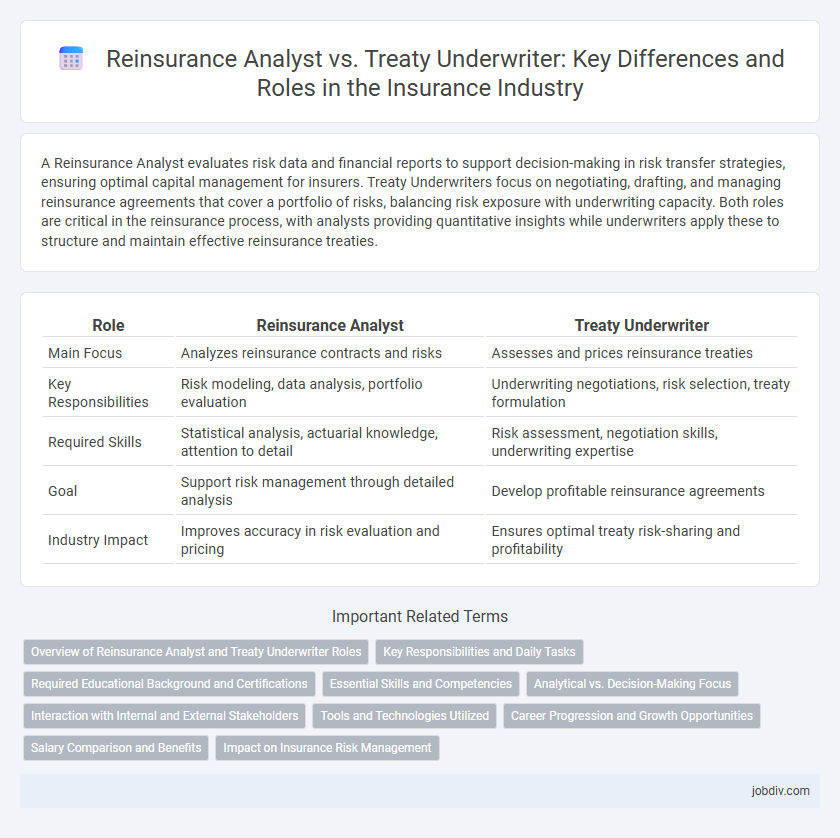

A Reinsurance Analyst evaluates risk data and financial reports to support decision-making in risk transfer strategies, ensuring optimal capital management for insurers. Treaty Underwriters focus on negotiating, drafting, and managing reinsurance agreements that cover a portfolio of risks, balancing risk exposure with underwriting capacity. Both roles are critical in the reinsurance process, with analysts providing quantitative insights while underwriters apply these to structure and maintain effective reinsurance treaties.

Table of Comparison

| Role | Reinsurance Analyst | Treaty Underwriter |

|---|---|---|

| Main Focus | Analyzes reinsurance contracts and risks | Assesses and prices reinsurance treaties |

| Key Responsibilities | Risk modeling, data analysis, portfolio evaluation | Underwriting negotiations, risk selection, treaty formulation |

| Required Skills | Statistical analysis, actuarial knowledge, attention to detail | Risk assessment, negotiation skills, underwriting expertise |

| Goal | Support risk management through detailed analysis | Develop profitable reinsurance agreements |

| Industry Impact | Improves accuracy in risk evaluation and pricing | Ensures optimal treaty risk-sharing and profitability |

Overview of Reinsurance Analyst and Treaty Underwriter Roles

Reinsurance Analysts assess portfolio risks by analyzing data and financial reports to support decision-making in treaty underwriting. Treaty Underwriters evaluate, negotiate, and structure reinsurance agreements, focusing on risk transfer and contract terms for long-term corporate protection. Both roles require strong analytical skills but differ in scope: Analysts focus on data insights, while Underwriters manage client relationships and treaty execution.

Key Responsibilities and Daily Tasks

Reinsurance Analysts primarily assess risk data, prepare detailed reports, and support treaty underwriting decisions by analyzing loss trends and pricing models. Treaty Underwriters focus on negotiating contract terms, evaluating treaty structures, and managing portfolios to ensure appropriate risk distribution and compliance with regulatory standards. Both roles require strong analytical skills, but analysts lean toward data-driven risk evaluation while underwriters emphasize strategic decision-making and client relationship management.

