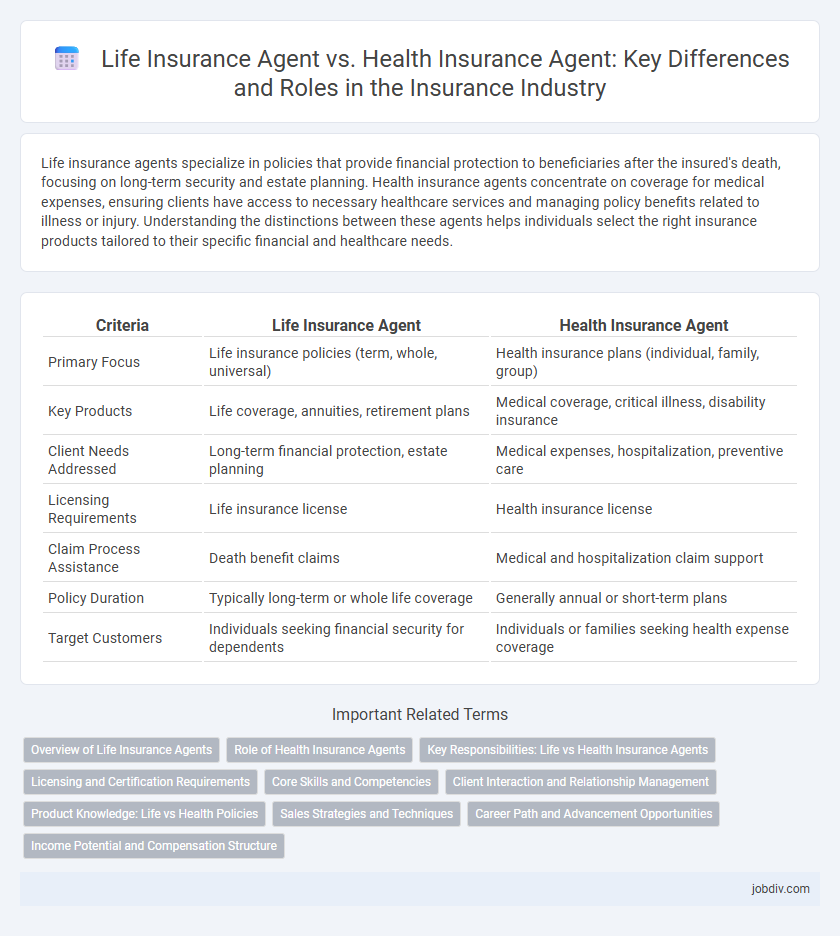

Life insurance agents specialize in policies that provide financial protection to beneficiaries after the insured's death, focusing on long-term security and estate planning. Health insurance agents concentrate on coverage for medical expenses, ensuring clients have access to necessary healthcare services and managing policy benefits related to illness or injury. Understanding the distinctions between these agents helps individuals select the right insurance products tailored to their specific financial and healthcare needs.

Table of Comparison

| Criteria | Life Insurance Agent | Health Insurance Agent |

|---|---|---|

| Primary Focus | Life insurance policies (term, whole, universal) | Health insurance plans (individual, family, group) |

| Key Products | Life coverage, annuities, retirement plans | Medical coverage, critical illness, disability insurance |

| Client Needs Addressed | Long-term financial protection, estate planning | Medical expenses, hospitalization, preventive care |

| Licensing Requirements | Life insurance license | Health insurance license |

| Claim Process Assistance | Death benefit claims | Medical and hospitalization claim support |

| Policy Duration | Typically long-term or whole life coverage | Generally annual or short-term plans |

| Target Customers | Individuals seeking financial security for dependents | Individuals or families seeking health expense coverage |

Overview of Life Insurance Agents

Life insurance agents specialize in policies that provide financial protection to beneficiaries upon the policyholder's death, focusing on terms like whole life, term life, and universal life insurance. They assess clients' long-term financial goals, estate planning needs, and income replacement strategies to tailor suitable coverage options. Expertise in underwriting guidelines, premium calculations, and beneficiary designations distinguishes life insurance agents from health insurance agents who focus on medical coverage.

