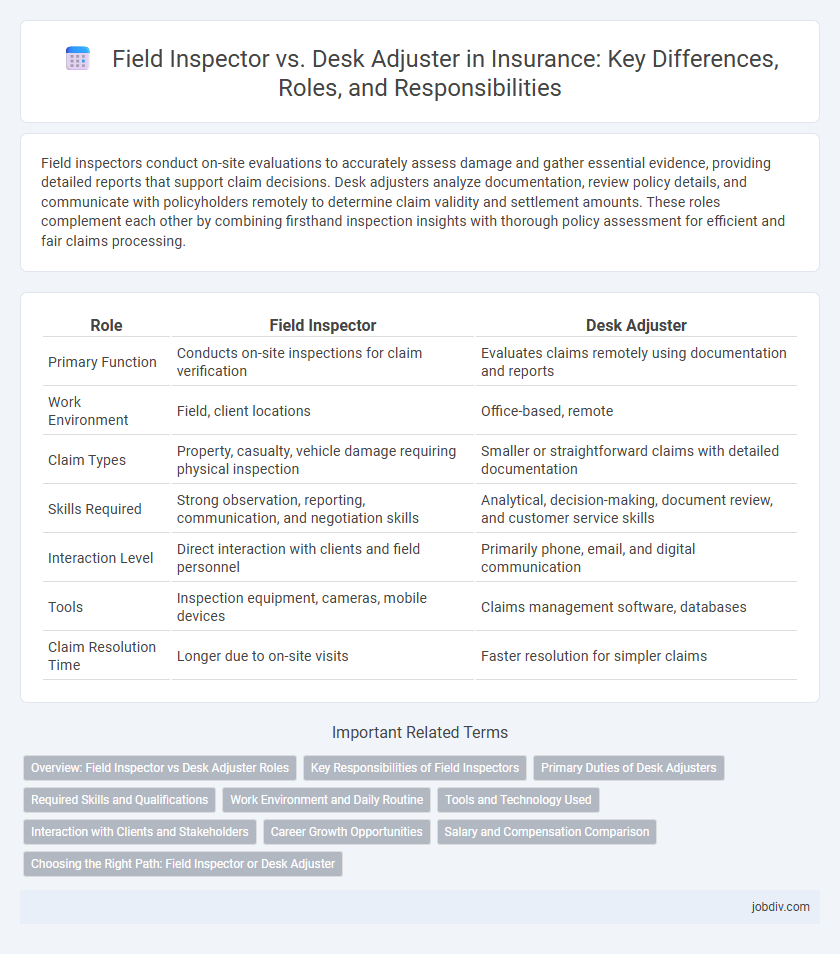

Field inspectors conduct on-site evaluations to accurately assess damage and gather essential evidence, providing detailed reports that support claim decisions. Desk adjusters analyze documentation, review policy details, and communicate with policyholders remotely to determine claim validity and settlement amounts. These roles complement each other by combining firsthand inspection insights with thorough policy assessment for efficient and fair claims processing.

Table of Comparison

| Role | Field Inspector | Desk Adjuster |

|---|---|---|

| Primary Function | Conducts on-site inspections for claim verification | Evaluates claims remotely using documentation and reports |

| Work Environment | Field, client locations | Office-based, remote |

| Claim Types | Property, casualty, vehicle damage requiring physical inspection | Smaller or straightforward claims with detailed documentation |

| Skills Required | Strong observation, reporting, communication, and negotiation skills | Analytical, decision-making, document review, and customer service skills |

| Interaction Level | Direct interaction with clients and field personnel | Primarily phone, email, and digital communication |

| Tools | Inspection equipment, cameras, mobile devices | Claims management software, databases |

| Claim Resolution Time | Longer due to on-site visits | Faster resolution for simpler claims |

Overview: Field Inspector vs Desk Adjuster Roles

Field Inspectors conduct on-site assessments to validate insurance claims by examining property damage or loss firsthand, providing detailed reports with photographic evidence. Desk Adjusters review claims remotely using documentation, photos, and policy details to determine claim validity and settlement amounts without visiting the scene. Both roles are essential in the claims process, with Field Inspectors offering direct inspection and Desk Adjusters providing efficient claim evaluation from the office.

