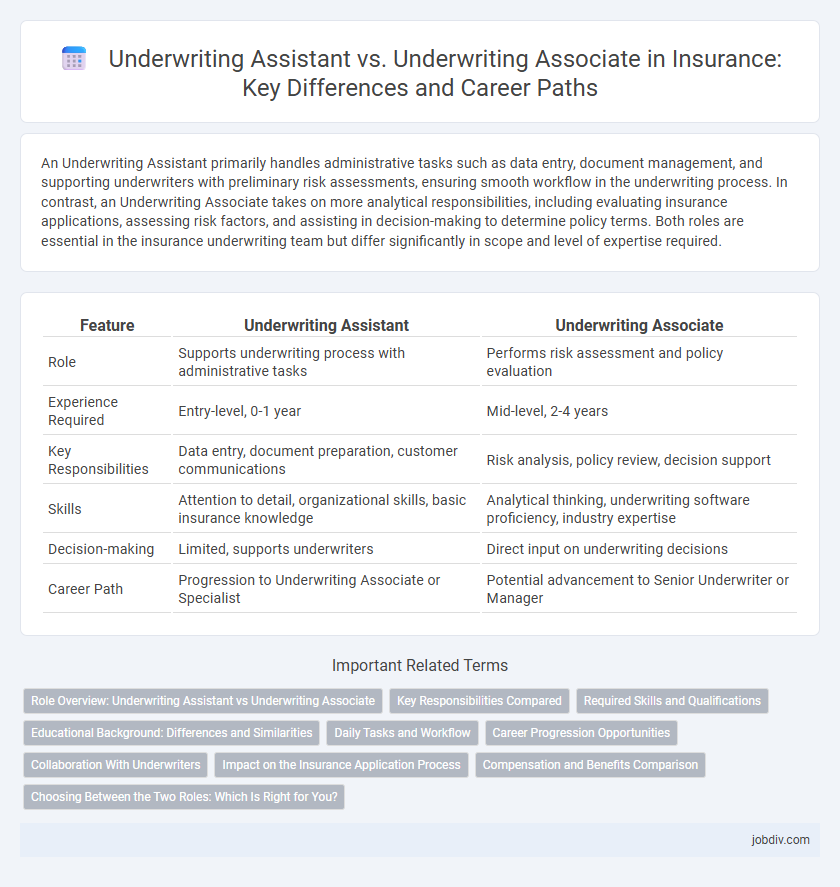

An Underwriting Assistant primarily handles administrative tasks such as data entry, document management, and supporting underwriters with preliminary risk assessments, ensuring smooth workflow in the underwriting process. In contrast, an Underwriting Associate takes on more analytical responsibilities, including evaluating insurance applications, assessing risk factors, and assisting in decision-making to determine policy terms. Both roles are essential in the insurance underwriting team but differ significantly in scope and level of expertise required.

Table of Comparison

| Feature | Underwriting Assistant | Underwriting Associate |

|---|---|---|

| Role | Supports underwriting process with administrative tasks | Performs risk assessment and policy evaluation |

| Experience Required | Entry-level, 0-1 year | Mid-level, 2-4 years |

| Key Responsibilities | Data entry, document preparation, customer communications | Risk analysis, policy review, decision support |

| Skills | Attention to detail, organizational skills, basic insurance knowledge | Analytical thinking, underwriting software proficiency, industry expertise |

| Decision-making | Limited, supports underwriters | Direct input on underwriting decisions |

| Career Path | Progression to Underwriting Associate or Specialist | Potential advancement to Senior Underwriter or Manager |

Role Overview: Underwriting Assistant vs Underwriting Associate

Underwriting Assistants support underwriters by managing documentation, performing data entry, and coordinating communication to streamline the underwriting process. Underwriting Associates engage in risk assessment, policy evaluation, and initial decision-making with moderate authority under the guidance of senior underwriters. The Underwriting Associate role requires deeper analytical skills and underwriting knowledge compared to the more administrative focus of the Underwriting Assistant.

