder concerns, managing renewal processes, and implementing customer loyalty programs. Their core responsibilities include analyzing client retention rates, identifying risk factors for policy lapses, and coordinating with claims and underwriting teams to ensure customer satisfaction. Effective Retention Specialists utilize data-driven strategies to reduce churn and maximize lifetime customer value.

Key Duties of Acquisition Specialists

Acquisition Specialists in insurance focus on generating new business by identifying potential clients and promoting insurance products tailored to their needs. They conduct market research, lead outreach campaigns, and build relationships with prospects to expand the client base. Their key duties also include negotiating terms, closing sales, and collaborating with marketing teams to optimize lead generation strategies.

Skill Sets Required for Each Role

Retention Specialists in insurance excel in customer relationship management, conflict resolution, and data analysis to identify risk factors for policy lapses. Acquisition Specialists require strong prospecting skills, lead generation expertise, and persuasive communication to convert leads into new policyholders. Both roles demand proficiency in CRM software and a deep understanding of insurance products, but retention focuses on client loyalty while acquisition targets market expansion.

Impact on Insurance Business Growth

Retention Specialists strengthen insurance business growth by improving customer loyalty and reducing policy lapse rates, leading to stable revenue streams and lower acquisition costs. Acquisition Specialists drive expansion through targeted marketing strategies and lead generation, increasing new policy sales and market share. Combining efforts from both roles optimizes customer lifetime value and accelerates overall insurance business growth.

Tools and Technologies Used

Retention Specialists rely heavily on customer relationship management (CRM) software, data analytics platforms, and automated communication tools to monitor client satisfaction and predict policy renewal likelihood. Acquisition Specialists utilize lead generation systems, marketing automation software, and advanced customer profiling technologies to identify and engage potential new policyholders efficiently. Both roles increasingly leverage artificial intelligence-driven insights and mobile apps to enhance customer interactions and streamline workflows in the insurance industry.

Performance Metrics and KPIs

Retention Specialists are primarily assessed through metrics such as customer renewal rates, churn reduction percentages, and customer satisfaction scores (CSAT), reflecting their ability to maintain and enhance policyholder loyalty. Acquisition Specialists focus on new policy sales volume, lead conversion rates, and cost per acquisition (CPA) to evaluate their efficiency in attracting and securing new clients. Both roles are crucial, yet their KPIs distinctly measure either customer retention effectiveness or the success of generating new business within the insurance sector.

Customer Interaction Strategies

Retention Specialists emphasize personalized communication and proactive problem-solving to enhance customer loyalty and reduce churn rates. Acquisition Specialists focus on targeted outreach and persuasive messaging to attract new clients and expand the customer base. Both roles leverage CRM tools and data analytics to optimize customer interaction strategies tailored to their specific goals.

Career Progression Opportunities

Retention Specialists often advance into senior client management roles due to their expertise in customer loyalty and risk mitigation strategies. Acquisition Specialists typically progress toward business development leadership positions, leveraging skills in market analysis and lead generation. Both career paths offer lucrative opportunities, with retention focusing on long-term client value and acquisition emphasizing portfolio expansion.

Deciding Which Role Fits Your Strengths

Retention Specialists excel at fostering long-term client relationships by addressing concerns and enhancing customer satisfaction, making them ideal for individuals with strong interpersonal and problem-solving skills. Acquisition Specialists thrive in generating new business by identifying prospects and closing sales, suited for those with a proactive mindset and persuasive communication abilities. Evaluating your strengths in client engagement versus lead generation helps determine the insurance role that aligns best with your professional aptitude.

Retention Specialist vs Acquisition Specialist Infographic

jobdiv.com

jobdiv.com