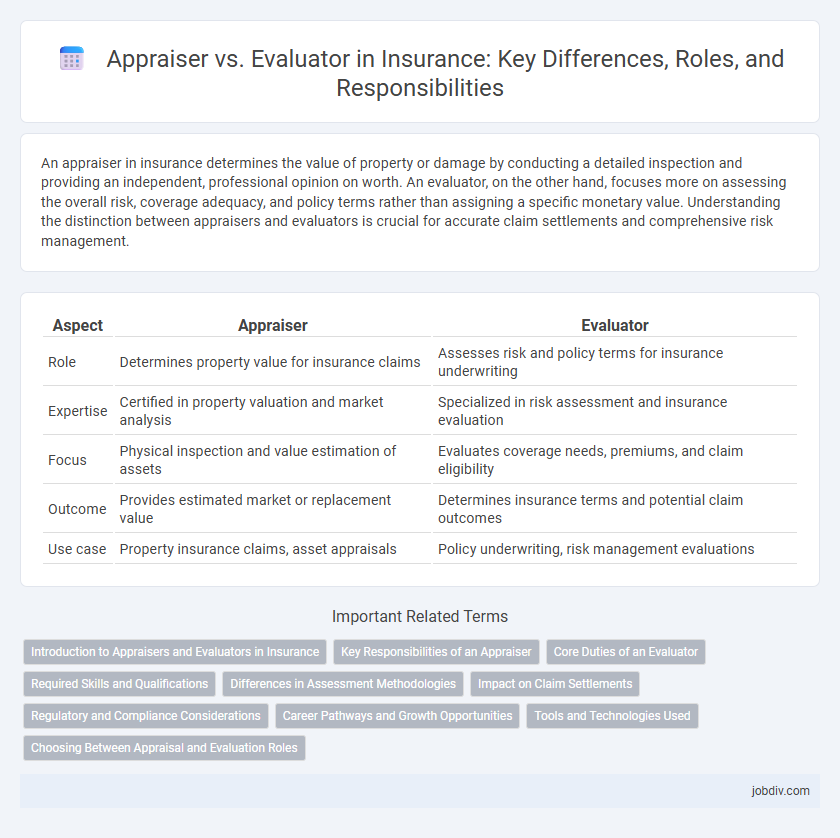

An appraiser in insurance determines the value of property or damage by conducting a detailed inspection and providing an independent, professional opinion on worth. An evaluator, on the other hand, focuses more on assessing the overall risk, coverage adequacy, and policy terms rather than assigning a specific monetary value. Understanding the distinction between appraisers and evaluators is crucial for accurate claim settlements and comprehensive risk management.

Table of Comparison

| Aspect | Appraiser | Evaluator |

|---|---|---|

| Role | Determines property value for insurance claims | Assesses risk and policy terms for insurance underwriting |

| Expertise | Certified in property valuation and market analysis | Specialized in risk assessment and insurance evaluation |

| Focus | Physical inspection and value estimation of assets | Evaluates coverage needs, premiums, and claim eligibility |

| Outcome | Provides estimated market or replacement value | Determines insurance terms and potential claim outcomes |

| Use case | Property insurance claims, asset appraisals | Policy underwriting, risk management evaluations |

Introduction to Appraisers and Evaluators in Insurance

Appraisers and evaluators in insurance perform critical roles in determining the value of insured properties and claims. Appraisers primarily assess property damage to establish repair costs or replacement value, while evaluators focus on analyzing policy coverage and claim legitimacy to ensure accurate settlements. Both professionals rely on detailed inspections and data analysis to support fair and efficient insurance claim processing.

Key Responsibilities of an Appraiser

An insurance appraiser is responsible for thoroughly assessing damaged property to determine repair costs or total loss values, providing detailed, objective estimates used for claim settlements. They analyze physical evidence, review policy terms, and collaborate with adjusters and contractors to ensure accurate valuation and fair compensation. Their expertise directly impacts claim resolution efficiency and accuracy, influencing both insurer costs and claimant satisfaction.

Core Duties of an Evaluator

An evaluator in insurance primarily assesses the value of assets, damages, or claims by analyzing documentation, market data, and relevant insurance policies to determine accurate settlement amounts. They verify claim legitimacy and provide detailed reports that support decision-making and claim resolution. Evaluators play a crucial role in minimizing fraud and ensuring fair compensation through objective and thorough evaluations.

Required Skills and Qualifications

Appraisers require strong analytical skills, attention to detail, and certification in property or casualty appraisal, often holding licenses such as Certified Residential Appraiser (CRA) or Chartered Property Casualty Underwriter (CPCU). Evaluators need expertise in data analysis, risk assessment, and sometimes specialized knowledge in financial or insurance evaluation, frequently supported by credentials like Associate in Claims (AIC) or Certified Insurance Counselor (CIC). Both roles demand excellent communication skills and a deep understanding of insurance policies, but appraisers focus more on physical asset valuation while evaluators prioritize risk and financial impact analysis.

Differences in Assessment Methodologies

Appraisers in insurance primarily use standardized valuation methods, such as market comparison and cost approach, to determine property value based on objective data and industry benchmarks. Evaluators focus on a broader assessment scope, incorporating qualitative factors like risk, condition, and potential future use to provide a comprehensive analysis beyond monetary value. The divergent methodologies highlight appraisers' emphasis on precise financial valuation, while evaluators prioritize contextual and functional understanding in insurance assessments.

Impact on Claim Settlements

Appraisers provide expert assessments of property damage, ensuring claim settlements are based on detailed valuations that reflect actual repair costs or replacement values. Evaluators analyze policy terms, coverage limits, and claim history to determine the legitimacy and extent of payout eligibility, directly influencing the financial outcome of claims. Accurate appraisals and thorough evaluations reduce disputes and expedite settlements, enhancing overall claims process efficiency.

Regulatory and Compliance Considerations

Appraisers operate under strict regulatory frameworks, often requiring state certification or licensing to ensure compliance with legal standards in property and casualty insurance claims. Evaluators, while also adhering to industry guidelines, focus on assessing the condition and value of insurance assets but may not always require formal licensure depending on jurisdiction. Both roles demand rigorous documentation and adherence to data privacy laws to maintain the integrity of the insurance claim process and avoid regulatory penalties.

Career Pathways and Growth Opportunities

Appraisers specialize in assessing the value of property, often working in real estate, automotive, or personal property insurance, with career growth leading to senior appraiser roles or specialization in niche markets. Evaluators focus on analyzing insurance claims and risks, typically advancing toward claims management or risk assessment positions. Both career paths offer progression through certifications and experience, enhancing opportunities in underwriting, consulting, or executive leadership within the insurance sector.

Tools and Technologies Used

Appraisers in insurance primarily use specialized software such as Xactimate and Symbility to estimate property damage and repair costs with high accuracy. Evaluators rely on advanced data analytics platforms and artificial intelligence algorithms to assess risk, policy compliance, and claim validity comprehensively. Both roles integrate digital imaging tools and geographic information systems (GIS) to enhance precision and streamline the assessment process.

Choosing Between Appraisal and Evaluation Roles

Appraisers provide expert valuations based on thorough property inspections and market analysis, ensuring accurate and defensible insurance claims. Evaluators assess risk factors and policy coverage requirements, focusing on compliance and loss prevention strategies. Selecting between appraisal and evaluation depends on whether precise asset valuation or risk assessment aligns best with your insurance objectives.

Appraiser vs Evaluator Infographic

jobdiv.com

jobdiv.com