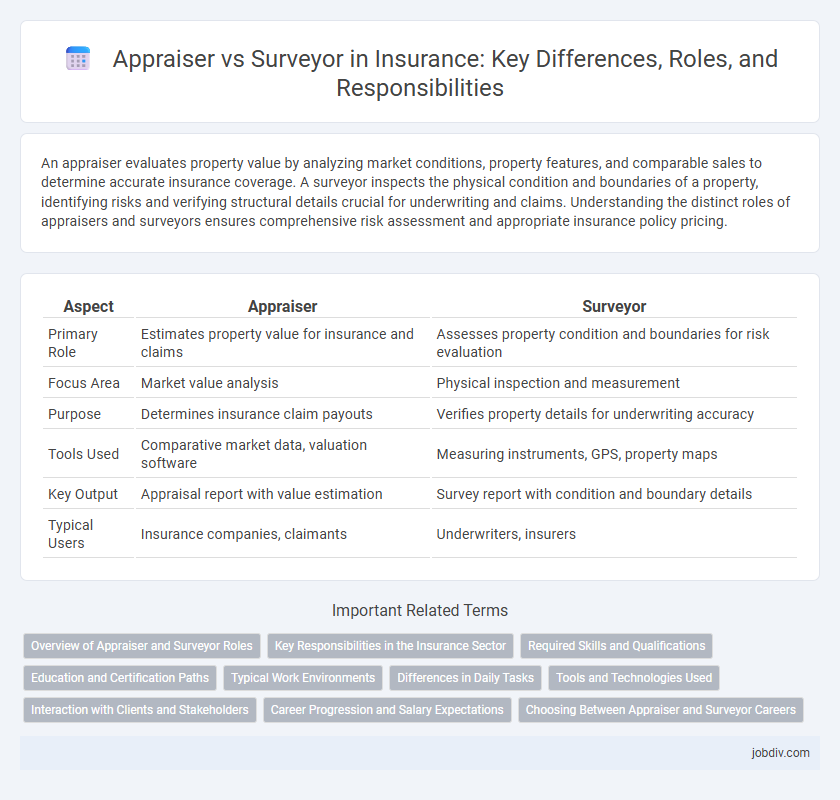

An appraiser evaluates property value by analyzing market conditions, property features, and comparable sales to determine accurate insurance coverage. A surveyor inspects the physical condition and boundaries of a property, identifying risks and verifying structural details crucial for underwriting and claims. Understanding the distinct roles of appraisers and surveyors ensures comprehensive risk assessment and appropriate insurance policy pricing.

Table of Comparison

| Aspect | Appraiser | Surveyor |

|---|---|---|

| Primary Role | Estimates property value for insurance and claims | Assesses property condition and boundaries for risk evaluation |

| Focus Area | Market value analysis | Physical inspection and measurement |

| Purpose | Determines insurance claim payouts | Verifies property details for underwriting accuracy |

| Tools Used | Comparative market data, valuation software | Measuring instruments, GPS, property maps |

| Key Output | Appraisal report with value estimation | Survey report with condition and boundary details |

| Typical Users | Insurance companies, claimants | Underwriters, insurers |

Overview of Appraiser and Surveyor Roles

Appraisers and surveyors both play critical roles in insurance by determining property value and condition, but their purposes differ significantly. Appraisers assess the monetary value of assets for claims and underwriting, using market trends and property characteristics, while surveyors inspect land boundaries and physical structures to ensure accuracy and compliance with legal standards. Their expertise helps insurers mitigate risks, establish accurate coverage, and process claims effectively.

Key Responsibilities in the Insurance Sector

Appraisers in the insurance sector primarily assess the value of insured property and determine the extent of loss after damage, ensuring accurate claim settlements. Surveyors conduct detailed inspections of properties to evaluate risk factors, compliance with safety standards, and potential hazards, aiding insurers in underwriting decisions. Both roles collaborate to provide comprehensive risk assessment and claims evaluation, optimizing policyholder protection and insurer risk management.

