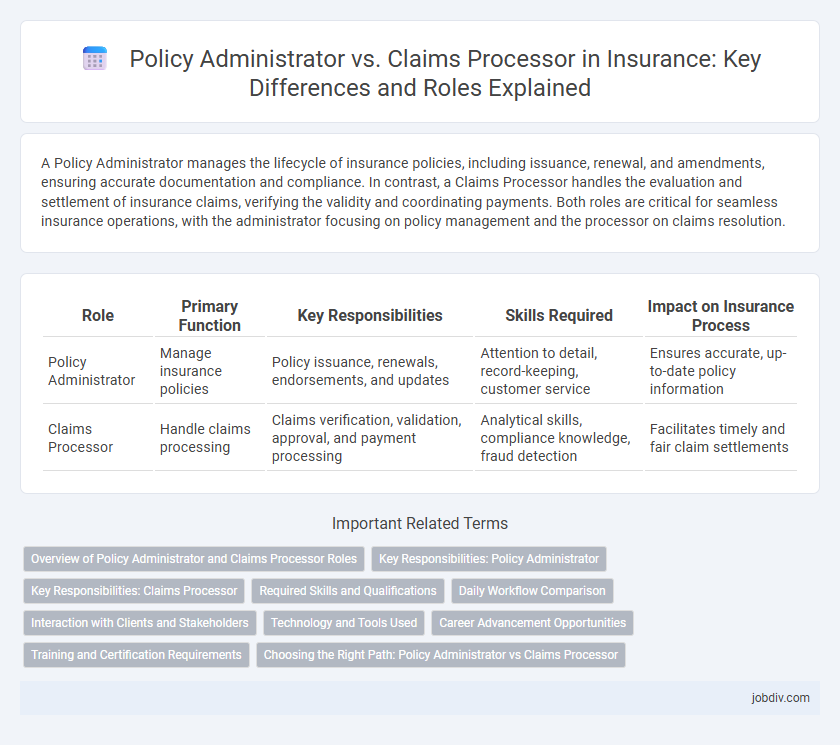

A Policy Administrator manages the lifecycle of insurance policies, including issuance, renewal, and amendments, ensuring accurate documentation and compliance. In contrast, a Claims Processor handles the evaluation and settlement of insurance claims, verifying the validity and coordinating payments. Both roles are critical for seamless insurance operations, with the administrator focusing on policy management and the processor on claims resolution.

Table of Comparison

| Role | Primary Function | Key Responsibilities | Skills Required | Impact on Insurance Process |

|---|---|---|---|---|

| Policy Administrator | Manage insurance policies | Policy issuance, renewals, endorsements, and updates | Attention to detail, record-keeping, customer service | Ensures accurate, up-to-date policy information |

| Claims Processor | Handle claims processing | Claims verification, validation, approval, and payment processing | Analytical skills, compliance knowledge, fraud detection | Facilitates timely and fair claim settlements |

Overview of Policy Administrator and Claims Processor Roles

Policy Administrators manage the lifecycle of insurance policies, including issuance, updates, renewals, and cancellations, ensuring compliance with regulatory standards. Claims Processors handle the evaluation, verification, and settlement of insurance claims, coordinating with policyholders and adjusters to expedite claim resolution. Both roles are crucial for maintaining operational efficiency and customer satisfaction in the insurance industry.

Key Responsibilities: Policy Administrator

Policy Administrators manage insurance policy documentation, ensuring accuracy in policy issuance, amendments, and renewals. They coordinate communication between underwriters, agents, and clients to maintain updated policy records. Their role includes verifying compliance with regulatory standards and processing premium payments efficiently.

Key Responsibilities: Claims Processor

Claims Processors handle the end-to-end management of insurance claims, including verifying claim accuracy, assessing coverage eligibility, and coordinating with claimants and service providers to ensure timely resolution. They review documentation, calculate claim settlements based on policy terms, and maintain detailed records to support audit compliance. Efficient claims processing directly impacts customer satisfaction and the insurer's risk management strategies.

Required Skills and Qualifications

Policy Administrators require strong organizational skills, attention to detail, and proficiency in insurance software to manage client policies and ensure compliance with regulations. Claims Processors need analytical abilities, effective communication skills, and knowledge of claims procedures to accurately evaluate and process insurance claims. Both roles demand a solid understanding of insurance policies, regulatory requirements, and customer service expertise to optimize operational efficiency.

Daily Workflow Comparison

Policy Administrators manage policy lifecycle tasks including issuing, renewing, and updating insurance policies, tracking premiums, and ensuring regulatory compliance. Claims Processors handle claim intake, verification, validation of coverage, and collaborate with adjusters to facilitate prompt claim settlements. Daily workflows for Policy Administrators emphasize policy documentation and customer communication, whereas Claims Processors focus on detailed claim analysis and fraud detection.

Interaction with Clients and Stakeholders

Policy Administrators manage client records and ensure policy terms align with customer needs, maintaining clear communication with clients and agents to update coverage details. Claims Processors collaborate with clients, adjusters, and medical professionals to verify claims accuracy and expedite settlements. Effective interaction between these roles and stakeholders ensures seamless policy management and timely claims resolution.

Technology and Tools Used

Policy Administrators utilize integrated policy management systems and automated underwriting software to streamline policy issuance, endorsements, and renewals, enhancing accuracy and efficiency. Claims Processors rely on claims management platforms, AI-powered fraud detection tools, and digital document processing technologies to expedite claim validation and settlement. Both roles increasingly incorporate cloud computing and data analytics for real-time access and improved decision-making in insurance operations.

Career Advancement Opportunities

Policy Administrators often have broader career advancement opportunities due to their involvement in managing client policies, coordinating renewals, and ensuring compliance, which can lead to higher roles in account management or underwriting. Claims Processors, while critical for handling claims efficiently and accurately, typically advance into specialized roles such as claims adjuster or fraud investigator. Both career paths benefit from acquiring certifications like CPCU (Chartered Property Casualty Underwriter) or AIC (Associate in Claims) to enhance promotion potential within the insurance industry.

Training and Certification Requirements

Policy administrators typically require comprehensive training in insurance law, risk assessment, and customer service, often supported by certifications such as the Life Office Management Association (LOMA) or Chartered Property Casualty Underwriter (CPCU). Claims processors generally need specialized training in claims management systems, investigation techniques, and regulatory compliance, with certifications like Associate in Claims (AIC) enhancing their expertise. Both roles demand ongoing professional development to stay current with industry standards and evolving legal requirements.

Choosing the Right Path: Policy Administrator vs Claims Processor

Choosing between a Policy Administrator and a Claims Processor depends on your career interests in the insurance industry. Policy Administrators manage contract details, policy renewals, and customer communications, ensuring accurate and compliant documentation. Claims Processors focus on evaluating, verifying, and processing insurance claims to facilitate timely settlements and mitigate risk.

Policy Administrator vs Claims Processor Infographic

jobdiv.com

jobdiv.com