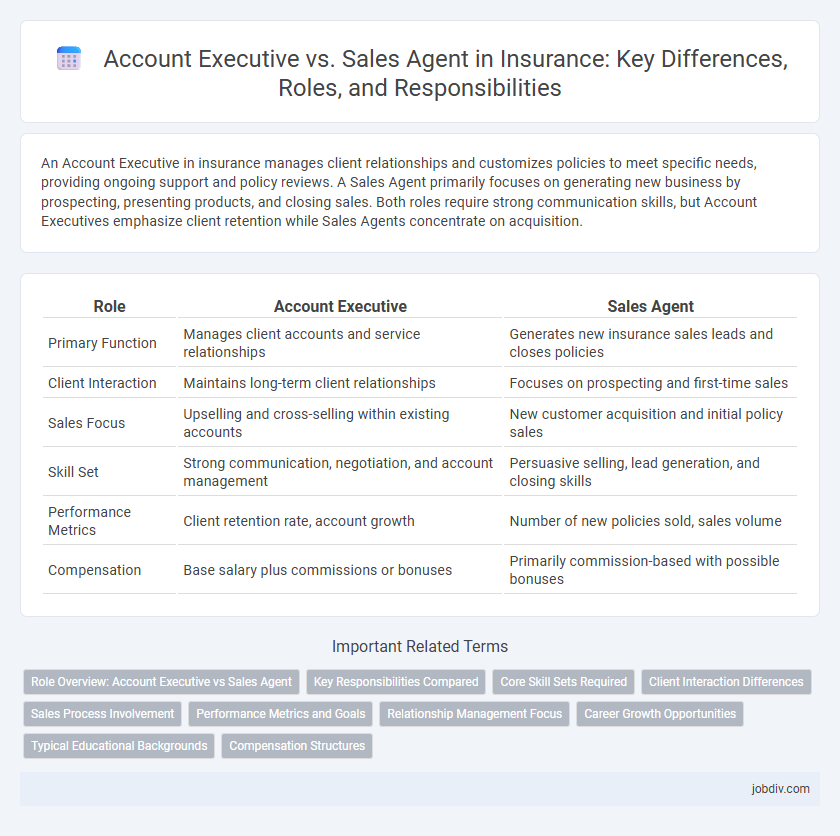

An Account Executive in insurance manages client relationships and customizes policies to meet specific needs, providing ongoing support and policy reviews. A Sales Agent primarily focuses on generating new business by prospecting, presenting products, and closing sales. Both roles require strong communication skills, but Account Executives emphasize client retention while Sales Agents concentrate on acquisition.

Table of Comparison

| Role | Account Executive | Sales Agent |

|---|---|---|

| Primary Function | Manages client accounts and service relationships | Generates new insurance sales leads and closes policies |

| Client Interaction | Maintains long-term client relationships | Focuses on prospecting and first-time sales |

| Sales Focus | Upselling and cross-selling within existing accounts | New customer acquisition and initial policy sales |

| Skill Set | Strong communication, negotiation, and account management | Persuasive selling, lead generation, and closing skills |

| Performance Metrics | Client retention rate, account growth | Number of new policies sold, sales volume |

| Compensation | Base salary plus commissions or bonuses | Primarily commission-based with possible bonuses |

Role Overview: Account Executive vs Sales Agent

Account Executives in insurance manage client relationships, coordinate policy renewals, and ensure customer satisfaction through ongoing support, often working with larger or corporate accounts. Sales Agents primarily focus on generating new business by prospecting, presenting insurance products, and closing sales with individual clients. Both roles require strong communication skills, but Account Executives emphasize client retention while Sales Agents prioritize acquisition.

Key Responsibilities Compared

Account Executives in insurance focus on managing client accounts, ensuring policy renewals, and customizing insurance solutions to meet client needs, emphasizing relationship management and retention. Sales Agents primarily concentrate on prospecting new clients, presenting insurance products, and closing sales to generate new business, with a strong emphasis on lead generation and conversion. Both roles require deep product knowledge, but Account Executives prioritize ongoing client service while Sales Agents focus on market expansion.

Core Skill Sets Required

Account Executives in insurance typically require advanced negotiation skills, strategic client management, and a deep understanding of policy structuring to tailor comprehensive coverage solutions. Sales Agents primarily need strong communication abilities, prospecting prowess, and product knowledge to effectively identify and convert leads. Mastery of customer relationship management (CRM) software and compliance with regulatory standards are essential skills shared by both roles.

Client Interaction Differences

Account Executives in insurance manage ongoing client relationships through personalized service, needs assessment, and policy adjustments to ensure retention and satisfaction. Sales Agents primarily focus on prospecting, presenting policy options, and closing initial sales, engaging clients during the acquisition phase. The level of client interaction for Account Executives is more continuous and consultative, while Sales Agents emphasize transactional and persuasive communication during the first point of contact.

Sales Process Involvement

Sales agents primarily focus on lead generation and initial client contact, driving the early stages of the insurance sales process. Account executives manage ongoing client relationships, overseeing policy implementation and renewals to ensure satisfaction and retention. Their combined roles streamline the sales cycle, enhancing customer acquisition and long-term engagement in the insurance industry.

Performance Metrics and Goals

Account Executives in insurance are typically evaluated on client retention rates, policy renewal percentages, and overall portfolio growth, measuring their ability to maintain long-term relationships. Sales Agents focus heavily on new policy sales, lead conversion rates, and monthly quota attainment, emphasizing acquisition and revenue generation. Both roles prioritize metrics aligned with revenue growth but differ in client engagement depth and lifecycle targets.

Relationship Management Focus

Account Executives in insurance prioritize long-term relationship management by maintaining client portfolios and ensuring personalized service tailored to evolving needs. Sales Agents primarily focus on acquiring new clients and generating leads through prospecting and direct sales efforts. Effective relationship management by Account Executives drives customer retention and upselling opportunities, enhancing overall business growth.

Career Growth Opportunities

Account Executives in insurance typically have broader responsibilities, managing client relationships and strategic accounts, which fosters advanced skills and leadership potential for career growth. Sales Agents often focus on generating new business and may experience faster entry-level job mobility but face more limited upward movement compared to Account Executives. Transitioning from Sales Agent to Account Executive is a common career path, offering increased earning potential and opportunities for managerial roles within insurance firms.

Typical Educational Backgrounds

Account Executives in insurance typically hold a bachelor's degree in business administration, marketing, or finance, which provides foundational knowledge for managing client accounts and developing strategic sales plans. Sales Agents often possess a high school diploma or associate degree, leveraging licensing courses and on-the-job training to understand insurance products and regulations. Both roles require industry-specific certifications, but Account Executives generally have more advanced formal education to support client relationship management and complex policy sales.

Compensation Structures

Account Executives in insurance typically receive a base salary plus commissions, ensuring stable income combined with performance incentives, while Sales Agents often rely primarily on commission-based compensation, driving aggressive sales behaviors. Compensation structures for Account Executives may include bonuses, profit sharing, and benefits, reflecting their broader client management responsibilities. Sales Agents' earnings fluctuate with sales volume, emphasizing lead generation and policy sales conversions.

Account Executive vs Sales Agent Infographic

jobdiv.com

jobdiv.com