Required Skills and Qualifications

Appraisers require strong analytical skills, proficiency in valuation methods, and knowledge of market trends to accurately assess property values, often needing certification from recognized bodies like the Appraisal Institute. Surveyors must have expertise in geometry, mapping technology, and legal regulations related to land boundaries, typically holding licenses from professional surveying boards. Both roles demand attention to detail, solid communication skills, and a background in relevant fields such as real estate, engineering, or finance.

Education and Certification Paths

Appraisers in insurance typically require a bachelor's degree in finance, real estate, or a related field, followed by certification such as the Certified Residential Appraiser (CRA) or the Certified General Appraiser (CGA) credential issued by the Appraisal Institute. Surveyors often pursue a degree in surveying, geomatics, or civil engineering, and must obtain licensure through the National Society of Professional Surveyors (NSPS) or pass the Fundamentals of Surveying (FS) and Professional Surveyor (PS) exams. Both professions demand continuing education to maintain certifications, ensuring up-to-date knowledge in valuation and measurement standards essential for insurance risk assessment.

Typical Work Environments

Appraisers typically work in real estate offices, insurance companies, or independently, assessing property values to determine insurance premiums or claim settlements. Surveyors operate primarily on construction sites, land development projects, and government agencies, measuring land and structures to ensure compliance with regulations and accurate property boundaries. Both professions require fieldwork, but appraisers focus more on valuation within controlled environments, while surveyors engage extensively with outdoor, technical terrain assessments.

Differences in Daily Tasks

Appraisers primarily evaluate property value for insurance claims, conducting thorough inspections to assess damage and estimate repair costs. Surveyors focus on measuring land and property boundaries, ensuring accurate property descriptions and compliance with legal regulations. While appraisers analyze financial impact, surveyors concentrate on precise mapping and documentation of physical attributes.

Tools and Technologies Used

Appraisers rely on advanced software tools such as automated valuation models (AVMs) and 3D imaging technology to accurately assess property values in insurance claims. Surveyors use specialized equipment like GPS devices, total stations, and laser scanners to measure land boundaries and structural details with precision. Both professionals integrate geographic information systems (GIS) to enhance data accuracy, but appraisers emphasize market analytics while surveyors focus on spatial measurements.

Interaction with Clients and Stakeholders

Appraisers in insurance primarily focus on evaluating asset values and damages to provide accurate claim settlements, maintaining direct communication with clients and insurers to clarify valuation details. Surveyors interact with clients by inspecting properties or goods to assess risk and ensure compliance with policy terms, often collaborating with underwriters and loss adjusters. Clear and timely communication between appraisers, surveyors, and stakeholders is crucial for resolving disputes and facilitating efficient claims processing.

Career Progression and Salary Expectations

Career progression for appraisers in insurance typically advances from junior appraiser roles to senior appraiser or appraisal manager positions, with salaries ranging from $50,000 to $90,000 annually depending on experience and specialization. Surveyors in the same field often progress from trainee surveyor to chartered surveyor or surveying manager roles, commanding salaries between $45,000 and $85,000 per year, influenced by geographic location and expertise. Both careers offer opportunities for specialization and higher earnings through certifications, with appraisers generally earning slightly higher salaries due to their valuation focus.

Choosing Between Appraiser and Surveyor Careers

Choosing between appraiser and surveyor careers depends on individual skills and industry focus; appraisers specialize in estimating property values for insurance and real estate, while surveyors measure land and prepare precise boundary maps. Both roles require strong analytical abilities, but surveyors often need proficiency in geomatics and use of advanced GPS technology, whereas appraisers rely on market analysis and regulatory knowledge. Career growth in insurance favors appraisers for underwriting and claims adjustments, while surveyors excel in property development and legal disputes resolution.

Appraiser vs Surveyor Infographic

jobdiv.com

jobdiv.com