Required Educational Background and Certifications

A Reinsurance Analyst typically requires a bachelor's degree in finance, economics, or actuarial science, with certifications such as Associate in Reinsurance (ARe) or Chartered Property Casualty Underwriter (CPCU) enhancing their credentials. Treaty Underwriters often hold degrees in business, insurance, or risk management, complemented by professional designations like Chartered Insurance Professional (CIP) or Fellow of the Risk and Insurance Management Society (FRIMS). Both roles benefit from advanced certifications related to reinsurance, underwriting principles, and risk assessment to improve analytical accuracy and compliance.

Essential Skills and Competencies

A Reinsurance Analyst excels in data analysis, risk assessment, and financial modeling to evaluate reinsurance treaties and support decision-making. Treaty Underwriters require strong negotiation skills, in-depth knowledge of underwriting guidelines, and the ability to structure and price reinsurance agreements effectively. Both roles demand proficiency in regulatory compliance, market trends analysis, and advanced communication to collaborate with brokers and insurers.

Analytical vs. Decision-Making Focus

A Reinsurance Analyst primarily emphasizes analytical skills, evaluating risk data, loss trends, and portfolio performance to support underwriting strategies through detailed quantitative assessments. In contrast, a Treaty Underwriter concentrates on decision-making, applying judgment to approve or reject reinsurance agreements, negotiate terms, and manage treaty portfolios based on risk appetite and market conditions. The analytical role centers on data interpretation and modeling, while the underwriting position requires balancing risk exposure with business objectives through proactive decision-making.

Interaction with Internal and External Stakeholders

Reinsurance Analysts collaborate closely with internal actuarial and claims teams to assess risk exposures and optimize treaty structures, while engaging external brokers and cedents to negotiate terms and assess market conditions. Treaty Underwriters maintain continuous communication with internal pricing, legal, and risk management departments to ensure compliance and profitability, alongside external reinsurers and regulatory bodies for agreement validation and relationship management. These interactions drive effective risk transfer strategies and maintain alignment with corporate risk appetite and regulatory frameworks.

Tools and Technologies Utilized

Reinsurance analysts leverage advanced data analytics platforms, predictive modeling software, and risk assessment tools to evaluate and quantify reinsurance exposures efficiently. Treaty underwriters utilize specialized underwriting software, automated policy management systems, and industry databases to assess treaty terms and manage portfolio risk effectively. Both roles increasingly rely on artificial intelligence and machine learning algorithms to enhance decision-making accuracy and streamline workflows.

Career Progression and Growth Opportunities

Reinsurance analysts primarily focus on risk assessment and data analysis to support underwriting decisions, providing a strong foundation in evaluating insurance portfolios and market trends. Treaty underwriters assume greater responsibility by managing reinsurance contracts and negotiating terms, which enhances skills in risk management and strategic decision-making. Career progression from reinsurance analyst to treaty underwriter often leads to leadership roles within underwriting teams or specialized positions in reinsurance strategy and portfolio management.

Salary Comparison and Benefits

Reinsurance analysts typically earn between $70,000 and $90,000 annually, while treaty underwriters command higher salaries averaging $90,000 to $120,000 due to their risk assessment responsibilities and negotiation expertise. Benefits for both roles often include health insurance, retirement plans, and performance bonuses, but treaty underwriters may receive enhanced incentives linked to underwriting results and profit sharing. The compensation difference reflects the treaty underwriter's greater impact on portfolio management and contract structuring within the reinsurance industry.

Impact on Insurance Risk Management

Reinsurance Analysts evaluate risk portfolios to optimize risk transfer strategies, directly influencing the accuracy of risk assessment and capital allocation in insurance companies. Treaty Underwriters negotiate and structure reinsurance contracts, shaping the terms that govern risk sharing and payout obligations. Together, their roles enhance the precision and effectiveness of insurance risk management by balancing exposure with financial stability.

Reinsurance Analyst vs Treaty Underwriter Infographic

jobdiv.com

jobdiv.com