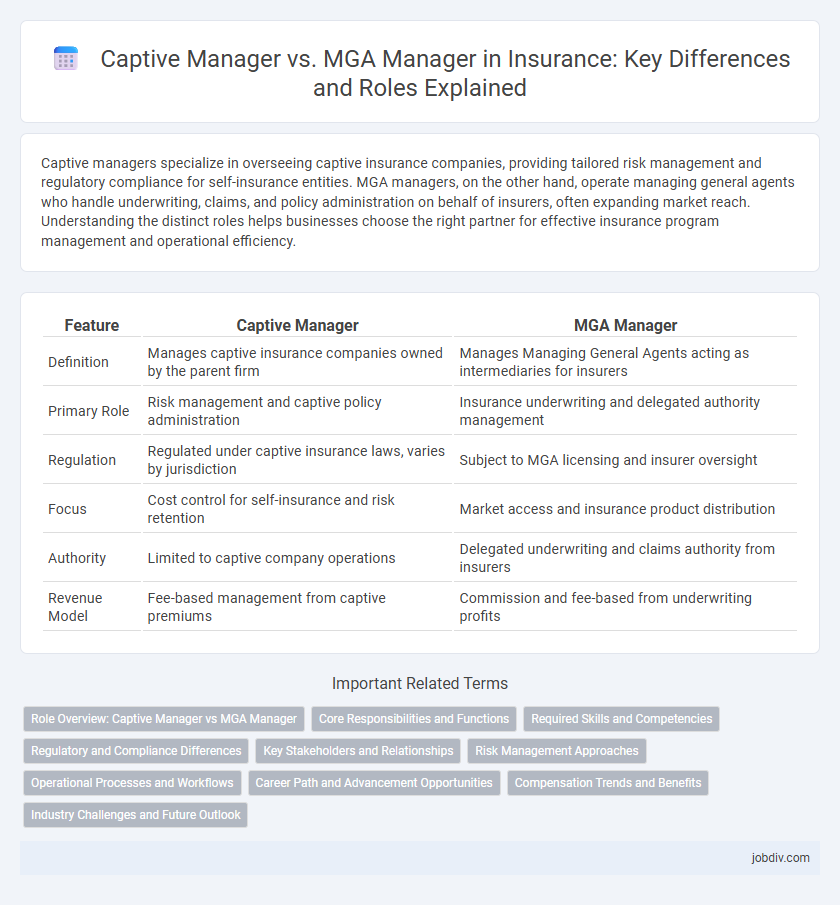

Captive managers specialize in overseeing captive insurance companies, providing tailored risk management and regulatory compliance for self-insurance entities. MGA managers, on the other hand, operate managing general agents who handle underwriting, claims, and policy administration on behalf of insurers, often expanding market reach. Understanding the distinct roles helps businesses choose the right partner for effective insurance program management and operational efficiency.

Table of Comparison

| Feature | Captive Manager | MGA Manager |

|---|---|---|

| Definition | Manages captive insurance companies owned by the parent firm | Manages Managing General Agents acting as intermediaries for insurers |

| Primary Role | Risk management and captive policy administration | Insurance underwriting and delegated authority management |

| Regulation | Regulated under captive insurance laws, varies by jurisdiction | Subject to MGA licensing and insurer oversight |

| Focus | Cost control for self-insurance and risk retention | Market access and insurance product distribution |

| Authority | Limited to captive company operations | Delegated underwriting and claims authority from insurers |

| Revenue Model | Fee-based management from captive premiums | Commission and fee-based from underwriting profits |

Role Overview: Captive Manager vs MGA Manager

A Captive Manager oversees the formation, operation, and regulatory compliance of captive insurance companies, ensuring risk retention strategies align with corporate objectives. An MGA Manager functions as an intermediary managing underwriting, claims, and policy administration on behalf of insurers, enhancing market access and operational efficiency. Both roles involve specialized oversight but differ in focus, with Captive Managers concentrating on self-insurance vehicles and MGA Managers on delegated authority from insurers.

Core Responsibilities and Functions

Captive managers primarily oversee the administration of captive insurance companies, including regulatory compliance, financial reporting, and risk management tailored to the parent organization's needs. MGA managers operate as intermediaries with underwriting authority delegated by insurers, focusing on policy issuance, claims handling, and market expansion for multiple insurance carriers. Both roles require deep expertise in regulatory frameworks but differ in scope, with captive managers emphasizing internal risk control and MGA managers driving external market distribution.

