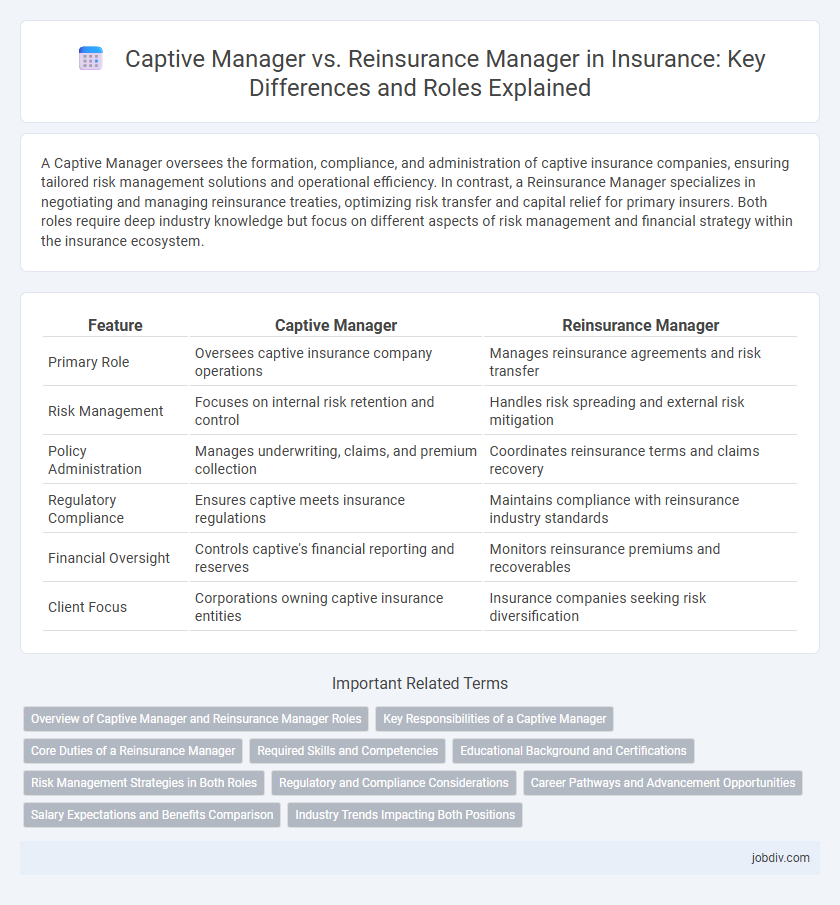

A Captive Manager oversees the formation, compliance, and administration of captive insurance companies, ensuring tailored risk management solutions and operational efficiency. In contrast, a Reinsurance Manager specializes in negotiating and managing reinsurance treaties, optimizing risk transfer and capital relief for primary insurers. