Policy administrators are responsible for managing the overall lifecycle of an insurance policy, including underwriting, documentation, and maintaining policyholder records. Policy servicers handle routine tasks such as processing claims, managing payments, and updating policy details to ensure smooth customer interactions. Differentiating these roles enhances operational efficiency and improves customer satisfaction within insurance companies.

Table of Comparison

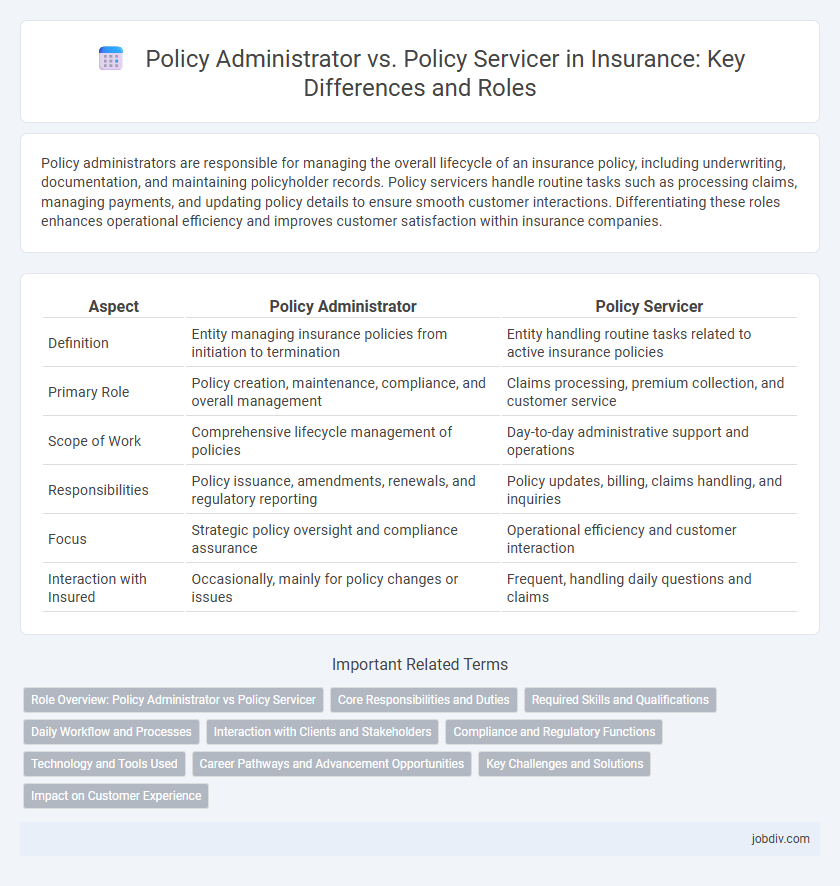

| Aspect | Policy Administrator | Policy Servicer |

|---|---|---|

| Definition | Entity managing insurance policies from initiation to termination | Entity handling routine tasks related to active insurance policies |

| Primary Role | Policy creation, maintenance, compliance, and overall management | Claims processing, premium collection, and customer service |

| Scope of Work | Comprehensive lifecycle management of policies | Day-to-day administrative support and operations |

| Responsibilities | Policy issuance, amendments, renewals, and regulatory reporting | Policy updates, billing, claims handling, and inquiries |

| Focus | Strategic policy oversight and compliance assurance | Operational efficiency and customer interaction |

| Interaction with Insured | Occasionally, mainly for policy changes or issues | Frequent, handling daily questions and claims |

Role Overview: Policy Administrator vs Policy Servicer

Policy administrators manage the overall lifecycle of insurance policies, including issuance, amendments, renewals, and compliance monitoring, ensuring policy data integrity and regulatory adherence. Policy servicers focus on day-to-day client interactions such as processing claims, handling customer inquiries, and updating policyholder information to maintain accurate and current records. Both roles are critical; administrators emphasize strategic policy management while servicers prioritize operational support and customer service within insurance organizations.

