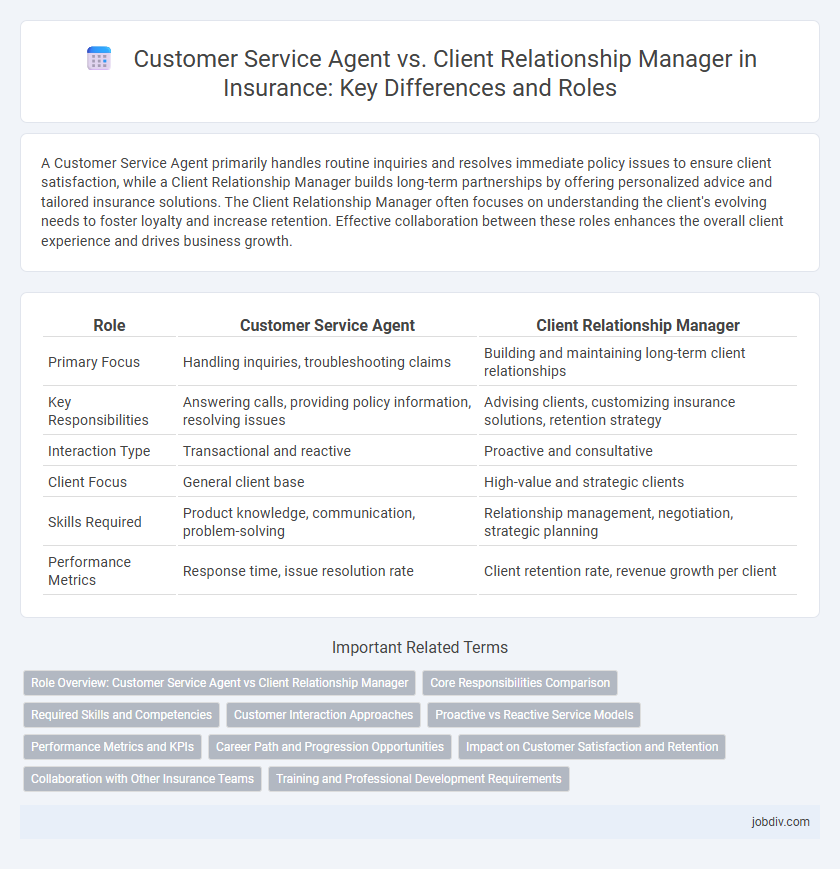

A Customer Service Agent primarily handles routine inquiries and resolves immediate policy issues to ensure client satisfaction, while a Client Relationship Manager builds long-term partnerships by offering personalized advice and tailored insurance solutions. The Client Relationship Manager often focuses on understanding the client's evolving needs to foster loyalty and increase retention. Effective collaboration between these roles enhances the overall client experience and drives business growth.

Table of Comparison

| Role | Customer Service Agent | Client Relationship Manager |

|---|---|---|

| Primary Focus | Handling inquiries, troubleshooting claims | Building and maintaining long-term client relationships |

| Key Responsibilities | Answering calls, providing policy information, resolving issues | Advising clients, customizing insurance solutions, retention strategy |

| Interaction Type | Transactional and reactive | Proactive and consultative |

| Client Focus | General client base | High-value and strategic clients |

| Skills Required | Product knowledge, communication, problem-solving | Relationship management, negotiation, strategic planning |

| Performance Metrics | Response time, issue resolution rate | Client retention rate, revenue growth per client |

Role Overview: Customer Service Agent vs Client Relationship Manager

Customer Service Agents in insurance handle policy inquiries, claims processing, and issue resolution, acting as the first point of contact for policyholders. Client Relationship Managers focus on building long-term relationships, offering personalized insurance solutions, and ensuring client satisfaction through proactive engagement and strategic account management. Both roles require strong communication skills, but Client Relationship Managers emphasize customer retention and tailored service strategies to maximize client value.