Role of Health Insurance Agents

Health insurance agents specialize in providing clients with tailored coverage plans that protect against medical expenses, including hospital stays, surgeries, and prescription drugs, ensuring financial security during health crises. They assess individual health risks and guide clients through complex policy options, maximizing benefits while minimizing out-of-pocket costs. Expertise in Medicaid, Medicare, and Affordable Care Act policies enables health insurance agents to navigate regulatory requirements and secure optimal plans for diverse client needs.

Key Responsibilities: Life vs Health Insurance Agents

Life insurance agents primarily focus on assessing clients' financial needs to recommend suitable life insurance policies, which provide financial security to beneficiaries after the policyholder's death. Health insurance agents concentrate on explaining coverage options, benefits, and claims processes related to medical expenses, ensuring clients receive appropriate health plans. Both roles require strong communication skills and knowledge of insurance regulations but differ in specialization--life agents handle long-term financial planning, while health agents manage healthcare coverage and claims assistance.

Licensing and Certification Requirements

Life insurance agents typically require a state-specific life insurance license, which involves completing pre-licensing courses and passing an exam focused on life insurance policies, taxation, and estate planning. Health insurance agents must obtain a health insurance license, often combined with a life insurance license, requiring knowledge of health policy regulations, Medicaid, Medicare, and Affordable Care Act provisions. Both agents may pursue further certifications, such as the Certified Insurance Counselor (CIC) or Chartered Life Underwriter (CLU) designations, to enhance expertise and credibility in their respective fields.

Core Skills and Competencies

Life insurance agents excel in assessing long-term financial planning needs, focusing on risk evaluation, policy customization, and client relationship management to secure future family stability. Health insurance agents specialize in understanding medical policy frameworks, claims processing, regulatory compliance, and communicating complex health benefits clearly to clients. Both roles require strong sales acumen, multitasking abilities, and ethical judgment, but the core competencies differ by product knowledge and client advisory focus.

Client Interaction and Relationship Management

Life insurance agents prioritize building long-term relationships by understanding clients' financial goals and providing personalized policy recommendations that ensure financial security for beneficiaries. Health insurance agents focus on immediate client needs by guiding them through complex healthcare plans, coverage options, and claims processes to ensure access to essential medical services. Both roles require strong interpersonal skills, but life insurance agents emphasize ongoing relationship management while health insurance agents concentrate on timely, solution-oriented communication.

Product Knowledge: Life vs Health Policies

Life insurance agents possess in-depth knowledge of policies such as term life, whole life, and universal life insurance, focusing on long-term financial protection and estate planning. Health insurance agents specialize in understanding coverage options like HMOs, PPOs, and Medicare plans, emphasizing medical expense management and benefits coordination. The difference in product knowledge directly impacts the agent's ability to tailor solutions based on client needs related to life coverage or health care costs.

Sales Strategies and Techniques

Life insurance agents focus on long-term financial security narratives, using needs-based selling and emphasizing future planning benefits to connect with clients emotionally. Health insurance agents prioritize timely coverage and risk management, often employing consultative selling techniques to explain policy complexities and tailor solutions to individual health needs. Mastery of personalized communication and digital tools enhances sales effectiveness for both agent types.

Career Path and Advancement Opportunities

Life insurance agents typically focus on long-term financial planning products with potential for higher commissions and opportunities to specialize in retirement or estate planning, while health insurance agents concentrate on short-term policies, often requiring up-to-date knowledge of healthcare laws and regulations. Career advancement for life insurance agents often includes roles such as financial advisors or sales managers, leveraging their expertise in wealth management, whereas health insurance agents may progress to roles like benefits consultants or underwriting specialists due to their proficiency in medical coverage and risk assessment. Both paths offer growth through certifications, client relationship development, and expanding product knowledge, aligning with evolving industry demands.

Income Potential and Compensation Structure

Life insurance agents typically earn income through commissions based on policy premiums, with opportunities for residual commissions that increase long-term earning potential. Health insurance agents often receive commissions tied to enrollment numbers and may have access to bonuses or renewals, but typically face lower residual income compared to life insurance agents. The compensation structure for life agents generally favors sustained income growth, while health agents benefit from volume-driven earnings and incentive bonuses.

Life Insurance Agent vs Health Insurance Agent Infographic

jobdiv.com

jobdiv.com