Underwriters assess risk and determine policy terms before insurance coverage is issued, ensuring premiums align with the level of risk. Adjusters investigate and evaluate claims after an incident occurs to decide the extent of the insurer's liability. Both roles are essential for maintaining balance between risk management and fair claims processing in the insurance industry.

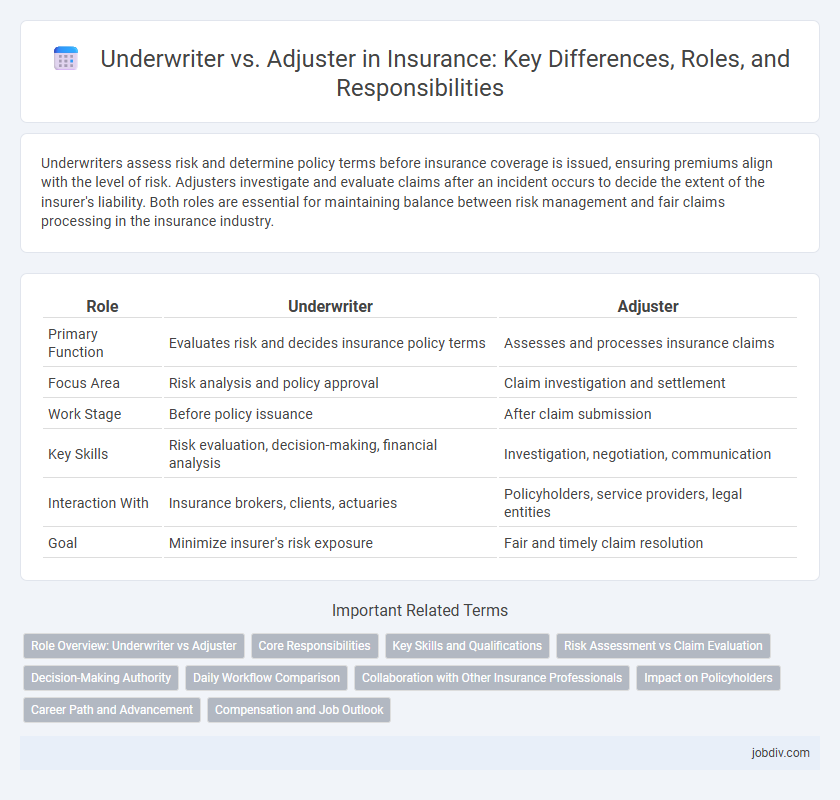

Table of Comparison

| Role | Underwriter | Adjuster |

|---|---|---|

| Primary Function | Evaluates risk and decides insurance policy terms | Assesses and processes insurance claims |

| Focus Area | Risk analysis and policy approval | Claim investigation and settlement |

| Work Stage | Before policy issuance | After claim submission |

| Key Skills | Risk evaluation, decision-making, financial analysis | Investigation, negotiation, communication |

| Interaction With | Insurance brokers, clients, actuaries | Policyholders, service providers, legal entities |

| Goal | Minimize insurer's risk exposure | Fair and timely claim resolution |

Role Overview: Underwriter vs Adjuster

Underwriters evaluate insurance applications, assessing risk factors to determine policy terms and premium rates based on data analysis and underwriting guidelines. Adjusters investigate and assess claims after losses occur, verifying facts, estimating damage, and negotiating settlements to ensure fair compensation for policyholders. Both roles are critical in managing insurance risk, with underwriters focusing on prevention and adjusters on resolution.

Core Responsibilities

Underwriters evaluate risk and determine policy terms by reviewing applications and assessing financial stability, medical history, and claim records. Adjusters investigate insurance claims, verify damages or losses, and negotiate settlements to ensure fair compensation. Both roles are essential for managing risk and maintaining the insurer's financial health.

Key Skills and Qualifications

Underwriters require strong analytical skills, attention to detail, and expertise in risk assessment and financial evaluation to determine policy terms and premiums. Adjusters need excellent investigative abilities, negotiation skills, and knowledge of insurance laws and claims processes to accurately assess damage and settle claims. Both roles demand proficiency in communication and familiarity with industry regulations to effectively manage policyholder interactions and ensure compliance.

Risk Assessment vs Claim Evaluation

Underwriters analyze applications to assess risk factors and determine policy terms, premiums, and coverage limits, ensuring profitability and regulatory compliance. Adjusters evaluate claims by investigating damages, verifying facts, and estimating costs to facilitate accurate and fair settlements. The underwriter's role centers on risk prevention through policy acceptance, while the adjuster focuses on post-loss claim evaluation and resolution.

Decision-Making Authority

Underwriters hold primary decision-making authority in assessing risk, determining policy terms, and approving or denying insurance applications based on detailed risk analysis. Adjusters, on the other hand, make critical decisions regarding claim evaluations, assessing damages, and negotiating settlements within the framework established by underwriters. Both roles require specialized expertise but differ fundamentally in the timing and nature of their decision-making processes within the insurance lifecycle.

Daily Workflow Comparison

Underwriters primarily focus on evaluating risk factors, reviewing applications, and determining policy terms during their daily workflow, while adjusters handle claims investigation, damage assessment, and settlement negotiation. Underwriters utilize statistical data and risk models to decide policy approvals and premiums, whereas adjusters gather evidence, interview claimants, and coordinate with repair services to resolve claims efficiently. The distinct tasks highlight underwriters' emphasis on risk evaluation and paperwork upfront, contrasted with adjusters' on-site inspections and claim resolution processes.

Collaboration with Other Insurance Professionals

Underwriters and adjusters collaborate closely to ensure accurate risk assessment and claims resolution within insurance processes. Underwriters evaluate policy applications and set terms based on risk analysis, while adjusters investigate claims to verify coverage and determine payouts. Their combined expertise enhances decision-making efficiency and helps maintain policyholder satisfaction through coordinated communication and shared data insights.

Impact on Policyholders

Underwriters assess risk and determine policy terms, directly influencing premium costs and coverage availability for policyholders. Adjusters investigate and process claims, ensuring fair compensation and timely resolution of losses. Effective collaboration between underwriters and adjusters enhances policyholder satisfaction by balancing risk management with responsive claims handling.

Career Path and Advancement

Underwriters analyze risk and determine policy terms, often advancing by specializing in complex insurance products or moving into managerial roles within underwriting departments. Adjusters investigate claims to assess their validity and negotiate settlements, frequently progressing to senior claims examiner or claims manager positions. Both careers offer paths into executive roles, with underwriters typically focusing on risk management strategy and adjusters on claims operations leadership.

Compensation and Job Outlook

Underwriters typically receive higher compensation than adjusters, with median annual salaries around $75,000 compared to $60,000 for adjusters, influenced by their role in risk assessment and policy approval. Job outlook for underwriters shows a decline of 8% due to automation, whereas adjusters face a more stable outlook with a projected growth rate of 1% driven by ongoing claims processing needs. Salary variations depend on industry, experience, and geographic location, with insurance hubs like New York and California offering premium pay scales.

Underwriter vs Adjuster Infographic

jobdiv.com

jobdiv.com