Core Responsibilities Comparison

Customer Service Agents in insurance primarily handle policy inquiries, claims assistance, and basic issue resolution, ensuring timely and accurate information delivery to clients. Client Relationship Managers focus on building long-term relationships by developing tailored insurance solutions, managing complex client portfolios, and driving customer retention through personalized service. Both roles are essential, but Agents emphasize transactional support while Relationship Managers prioritize strategic account growth and client satisfaction.

Required Skills and Competencies

Customer Service Agents in insurance require strong communication skills, attention to detail, and proficiency in handling policy inquiries and claims processing efficiently. Client Relationship Managers must possess advanced interpersonal skills, strategic thinking, and expertise in managing client portfolios and fostering long-term business relationships. Both roles demand problem-solving abilities, knowledge of insurance products, and a customer-centric approach to ensure client satisfaction and retention.

Customer Interaction Approaches

Customer Service Agents in insurance primarily address immediate client inquiries and resolve policy-related issues quickly through standardized procedures and scripted responses, ensuring efficient and consistent service. Client Relationship Managers adopt a more personalized approach, focusing on building long-term trust by understanding individual client needs, offering tailored insurance solutions, and proactively managing portfolios. Emphasizing proactive communication and personalized engagement, Relationship Managers enhance customer satisfaction and retention beyond routine transactional interactions.

Proactive vs Reactive Service Models

Customer Service Agents primarily operate within a reactive service model, addressing client issues as they arise and resolving inquiries promptly to maintain satisfaction. Client Relationship Managers employ a proactive approach, anticipating client needs through data analysis and personalized outreach to foster long-term loyalty and cross-selling opportunities. Leveraging advanced CRM systems, Relationship Managers enhance customer retention by identifying trends and offering tailored insurance solutions before clients request assistance.

Performance Metrics and KPIs

Customer Service Agents in insurance focus on key performance indicators such as average handle time (AHT), first contact resolution (FCR), and customer satisfaction score (CSAT) to ensure efficient and effective issue resolution. Client Relationship Managers prioritize metrics including client retention rate, net promoter score (NPS), and portfolio growth to drive long-term customer loyalty and business development. Both roles utilize tailored KPIs to measure performance aligned with operational goals, enhancing client experience and company profitability.

Career Path and Progression Opportunities

Customer Service Agents in insurance typically start with handling policy inquiries and claims, offering foundational knowledge essential for career advancement. Client Relationship Managers build on this experience by focusing on personalized client portfolios, leading to opportunities in senior advisory or management roles. Progression from Customer Service Agent to Client Relationship Manager often involves targeted training in sales strategies and regulatory compliance, enhancing leadership potential within the insurance sector.

Impact on Customer Satisfaction and Retention

Customer Service Agents handle immediate policy inquiries and claim issues efficiently, which directly improves customer satisfaction by resolving concerns promptly. Client Relationship Managers build long-term trust through personalized service and strategic financial advice, significantly enhancing customer retention rates. Companies combining both roles see stronger loyalty and higher lifetime value due to the balance of reactive support and proactive client engagement.

Collaboration with Other Insurance Teams

Customer Service Agents coordinate closely with underwriting and claims departments to resolve policyholder inquiries quickly and accurately, ensuring seamless communication across operational teams. Client Relationship Managers collaborate strategically with sales and risk management teams to tailor insurance solutions and enhance client retention through personalized service. Effective teamwork between these roles fosters comprehensive support and improves overall customer satisfaction within the insurance company.

Training and Professional Development Requirements

Customer Service Agents in insurance require foundational training in product knowledge, communication skills, and basic problem-solving to address client inquiries efficiently. Client Relationship Managers need advanced professional development, including strategic account management, negotiation techniques, and in-depth industry regulations training to foster long-term client retention and growth. Ongoing certification programs and workshops are essential for both roles to stay updated with evolving compliance standards and customer service technologies.

Customer Service Agent vs Client Relationship Manager Infographic

jobdiv.com

jobdiv.com