Key Responsibilities of Field Inspectors

Field inspectors primarily conduct on-site investigations to assess property damage, verify claim details, and gather crucial evidence through photos and interviews, ensuring accurate claim evaluations. They play a vital role in identifying fraud by detecting inconsistencies and verifying the legitimacy of claims directly at the location. Their in-person assessments support timely and precise claim settlements, complementing the analytical work performed by desk adjusters.

Primary Duties of Desk Adjusters

Desk adjusters primarily handle claims by reviewing submitted documentation, assessing coverage, and determining claim validity without on-site visits. They analyze policy details, coordinate with policyholders or agents, and negotiate settlements based on recorded evidence and company guidelines. Effective communication and detailed evaluation ensure prompt, accurate claim resolutions while minimizing in-person investigations.

Required Skills and Qualifications

Field Inspectors require strong observational skills, attention to detail, and the ability to conduct on-site investigations to assess property damage accurately. Desk Adjusters need excellent analytical abilities, proficiency in claim management software, and strong communication skills to evaluate claims remotely and negotiate settlements. Both roles demand knowledge of insurance policies, exceptional problem-solving capabilities, and a background in customer service or claims handling.

Work Environment and Daily Routine

Field Inspectors conduct on-site evaluations of claims, gathering physical evidence and interviewing witnesses directly at the location of loss, often facing varied and dynamic work environments. Desk Adjusters operate primarily from an office setting, managing claims remotely through phone calls, video inspections, and document reviews, maintaining a consistent indoor routine. Both roles require detailed analysis, but Field Inspectors experience more travel and outdoor conditions, while Desk Adjusters benefit from a stable, controlled workspace.

Tools and Technology Used

Field inspectors utilize mobile devices equipped with advanced imaging tools, GPS tracking, and inspection apps to collect accurate, on-site data. Desk adjusters rely on specialized claims management software, digital communication platforms, and databases to analyze reports and process claims remotely. Both roles leverage technology to enhance efficiency, accuracy, and timely decision-making in the insurance claims process.

Interaction with Clients and Stakeholders

Field inspectors conduct on-site evaluations to gather firsthand information, enhancing accuracy in damage assessment through direct interaction with clients and witnesses. Desk adjusters analyze claim details remotely, coordinating with clients, agents, and contractors via phone or digital communication to expedite claim resolution. Both roles require effective communication skills, but field inspectors rely more on in-person engagement, while desk adjusters focus on remote collaboration with stakeholders.

Career Growth Opportunities

Field Inspectors in insurance gain hands-on experience by assessing property damage and conducting on-site investigations, which can lead to advancement into senior adjuster roles or claims management. Desk Adjusters analyze claims remotely, developing expertise in claim evaluation and negotiation, providing a pathway toward specialist adjuster positions or supervisory roles within claims departments. Both roles offer distinct career trajectories, with fieldwork fostering operational knowledge and desk work emphasizing analytical skills critical for leadership in insurance claims.

Salary and Compensation Comparison

Field Inspectors typically earn an average salary ranging from $45,000 to $65,000 annually, reflecting the on-site nature and travel demands of their role. Desk Adjusters usually have a salary range between $50,000 and $70,000, influenced by office-based claim analysis and negotiation responsibilities. Compensation for both roles may include performance bonuses, with Desk Adjusters often receiving higher incentives due to their claim resolution volume and complexity.

Choosing the Right Path: Field Inspector or Desk Adjuster

Choosing the right path in insurance claims depends on whether you prefer direct interaction or analytical evaluation; Field Inspectors conduct on-site investigations to assess damages firsthand, while Desk Adjusters analyze claim documents remotely to determine settlements. Field Inspectors require strong observation skills and comfort with travel, whereas Desk Adjusters excel in interpreting complex data and managing multiple cases efficiently from the office. Understanding these roles' demands and work environments helps professionals align their strengths with career growth in the insurance industry.

Field Inspector vs Desk Adjuster Infographic

jobdiv.com

jobdiv.com