Required Skills and Competencies

Captive Managers must have expertise in risk assessment, financial reporting, and regulatory compliance to effectively oversee self-insured entities, ensuring alignment with captive insurance laws and company objectives. MGA Managers require strong underwriting knowledge, market negotiation skills, and the ability to manage distribution channels, emphasizing contract management and claims oversight within delegated authority frameworks. Both roles demand proficiency in data analytics and stakeholder communication but diverge in focus areas: captive managers prioritize governance and accounting, whereas MGA managers emphasize underwriting agility and market responsiveness.

Regulatory and Compliance Differences

Captive managers operate under stringent state insurance regulations focused on risk retention and captive formation, ensuring compliance with licensing and solvency requirements specific to captive insurance companies. MGA (Managing General Agent) managers function within broader insurance legal frameworks, emphasizing adherence to carrier agreements, underwriting authorities, and market conduct rules imposed by state insurance departments. Regulatory oversight for captive managers centers on self-insurance statutes, while MGA managers navigate producer licensing and compliance with multiple insurer contracts.

Key Stakeholders and Relationships

Captive managers primarily engage with captive insurance company owners, regulators, and reinsurers to ensure compliance, risk management, and capital optimization, emphasizing long-term strategic partnerships. MGA managers collaborate closely with carriers, brokers, and insured clients to underwrite policies, manage claims, and accelerate market access, prioritizing operational efficiency and customer service. Both roles require strong relationship management but differ in stakeholder focus, with captive managers centered on ownership interests and MGA managers aligned with market and client dynamics.

Risk Management Approaches

Captive Managers emphasize tailored risk management by directly controlling underwriting, claims, and loss prevention strategies within a single organization's captive insurance entity, allowing for customized risk retention and mitigation. MGA Managers focus on distributed risk management by underwriting and managing insurance policies on behalf of insurers, leveraging specialized market access and expertise to diversify and transfer risk efficiently. Both approaches optimize risk exposure but differ in control scope, with captive managers prioritizing internal risk containment and MGA managers enhancing risk distribution across broader insurance markets.

Operational Processes and Workflows

Captive Managers streamline operational processes by overseeing risk retention entities, ensuring regulatory compliance, and managing premium collections with tailored workflows specific to captive insurance structures. MGA Managers operate complex underwriting and claims workflows designed to enhance insurer distribution channels, often integrating advanced technology to optimize broker coordination and policy issuance. Both roles demand rigorous data management but differ in focus, with Captive Managers prioritizing risk control and MGA Managers emphasizing market expansion and service agility.

Career Path and Advancement Opportunities

Captive managers typically advance through specialized roles within captive insurance companies, gaining deep expertise in risk management, regulatory compliance, and client relations, which can lead to senior leadership positions such as Chief Risk Officer or Captive Program Director. MGA managers often experience a broader career trajectory, acquiring skills in underwriting, broker liaison, and product development, enabling progression toward executive roles like Chief Underwriting Officer or Head of MGA Operations. Both paths offer unique advancement opportunities, with captive management focusing on niche markets and MGA roles providing exposure to diverse insurance portfolios and market strategies.

Compensation Trends and Benefits

Captive managers typically receive compensation through fixed fees or a percentage of premiums, aligning incentives with the overall performance of the captive insurer, while MGA managers often earn commissions based on underwriting results and premium volume. Captive management offers benefits such as greater control over policy terms and reduced external conflicts of interest, whereas MGA managers provide specialized underwriting expertise and market access with flexible commission structures. Trending compensation models show increasing adoption of performance-based incentives for both roles, enhancing alignment between managerial activities and insurer profitability.

Industry Challenges and Future Outlook

Captive managers face challenges such as regulatory compliance complexities and risk retention optimization, while MGA managers grapple with underwriting authority limitations and distribution network scalability. Both roles require advanced data analytics and technology integration to enhance risk assessment and operational efficiency. The future outlook indicates increased collaboration between captive managers and MGAs, driven by digital transformation and evolving insurance regulations.

Captive Manager vs MGA Manager Infographic

jobdiv.com

jobdiv.com