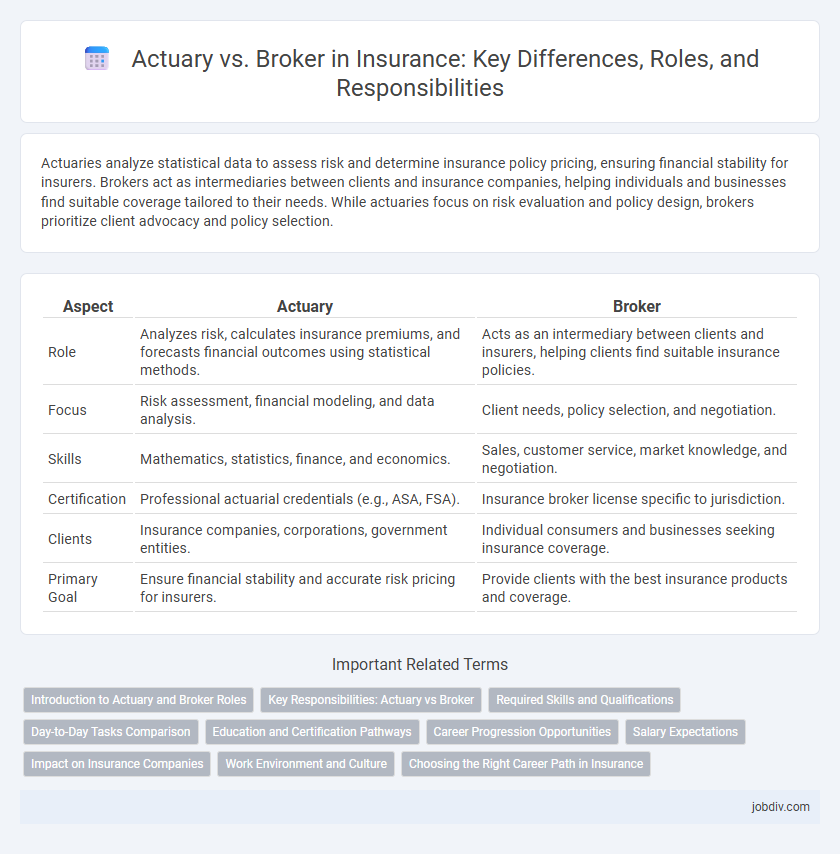

Actuaries analyze statistical data to assess risk and determine insurance policy pricing, ensuring financial stability for insurers. Brokers act as intermediaries between clients and insurance companies, helping individuals and businesses find suitable coverage tailored to their needs. While actuaries focus on risk evaluation and policy design, brokers prioritize client advocacy and policy selection.

Table of Comparison

| Aspect | Actuary | Broker |

|---|---|---|

| Role | Analyzes risk, calculates insurance premiums, and forecasts financial outcomes using statistical methods. | Acts as an intermediary between clients and insurers, helping clients find suitable insurance policies. |

| Focus | Risk assessment, financial modeling, and data analysis. | Client needs, policy selection, and negotiation. |

| Skills | Mathematics, statistics, finance, and economics. | Sales, customer service, market knowledge, and negotiation. |

| Certification | Professional actuarial credentials (e.g., ASA, FSA). | Insurance broker license specific to jurisdiction. |

| Clients | Insurance companies, corporations, government entities. | Individual consumers and businesses seeking insurance coverage. |

| Primary Goal | Ensure financial stability and accurate risk pricing for insurers. | Provide clients with the best insurance products and coverage. |

Introduction to Actuary and Broker Roles

Actuaries analyze statistical data to assess risk and determine insurance premiums using mathematical models and financial theory. Brokers serve as intermediaries between clients and insurance companies, helping customers find the best insurance policies tailored to their needs. Both roles are crucial in the insurance industry, with actuaries focusing on risk evaluation and brokers on policy distribution and client advisory.

