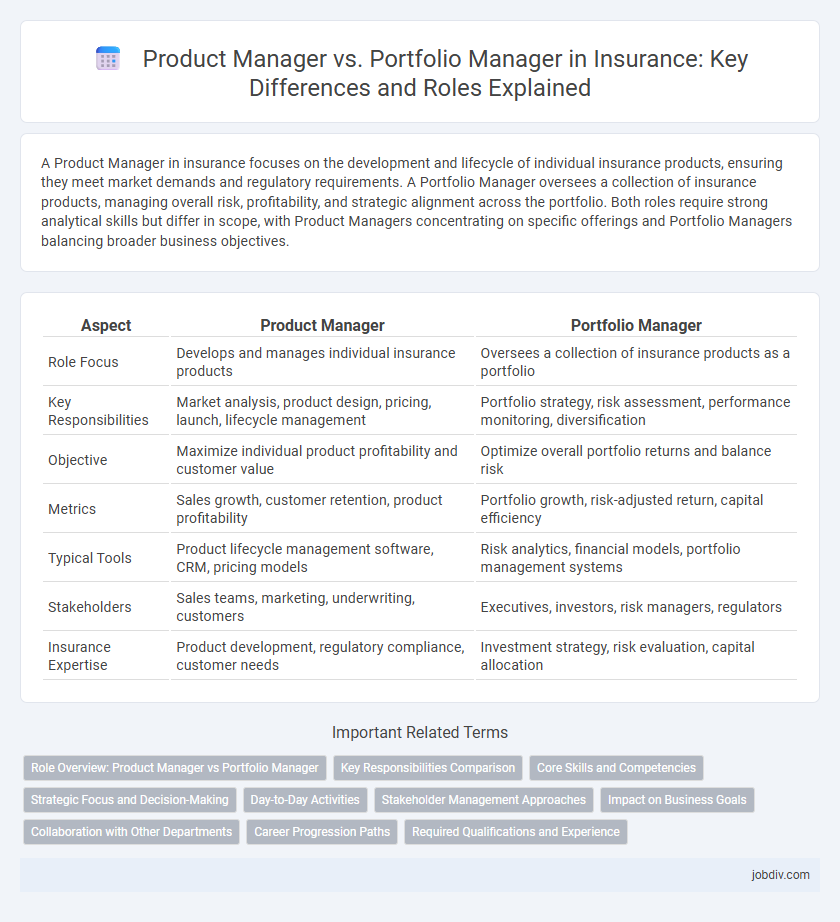

A Product Manager in insurance focuses on the development and lifecycle of individual insurance products, ensuring they meet market demands and regulatory requirements. A Portfolio Manager oversees a collection of insurance products, managing overall risk, profitability, and strategic alignment across the portfolio. Both roles require strong analytical skills but differ in scope, with Product Managers concentrating on specific offerings and Portfolio Managers balancing broader business objectives.

Table of Comparison

| Aspect | Product Manager | Portfolio Manager |

|---|---|---|

| Role Focus | Develops and manages individual insurance products | Oversees a collection of insurance products as a portfolio |

| Key Responsibilities | Market analysis, product design, pricing, launch, lifecycle management | Portfolio strategy, risk assessment, performance monitoring, diversification |

| Objective | Maximize individual product profitability and customer value | Optimize overall portfolio returns and balance risk |

| Metrics | Sales growth, customer retention, product profitability | Portfolio growth, risk-adjusted return, capital efficiency |

| Typical Tools | Product lifecycle management software, CRM, pricing models | Risk analytics, financial models, portfolio management systems |

| Stakeholders | Sales teams, marketing, underwriting, customers | Executives, investors, risk managers, regulators |

| Insurance Expertise | Product development, regulatory compliance, customer needs | Investment strategy, risk evaluation, capital allocation |

Role Overview: Product Manager vs Portfolio Manager

A Product Manager in insurance drives the development, launch, and lifecycle management of specific insurance products, focusing on customer needs, market trends, and competitive analysis. A Portfolio Manager oversees the performance, risk, and profitability of a group of insurance products, balancing asset allocation and underwriting strategies to optimize returns. Both roles are crucial for aligning product offerings with business goals and market demands but differ in scope and responsibility.

