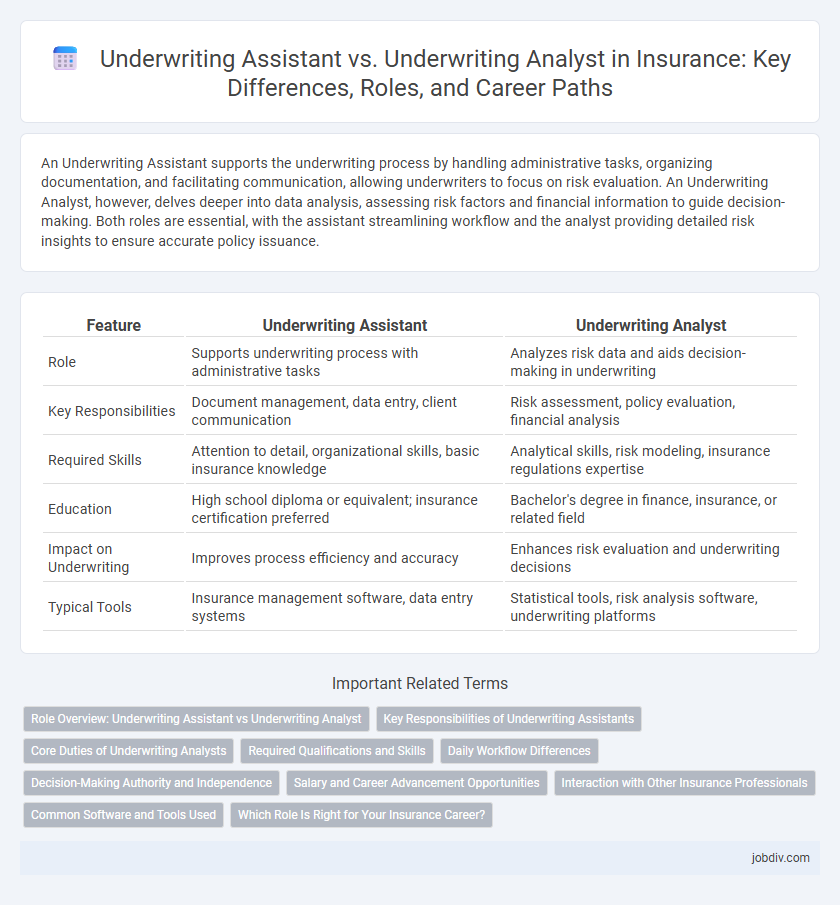

An Underwriting Assistant supports the underwriting process by handling administrative tasks, organizing documentation, and facilitating communication, allowing underwriters to focus on risk evaluation. An Underwriting Analyst, however, delves deeper into data analysis, assessing risk factors and financial information to guide decision-making. Both roles are essential, with the assistant streamlining workflow and the analyst providing detailed risk insights to ensure accurate policy issuance.

Table of Comparison

| Feature | Underwriting Assistant | Underwriting Analyst |

|---|---|---|

| Role | Supports underwriting process with administrative tasks | Analyzes risk data and aids decision-making in underwriting |

| Key Responsibilities | Document management, data entry, client communication | Risk assessment, policy evaluation, financial analysis |

| Required Skills | Attention to detail, organizational skills, basic insurance knowledge | Analytical skills, risk modeling, insurance regulations expertise |

| Education | High school diploma or equivalent; insurance certification preferred | Bachelor's degree in finance, insurance, or related field |

| Impact on Underwriting | Improves process efficiency and accuracy | Enhances risk evaluation and underwriting decisions |

| Typical Tools | Insurance management software, data entry systems | Statistical tools, risk analysis software, underwriting platforms |

Role Overview: Underwriting Assistant vs Underwriting Analyst

Underwriting Assistants support underwriters by managing administrative tasks, gathering documentation, and ensuring efficient data entry to streamline the underwriting process. Underwriting Analysts perform in-depth risk assessments using quantitative data, financial reports, and market trends to evaluate insurance applications and recommend approval or modifications. Both roles are essential to underwriting efficiency, with assistants focused on operational support and analysts dedicated to risk evaluation and decision-making.