Key Responsibilities Compared

An Underwriting Assistant primarily supports the underwriting process by gathering and verifying client information, preparing documentation, and coordinating communication between agents and underwriters. In contrast, an Underwriting Associate handles more complex risk assessments, evaluates insurance applications, and makes preliminary decisions on policy approvals to ensure accurate premium calculations. Both roles are essential to managing underwriting workflows, but the Associate often takes on greater analytical responsibilities and decision-making authority.

Required Skills and Qualifications

Underwriting Assistants typically require strong organizational skills, proficiency in data entry, and basic knowledge of insurance policies, alongside attention to detail and effective communication abilities. Underwriting Associates demand advanced analytical skills, a deep understanding of risk assessment, underwriting guidelines, and often hold a bachelor's degree in finance, business, or a related field. Both roles necessitate familiarity with underwriting software, but Associates are expected to manage complex cases and collaborate closely with underwriters to make informed decisions.

Educational Background: Differences and Similarities

Underwriting Assistants typically hold an associate degree or a certification in insurance or finance, providing foundational knowledge in risk assessment and policy evaluation. Underwriting Associates often possess a bachelor's degree in business, finance, or a related field, offering a deeper understanding of underwriting principles and analytical skills. Both roles require strong attention to detail and familiarity with insurance regulations, but Underwriting Associates generally engage in more complex decision-making processes due to their advanced educational background.

Daily Tasks and Workflow

Underwriting Assistants manage data collection, verify documentation, and assist with risk assessments to support underwriters in processing insurance policies efficiently. Underwriting Associates perform more complex tasks such as evaluating applications, analyzing risk factors, and making preliminary decisions on policy approvals while maintaining communication with brokers and clients. Both roles optimize workflow by ensuring accurate data input and timely processing, yet Associates engage more directly in risk evaluation and decision-making.

Career Progression Opportunities

Underwriting Assistants typically support underwriters by handling administrative tasks and data entry, providing a foundational understanding of insurance policies and risk assessment. Underwriting Associates engage more directly in analyzing risks, preparing reports, and making preliminary decisions, positioning them for eventual advancement to Underwriter roles. Career progression often involves moving from Underwriting Assistant to Associate as skills and industry knowledge deepen, leading to greater responsibility and higher compensation within the underwriting field.

Collaboration With Underwriters

Underwriting Assistants streamline the underwriting process by managing data entry and preliminary risk assessments, enabling underwriters to focus on complex evaluations. Underwriting Associates collaborate closely with underwriters to analyze risk factors, prepare detailed reports, and ensure accurate policy documentation. Effective collaboration between both roles enhances decision-making efficiency and improves overall risk management in insurance underwriting.

Impact on the Insurance Application Process

Underwriting Assistants streamline data collection and preliminary risk assessment, accelerating the insurance application process by ensuring accurate and organized documentation. Underwriting Associates perform in-depth risk analysis and decision-making, directly influencing policy approval and pricing accuracy. Their combined roles enhance efficiency and precision, reducing turnaround times and improving overall customer satisfaction in underwriting operations.

Compensation and Benefits Comparison

Underwriting Associates typically receive higher base salaries and more comprehensive benefits packages compared to Underwriting Assistants due to their advanced responsibilities and experience level. Compensation for Underwriting Associates often includes performance bonuses, health insurance, retirement plans, and professional development allowances, whereas Underwriting Assistants might have more limited bonus opportunities and basic benefits. The salary range for Underwriting Associates usually spans from $60,000 to $85,000 annually, while Underwriting Assistants earn between $40,000 and $55,000, reflecting their respective roles within underwriting teams.

Choosing Between the Two Roles: Which Is Right for You?

Choosing between an Underwriting Assistant and an Underwriting Associate depends on your career goals and level of experience within the insurance industry. Underwriting Assistants typically provide administrative support and handle preliminary risk assessments, making this role ideal for entry-level professionals seeking to build foundational knowledge. Underwriting Associates engage in more complex risk evaluation and decision-making processes, offering a pathway for those aiming for advanced underwriting responsibilities and deeper analytical expertise.

Underwriting Assistant vs Underwriting Associate Infographic

jobdiv.com

jobdiv.com