Core Responsibilities and Duties

Policy Administrators primarily oversee the entire policy lifecycle, including underwriting coordination, policy issuance, and regulatory compliance to ensure accurate documentation and adherence to company standards. Policy Servicers handle day-to-day customer interactions such as processing claims, policy updates, premium billing, and addressing customer inquiries to maintain service quality and client satisfaction. Both roles are integral to effective insurance operations, with Administrators focusing on policy management frameworks and Servicers on operational execution and client support.

Required Skills and Qualifications

Policy administrators require strong organizational skills, attention to detail, and proficiency in insurance software to manage policy documentation and compliance efficiently. Policy servicers need excellent customer service abilities, communication skills, and knowledge of claims processing to address client inquiries and support policy modifications effectively. Both roles demand understanding of insurance regulations, data analysis capabilities, and the ability to work collaboratively within cross-functional teams.

Daily Workflow and Processes

Policy administrators manage the overall lifecycle of insurance policies, including issuance, renewals, endorsements, and cancellations to ensure compliance and accuracy. Policy servicers handle day-to-day customer interactions such as processing premium payments, updating policyholder information, and addressing service requests or claims inquiries. Both roles rely on efficient workflow automation systems to maintain timely processing and enhance customer satisfaction within insurance operations.

Interaction with Clients and Stakeholders

Policy administrators manage the overall insurance contract lifecycle, ensuring accurate policy issuance, amendments, and compliance, which requires direct communication with clients to clarify policy terms and conditions. Policy servicers handle day-to-day client service requests such as premium payments, claims processing, and updates to personal information, maintaining consistent interaction to provide timely support. Both roles collaborate closely with stakeholders like underwriters, brokers, and regulatory bodies to maintain seamless policy operations and enhance customer satisfaction.

Compliance and Regulatory Functions

Policy administrators oversee compliance by ensuring insurance policies adhere to regulatory standards and internal guidelines, maintaining accurate documentation and managing policy issuance processes. Policy servicers focus on executing ongoing service tasks such as updates, endorsements, and claims processing while ensuring these operations comply with relevant legal and regulatory requirements. Both roles are essential for maintaining regulatory compliance, minimizing risks, and supporting audits within the insurance lifecycle.

Technology and Tools Used

Policy Administrators leverage advanced policy management systems and automation tools to handle underwriting, policy issuance, and compliance monitoring efficiently. Policy Servicers utilize customer relationship management (CRM) software and digital platforms to manage claims processing, payments, and policyholder communications seamlessly. Both roles integrate cloud-based solutions and AI-powered analytics to enhance operational accuracy and customer experience in the insurance industry.

Career Pathways and Advancement Opportunities

Policy administrators typically oversee the entire lifecycle of insurance policies, managing underwriting, compliance, and renewals, which positions them for advancement into senior management or underwriting leadership roles. Policy servicers focus on client interactions, claims processing, and policy modifications, gaining specialized skills valuable for progressing into customer service management or claims supervision. Both career pathways offer growth potential, with administrators leaning toward strategic and operational roles, while servicers often advance through client-facing and claims resolution positions.

Key Challenges and Solutions

Policy administrators face challenges in maintaining accurate policy data across multiple platforms, often requiring integrated technology solutions to streamline workflows and enhance data consistency. Policy servicers struggle with timely claims processing and customer communication, addressed by implementing automation tools and customer relationship management (CRM) systems. Both roles benefit from advanced analytics to predict policyholder behavior and improve service efficiency.

Impact on Customer Experience

Policy Administrators manage the overall lifecycle of insurance policies, ensuring accuracy and compliance, which directly enhances customer trust and satisfaction. Policy Servicers handle day-to-day interactions like claims processing and updates, providing timely responses that improve customer convenience and retention. The seamless coordination between both roles significantly impacts the efficiency and quality of the customer experience in the insurance industry.

Policy Administrator vs Policy Servicer Infographic

jobdiv.com

jobdiv.com