Key Responsibilities of Underwriting Assistants

Underwriting Assistants primarily support the underwriting process by collecting and verifying applicant information, preparing documentation, and maintaining accurate records to ensure seamless policy issuance. They assist underwriters by conducting preliminary risk assessments, coordinating communication between clients and underwriters, and managing data entry into underwriting systems. Their role streamlines workflow efficiency, enabling underwriters to focus on detailed risk analysis and decision-making.

Core Duties of Underwriting Analysts

Underwriting Analysts primarily assess financial information, risk data, and historical claims to determine appropriate insurance coverage and pricing. They analyze applicant profiles using statistical models and industry benchmarks to recommend policy terms that balance profitability with risk exposure. This analytical role supports underwriting decisions by providing data-driven insights to improve the accuracy and efficiency of risk evaluation.

Required Qualifications and Skills

Underwriting Assistants typically require strong organizational skills, proficiency in data entry, and basic knowledge of insurance policies, while Underwriting Analysts need advanced analytical abilities, expertise in risk assessment, and familiarity with financial modeling. Both roles demand excellent communication skills and attention to detail, but Analysts often hold degrees in finance, insurance, or related fields and require experience with underwriting software and statistical tools. Mastery of regulatory compliance and risk evaluation methodologies distinguishes Underwriting Analysts from Assistants in the insurance underwriting process.

Daily Workflow Differences

An Underwriting Assistant primarily manages administrative tasks such as data entry, document preparation, and scheduling, ensuring smooth workflow support for underwriting teams. In contrast, an Underwriting Analyst evaluates risk factors, analyzes financial data, and assesses policy applications to inform underwriting decisions. The assistant's daily workflow emphasizes operational efficiency, while the analyst focuses on in-depth risk assessment and decision-making processes.

Decision-Making Authority and Independence

Underwriting Assistants typically support underwriters by gathering data and preparing documentation but have limited decision-making authority, operating under close supervision. Underwriting Analysts possess greater independence, analyzing risks and financial information to recommend approval or denial of insurance applications, often influencing final underwriting decisions. The distinction in decision-making authority reflects the Analysts' critical role in risk assessment, whereas Assistants focus on administrative and preparatory tasks.

Salary and Career Advancement Opportunities

Underwriting Assistants typically earn lower salaries ranging from $40,000 to $55,000 annually, while Underwriting Analysts command higher pay between $60,000 and $80,000 due to their analytical responsibilities. Career advancement for Underwriting Assistants often involves transitioning to Underwriting Analyst roles, which offer greater strategic input and decision-making authority in risk assessment. Underwriting Analysts have clearer pathways to senior underwriting or managerial positions, reflecting enhanced expertise and higher compensation potential.

Interaction with Other Insurance Professionals

Underwriting Assistants primarily support underwriters by handling administrative tasks and coordinating communication between agents, brokers, and underwriters to ensure accurate data flow. Underwriting Analysts evaluate risk data and interact closely with actuaries, claims adjusters, and underwriters to perform detailed risk assessments and pricing analysis. Both roles require strong collaboration skills to facilitate efficient underwriting processes and maintain effective communication within insurance teams.

Common Software and Tools Used

Underwriting Assistants and Underwriting Analysts commonly use software such as Applied Epic, TurboRater, and Guidewire for policy management and risk assessment. Both roles rely on data analytics tools like Microsoft Excel and SQL databases to analyze underwriting data and streamline decision-making processes. Familiarity with customer relationship management (CRM) systems like Salesforce enhances efficiency in managing client information and underwriting tasks.

Which Role Is Right for Your Insurance Career?

Underwriting Assistants support underwriters by managing documentation, data entry, and administrative tasks, making this role ideal for entry-level professionals seeking foundational knowledge in insurance underwriting. Underwriting Analysts analyze risk data, assess policy applications, and make recommendations, requiring stronger analytical skills and offering a clearer path to underwriting decision-making roles. Choosing between these positions depends on career goals, with Underwriting Assistants providing operational exposure and Underwriting Analysts focusing on risk evaluation and policy strategy.

Underwriting Assistant vs Underwriting Analyst Infographic

jobdiv.com

jobdiv.com