Key Responsibilities Comparison

Product Managers in insurance develop and oversee specific insurance products, focusing on market research, product design, pricing strategies, and lifecycle management to meet customer needs and drive profitability. Portfolio Managers handle a group of insurance products, analyzing overall portfolio performance, managing risk exposure, and allocating resources to optimize returns and maintain balanced risk profiles. Both roles require strong analytical skills, but Product Managers prioritize individual product success while Portfolio Managers concentrate on strategic alignment and risk diversification across multiple products.

Core Skills and Competencies

Product Managers in insurance specialize in market analysis, customer needs assessment, and product lifecycle management to develop innovative insurance solutions. Portfolio Managers focus on risk assessment, asset allocation, and performance monitoring to optimize the portfolio of insurance products and maximize returns. Both roles require strong analytical skills, strategic thinking, and collaboration with cross-functional teams to drive business growth and customer satisfaction.

Strategic Focus and Decision-Making

A Product Manager in insurance concentrates on the development, positioning, and lifecycle of individual insurance products, utilizing market data and customer insights to drive product innovation and profitability. In contrast, a Portfolio Manager oversees a collection of insurance products, making strategic decisions on resource allocation, risk diversification, and performance optimization to achieve overall business objectives. Strategic focus for Product Managers centers on aligning products with market demands, while Portfolio Managers prioritize balancing risk and return across the entire insurance product mix.

Day-to-Day Activities

Product Managers in insurance focus on defining product features, managing development cycles, and aligning offerings with market needs to drive customer acquisition and retention. Portfolio Managers oversee a group of insurance products, analyzing performance data, balancing risk, and optimizing the mix to maximize overall profitability and strategic goals. Daily tasks for Product Managers include stakeholder meetings, roadmap planning, and market research, while Portfolio Managers concentrate on financial analysis, risk assessment, and portfolio rebalancing.

Stakeholder Management Approaches

Product Managers in insurance prioritize direct engagement with cross-functional teams and clients to align product development with user needs and market demands. Portfolio Managers focus on balancing stakeholder interests by optimizing the performance and risk across a collection of insurance products, ensuring strategic alignment with organizational goals. Effective stakeholder management in Product Management involves iterative feedback loops, while Portfolio Management requires comprehensive risk assessment and stakeholder communication at a macro level.

Impact on Business Goals

Product Managers in insurance drive business growth by focusing on the development and enhancement of specific insurance products, ensuring alignment with customer needs and market trends to maximize profitability and customer retention. Portfolio Managers oversee a collection of insurance products, strategically balancing risk and return to optimize overall business performance and achieve long-term financial targets. The impact on business goals is differentiated by Product Managers optimizing individual product success, while Portfolio Managers enhance aggregate portfolio value and risk management.

Collaboration with Other Departments

Product Managers in insurance collaborate closely with underwriting, marketing, and actuarial teams to develop and refine specific insurance products tailored to market demands and regulatory requirements. Portfolio Managers coordinate with risk management, finance, and sales departments to balance risk exposure and optimize the overall performance of the insurance portfolio. Effective collaboration between both roles ensures alignment between product development and strategic portfolio goals, driving growth and compliance.

Career Progression Paths

Product Managers in insurance focus on developing and managing specific insurance products, leveraging market analysis and customer insights to enhance product offerings, while Portfolio Managers oversee a collection of insurance products to maximize overall portfolio performance and risk-adjusted returns. Career progression for Product Managers typically advances through roles such as Senior Product Manager, Product Director, and Head of Product, emphasizing product innovation and strategy execution. Portfolio Managers often progress to positions like Senior Portfolio Manager, Portfolio Director, or Chief Investment Officer, concentrating on portfolio optimization, financial performance, and strategic asset allocation within insurance firms.

Required Qualifications and Experience

A Product Manager in insurance requires strong expertise in product development, market analysis, and regulatory compliance, typically possessing a degree in business or finance and 3-5 years of experience in product lifecycle management. A Portfolio Manager demands advanced skills in investment analysis, risk assessment, and strategic asset allocation, often holding certifications such as CFA or FRM along with 5-7 years of experience in managing diverse insurance portfolios. Both roles necessitate excellent communication skills and a thorough understanding of insurance industry regulations but differ significantly in their focus on either product innovation or portfolio performance optimization.

Product Manager vs Portfolio Manager Infographic

jobdiv.com

jobdiv.com