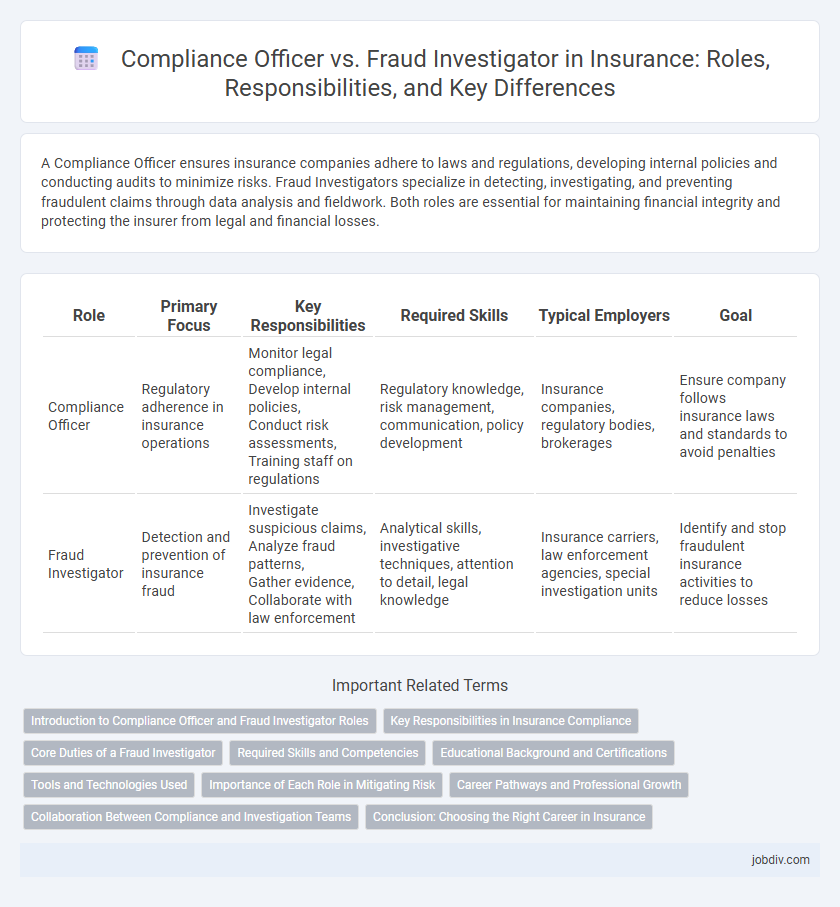

A Compliance Officer ensures insurance companies adhere to laws and regulations, developing internal policies and conducting audits to minimize risks. Fraud Investigators specialize in detecting, investigating, and preventing fraudulent claims through data analysis and fieldwork. Both roles are essential for maintaining financial integrity and protecting the insurer from legal and financial losses.

Table of Comparison

| Role | Primary Focus | Key Responsibilities | Required Skills | Typical Employers | Goal |

|---|---|---|---|---|---|

| Compliance Officer | Regulatory adherence in insurance operations |

Monitor legal compliance, Develop internal policies, Conduct risk assessments, Training staff on regulations |

Regulatory knowledge, risk management, communication, policy development | Insurance companies, regulatory bodies, brokerages | Ensure company follows insurance laws and standards to avoid penalties |

| Fraud Investigator | Detection and prevention of insurance fraud |

Investigate suspicious claims, Analyze fraud patterns, Gather evidence, Collaborate with law enforcement |

Analytical skills, investigative techniques, attention to detail, legal knowledge | Insurance carriers, law enforcement agencies, special investigation units | Identify and stop fraudulent insurance activities to reduce losses |

Introduction to Compliance Officer and Fraud Investigator Roles

A Compliance Officer in insurance ensures adherence to industry regulations, internal policies, and legal standards to mitigate risks and protect the company from regulatory penalties. A Fraud Investigator specializes in detecting, investigating, and preventing fraudulent claims and activities that could lead to financial losses for insurers. Both roles are crucial in maintaining the integrity and financial stability of insurance organizations by addressing compliance and fraud challenges.