Key Responsibilities: Actuary vs Broker

Actuaries analyze statistical data to assess risk and determine insurance premiums using advanced mathematical models and financial theory. Brokers serve as intermediaries between clients and insurance companies, advising on suitable policies, negotiating terms, and facilitating coverage that meets individual or business needs. Actuaries focus on risk evaluation and pricing strategy, while brokers concentrate on client relationships and policy customization.

Required Skills and Qualifications

Actuaries require strong analytical skills, proficiency in mathematics, statistics, and risk assessment, along with professional certifications such as the Society of Actuaries (SOA) or Casualty Actuarial Society (CAS) credentials. Brokers need excellent communication, negotiation, and interpersonal skills, typically holding insurance licenses and deep knowledge of market trends and policy details. Both roles demand continuous education, but actuaries emphasize quantitative expertise while brokers focus on client relations and sales acumen.

Day-to-Day Tasks Comparison

Actuaries analyze statistical data, calculate risks, and develop insurance policies to ensure financial stability using advanced modeling techniques. Brokers communicate with clients to assess their insurance needs, negotiate terms with insurers, and facilitate policy purchases while offering personalized advice. Actuaries focus on risk assessment and policy creation behind the scenes, whereas brokers engage in direct client interaction and policy distribution.

Education and Certification Pathways

Actuaries typically require a strong foundation in mathematics, statistics, and finance, with a bachelor's degree in actuarial science, mathematics, or related fields, followed by passing a series of rigorous exams administered by professional bodies such as the Society of Actuaries (SOA) or Casualty Actuarial Society (CAS). Brokers usually pursue a degree in business, finance, or insurance and must obtain licensing from state insurance departments, which involves passing exams like the Property and Casualty Insurance License or Life and Health Insurance License. While actuaries focus on extensive technical certification emphasizing risk assessment models, brokers prioritize licensing that enables them to legally sell insurance products and advise clients.

Career Progression Opportunities

Actuaries typically follow a clear career path progressing from entry-level analyst roles to senior actuary and chief risk officer positions, with opportunities to specialize in areas like risk management or pensions. Brokers advance by building client relationships and sales expertise, potentially moving into senior brokerage, management, or executive roles within insurance firms. While actuaries rely heavily on technical skills and certifications like ASA or FSA, brokers develop negotiation and interpersonal skills essential for leadership and business development positions.

Salary Expectations

Actuaries typically command higher salary expectations than insurance brokers due to their specialized expertise in risk assessment, statistical analysis, and financial modeling. According to the Society of Actuaries, entry-level actuaries can expect starting salaries around $70,000, with experienced professionals earning well over $150,000 annually. In contrast, insurance brokers usually earn commissions and base salaries ranging from $40,000 to $90,000, varying widely based on sales success and market conditions.

Impact on Insurance Companies

Actuaries play a critical role in insurance companies by analyzing risk, setting premium rates, and ensuring financial stability through statistical models and data-driven forecasts. Brokers influence insurance companies indirectly by acting as intermediaries who connect clients with appropriate policies, impacting sales volume and customer acquisition strategies. The collaboration between actuaries' risk assessment precision and brokers' market reach helps optimize the insurer's profitability and risk management.

Work Environment and Culture

Actuaries typically work in structured office settings within insurance companies or consulting firms, emphasizing data analysis and risk assessment in a collaborative yet focused environment. Brokers operate in dynamic, client-facing roles often involving travel and networking, fostering a fast-paced culture centered on relationship management and sales. Both professions demand strong communication skills, but actuaries prioritize analytical precision while brokers thrive in adaptable, customer-oriented atmospheres.

Choosing the Right Career Path in Insurance

Actuaries analyze statistical data to assess risk and determine insurance premiums, requiring strong mathematical and analytical skills with actuarial certifications like SOA or CAS. Insurance brokers act as intermediaries between clients and insurers, focusing on client communication, policy selection, and negotiation, often requiring sales expertise and industry knowledge. Choosing between these careers depends on one's strengths in technical analysis versus interpersonal skills and preference for behind-the-scenes risk modeling versus client-facing advisory roles.

Actuary vs Broker Infographic

jobdiv.com

jobdiv.com