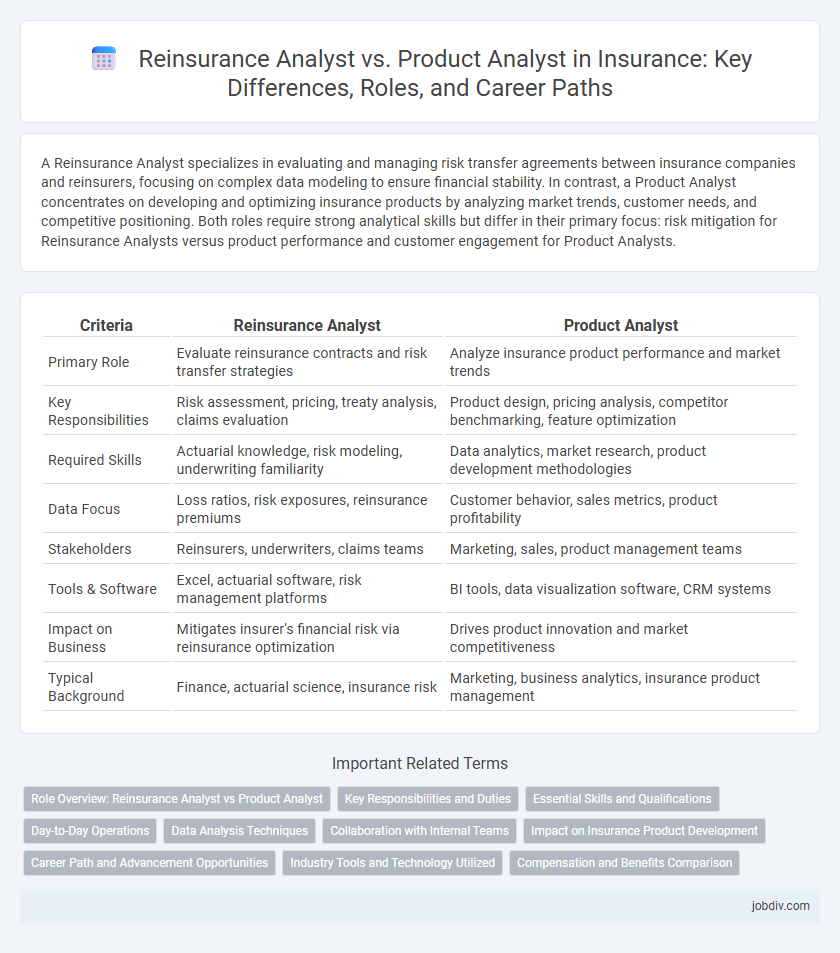

A Reinsurance Analyst specializes in evaluating and managing risk transfer agreements between insurance companies and reinsurers, focusing on complex data modeling to ensure financial stability. In contrast, a Product Analyst concentrates on developing and optimizing insurance products by analyzing market trends, customer needs, and competitive positioning. Both roles require strong analytical skills but differ in their primary focus: risk mitigation for Reinsurance Analysts versus product performance and customer engagement for Product Analysts.

Table of Comparison

| Criteria | Reinsurance Analyst | Product Analyst |

|---|---|---|

| Primary Role | Evaluate reinsurance contracts and risk transfer strategies | Analyze insurance product performance and market trends |

| Key Responsibilities | Risk assessment, pricing, treaty analysis, claims evaluation | Product design, pricing analysis, competitor benchmarking, feature optimization |

| Required Skills | Actuarial knowledge, risk modeling, underwriting familiarity | Data analytics, market research, product development methodologies |

| Data Focus | Loss ratios, risk exposures, reinsurance premiums | Customer behavior, sales metrics, product profitability |

| Stakeholders | Reinsurers, underwriters, claims teams | Marketing, sales, product management teams |

| Tools & Software | Excel, actuarial software, risk management platforms | BI tools, data visualization software, CRM systems |

| Impact on Business | Mitigates insurer's financial risk via reinsurance optimization | Drives product innovation and market competitiveness |

| Typical Background | Finance, actuarial science, insurance risk | Marketing, business analytics, insurance product management |

Role Overview: Reinsurance Analyst vs Product Analyst

A Reinsurance Analyst evaluates risk exposure and pricing models to support the negotiation and management of reinsurance treaties, ensuring financial stability for insurers. In contrast, a Product Analyst focuses on designing, developing, and optimizing insurance products by analyzing market trends, customer needs, and profitability metrics. Both roles require strong analytical skills but differ in scope: reinsurance centers on risk transfer mechanisms, while product analysis targets competitive product offerings and customer value.