Key Responsibilities in Insurance Compliance

Compliance Officers in insurance ensure adherence to regulatory requirements, conduct internal audits, and develop policies to prevent legal violations. Fraud Investigators focus on detecting, investigating, and resolving fraudulent claims by analyzing suspicious activities and gathering evidence. Both roles are critical for maintaining integrity and minimizing financial losses within insurance companies.

Core Duties of a Fraud Investigator

A Fraud Investigator in insurance primarily focuses on identifying, investigating, and preventing fraudulent claims to protect company assets and reduce financial losses. They analyze suspicious activities, gather evidence, interview suspects and witnesses, and collaborate with law enforcement to build strong cases. Their work ensures the integrity of insurance operations and supports the company's compliance with legal and regulatory standards.

Required Skills and Competencies

Compliance Officers in insurance must possess strong knowledge of regulatory frameworks, risk assessment capabilities, and excellent analytical skills to ensure company policies align with legal standards. Fraud Investigators require expertise in forensic analysis, investigative techniques, and proficiency with data analytics tools to detect and prevent fraudulent claims. Both roles demand attention to detail, critical thinking, and effective communication skills to navigate complex insurance regulations and maintain organizational integrity.

Educational Background and Certifications

Compliance Officers in insurance typically hold degrees in law, business administration, or finance, with certifications such as Certified Regulatory Compliance Manager (CRCM) enhancing their expertise. Fraud Investigators often have backgrounds in criminal justice, accounting, or forensic science, complemented by certifications like Certified Fraud Examiner (CFE) or Certified Forensic Accountant (Cr.FA). Both roles require specialized education and professional credentials to ensure adherence to legal standards and effective fraud detection within the industry.

Tools and Technologies Used

Compliance officers in the insurance industry utilize regulatory compliance software, risk management platforms, and audit management tools to ensure adherence to laws and internal policies. Fraud investigators leverage advanced data analytics, AI-powered fraud detection systems, and digital forensics tools to identify and analyze suspicious claims and transactions. Both roles integrate automated reporting systems and secure databases to maintain data integrity and streamline investigations.

Importance of Each Role in Mitigating Risk

Compliance Officers play a crucial role in mitigating risk by ensuring that insurance companies adhere to regulatory requirements, thereby preventing legal penalties and reputational damage. Fraud Investigators are essential in detecting and investigating fraudulent claims, which helps reduce financial losses and maintain the integrity of insurance operations. Both roles contribute significantly to risk management by safeguarding the company from regulatory violations and fraudulent activities that can result in substantial financial exposure.

Career Pathways and Professional Growth

Compliance Officers in insurance focus on regulatory adherence, developing expertise in risk management and legal frameworks, which can lead to roles such as Chief Compliance Officer or Risk Manager. Fraud Investigators specialize in detecting and preventing insurance fraud, building skills in forensic analysis and investigative techniques, often advancing to positions like Fraud Prevention Manager or Special Investigations Unit Leader. Both career paths offer professional growth through certifications such as Certified Compliance & Ethics Professional (CCEP) for compliance officers and Certified Fraud Examiner (CFE) for fraud investigators.

Collaboration Between Compliance and Investigation Teams

Collaboration between Compliance Officers and Fraud Investigators enhances risk management by combining regulatory oversight with in-depth fraud detection expertise. Compliance Officers ensure adherence to legal and policy standards, while Fraud Investigators analyze suspicious activities to identify and prevent fraudulent claims. Integrating these roles fosters efficient communication, accelerates case resolution, and strengthens an insurance company's overall fraud prevention strategy.

Conclusion: Choosing the Right Career in Insurance

Choosing the right career in insurance depends on individual strengths and interests; Compliance Officers excel in regulatory adherence and risk management while Fraud Investigators specialize in detecting and preventing fraudulent claims. Both roles play crucial parts in maintaining the integrity and financial stability of insurance companies. Professionals aiming for a detail-oriented, analytical path may prefer fraud investigation, whereas those interested in policy, law, and corporate governance might find compliance more rewarding.

Compliance Officer vs Fraud Investigator Infographic

jobdiv.com

jobdiv.com