An insurance appraiser evaluates the extent of damage to property or vehicles to determine the compensation amount for a claim, relying on detailed inspections and industry standards. An insurance inspector, on the other hand, primarily assesses risk factors before a policy is issued, identifying potential hazards and verifying the accuracy of application information. Understanding the distinct roles of an insurance appraiser and an insurance inspector helps ensure accurate claim settlements and informed underwriting decisions.

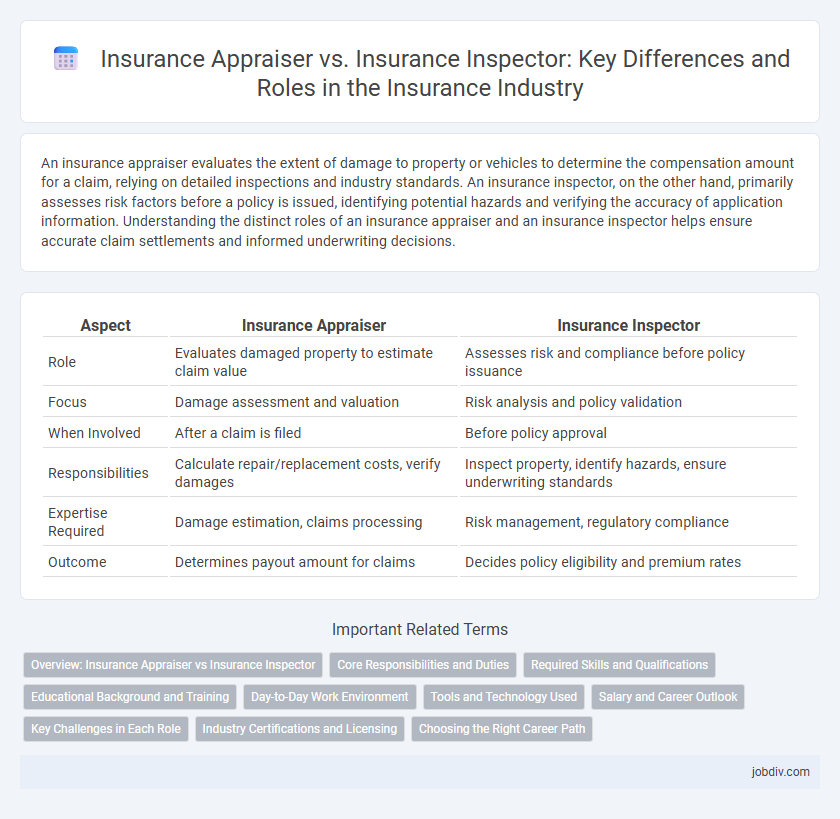

Table of Comparison

| Aspect | Insurance Appraiser | Insurance Inspector |

|---|---|---|

| Role | Evaluates damaged property to estimate claim value | Assesses risk and compliance before policy issuance |

| Focus | Damage assessment and valuation | Risk analysis and policy validation |

| When Involved | After a claim is filed | Before policy approval |

| Responsibilities | Calculate repair/replacement costs, verify damages | Inspect property, identify hazards, ensure underwriting standards |

| Expertise Required | Damage estimation, claims processing | Risk management, regulatory compliance |

| Outcome | Determines payout amount for claims | Decides policy eligibility and premium rates |

Overview: Insurance Appraiser vs Insurance Inspector

An Insurance Appraiser evaluates and estimates the value and extent of property damage to determine insurance claim settlements, relying on detailed assessments and cost analyses. An Insurance Inspector investigates insurance applications, inspects insured properties or projects to verify compliance with policy terms, and identifies potential risks or fraud. Both roles are essential for accurate claims processing and risk management within the insurance industry.

Core Responsibilities and Duties

Insurance appraisers evaluate property damage and determine the cost of repairs or replacement for insurance claims, using detailed inspections to assess loss severity and validate claim accuracy. Insurance inspectors conduct risk assessments by examining properties before policy issuance, identifying hazards, and ensuring compliance with underwriting guidelines to minimize insurer exposure. Both roles require strong analytical skills and detailed reports, with appraisers focused on post-loss evaluation and inspectors on pre-policy risk analysis.

Required Skills and Qualifications

Insurance appraisers require strong analytical skills, thorough knowledge of insurance policies, and expertise in assessing damage values to accurately estimate claim amounts. Insurance inspectors need keen attention to detail, in-depth understanding of safety regulations, and the ability to conduct thorough site evaluations to verify insurance applications. Both roles demand excellent communication abilities, proficiency in documentation, and relevant certifications such as the Associate in Claims (AIC) for appraisers or insurance inspection licenses.

Educational Background and Training

Insurance appraisers typically hold degrees in fields such as finance, insurance, or business administration and undergo specialized training in property valuation and claims assessment. Insurance inspectors usually have a background in engineering, construction, or fire science and receive hands-on training to evaluate risks, damages, and compliance with safety regulations. Both roles require certification and ongoing education to stay updated on industry standards and regulatory changes.

Day-to-Day Work Environment

Insurance appraisers primarily assess property damage and evaluate claims by inspecting vehicles or homes to determine repair costs, often collaborating with adjusters and repair shops. Insurance inspectors focus on risk evaluation by examining properties or businesses for compliance with underwriting standards, identifying potential hazards, and documenting conditions to support policy decisions. Both roles require fieldwork, but appraisers emphasize claim valuation while inspectors concentrate on risk assessment and policy underwriting.

Tools and Technology Used

Insurance appraisers utilize advanced estimating software and digital photography tools to assess vehicle damage accurately and generate repair cost reports. Insurance inspectors rely on mobile inspection apps, drones, and infrared cameras to evaluate property conditions and detect hidden damages efficiently. Both professionals leverage GPS technology and cloud-based platforms to streamline data collection and improve communication with insurance carriers.

Salary and Career Outlook

Insurance appraisers typically earn between $50,000 and $70,000 annually, with opportunities to increase income through specialization in property or auto claims. Insurance inspectors often start with salaries around $45,000, with career growth linked to experience and certifications in risk assessment or safety inspections. Both roles offer steady demand, but appraisers may experience faster salary growth due to the complexity and expertise required in claim evaluations.

Key Challenges in Each Role

Insurance appraisers face the key challenge of accurately assessing the value and damage extent to ensure fair claim settlements, often dealing with complex property conditions and disputes. Insurance inspectors primarily struggle with thorough risk evaluation and compliance verification, requiring meticulous attention to detail to identify potential hazards and underwriting issues. Both roles demand strong analytical skills and effective communication to resolve discrepancies between insurers and policyholders.

Industry Certifications and Licensing

Insurance appraisers typically hold industry certifications such as the Certified Insurance Appraiser (CIA) or certifications from the National Association of Independent Insurance Adjusters (NAIIA), which emphasize expertise in damage assessment and valuation. Insurance inspectors often require state-specific licensing and certifications like the Property and Casualty Adjuster License, ensuring compliance with local regulations and standards for property inspections. Both roles demand specialized training, but appraisers focus more on detailed damage evaluation credentials while inspectors prioritize regulatory licensing for conducting accurate risk assessments.

Choosing the Right Career Path

An Insurance Appraiser evaluates damaged property and estimates repair or replacement costs, requiring strong analytical skills and attention to detail. An Insurance Inspector assesses risks related to insurance policies, focusing on safety compliance and risk prevention, which demands keen observation and regulatory knowledge. Choosing between these careers depends on whether you prefer detailed damage assessment (appraiser) or risk evaluation and policy safety (inspector).

Insurance Appraiser vs Insurance Inspector Infographic

jobdiv.com

jobdiv.com