Key Responsibilities and Duties

A Reinsurance Analyst primarily assesses risk exposure, evaluates reinsurance treaties, and supports underwriting decisions to optimize risk transfer and minimize financial loss. A Product Analyst focuses on analyzing insurance product performance, conducting market research, and collaborating with the development team to enhance product offerings and profitability. Both roles require strong data analysis skills, but the Reinsurance Analyst emphasizes risk management while the Product Analyst centers on product strategy and customer needs.

Essential Skills and Qualifications

Reinsurance Analysts require strong expertise in risk assessment, actuarial modeling, and claims analysis to evaluate reinsurance contracts and optimize risk transfer strategies. Product Analysts in insurance prioritize data analytics, market research, and product development skills to design competitive insurance products tailored to customer needs and regulatory requirements. Both roles demand proficiency in statistical software, excellent communication abilities, and a deep understanding of insurance principles, but Reinsurance Analysts emphasize financial risk metrics while Product Analysts focus on market trends and consumer behavior.

Day-to-Day Operations

Reinsurance Analysts primarily evaluate risk exposures, analyze treaties, and support underwriting decisions by assessing loss data and pricing models to optimize portfolio performance. Product Analysts focus on designing, developing, and refining insurance products by examining market trends, customer needs, and competitive positioning to enhance product profitability and compliance. Both roles involve detailed data analysis but differ as Reinsurance Analysts emphasize risk management while Product Analysts drive product innovation and market strategy.

Data Analysis Techniques

Reinsurance Analysts specialize in advanced data modeling, stochastic simulations, and risk quantification to evaluate insurer exposure and optimize treaty structures. Product Analysts utilize predictive analytics, customer segmentation, and pricing algorithms to enhance product development and market competitiveness. Both roles leverage data visualization and statistical software but apply distinct analytical techniques tailored to reinsurance risk assessment versus product performance analysis.

Collaboration with Internal Teams

Reinsurance Analysts collaborate closely with underwriting, actuarial, and claims teams to assess risk exposure and optimize reinsurance programs, ensuring comprehensive risk management. Product Analysts work alongside marketing, sales, and development teams to design insurance products that meet market demands and regulatory standards. Effective collaboration between these roles enhances product innovation while maintaining financial stability and compliance within the insurance company.

Impact on Insurance Product Development

Reinsurance Analysts provide critical risk assessment models that influence underwriting strategies and pricing accuracy, significantly shaping insurance product viability and profitability. Product Analysts integrate market data and customer insights to design features that meet demand and regulatory requirements, driving innovation and competitive positioning. The collaboration between these roles enhances insurance product development by balancing risk management with customer-centric design, optimizing portfolio performance and growth.

Career Path and Advancement Opportunities

Reinsurance Analysts specialize in assessing risks transferred between insurance companies, focusing on contract evaluations and financial risk management, which leads to advanced roles in underwriting or risk management departments. Product Analysts concentrate on developing and optimizing insurance products through market research and customer data analysis, often progressing toward product management or marketing leadership positions. Career advancement in reinsurance typically involves deepening expertise in risk assessment, while product analysts advance by enhancing strategic product development and innovation skills.

Industry Tools and Technology Utilized

Reinsurance Analysts primarily leverage advanced risk modeling software such as RMS and AIR to assess and manage insurance portfolios, while Product Analysts utilize data analytics platforms like Tableau and SAS to develop and optimize insurance products based on market trends. Both roles increasingly rely on machine learning algorithms and cloud-based solutions from providers like AWS and Microsoft Azure to enhance data processing efficiency and decision-making accuracy. Expertise in SQL and Python is common across both positions to manipulate large datasets and automate reporting tasks within the insurance industry.

Compensation and Benefits Comparison

Reinsurance Analysts typically earn higher average salaries than Product Analysts due to specialized expertise in risk assessment and treaty negotiations within the insurance sector. Benefits for Reinsurance Analysts often include performance bonuses tied to underwriting outcomes, comprehensive health packages, and opportunities for professional certifications like CPCU. Product Analysts receive competitive base pay with benefits emphasizing market research tools access, flexible work arrangements, and development programs focused on product lifecycle management.

Reinsurance Analyst vs Product Analyst Infographic

jobdiv.com

jobdiv.com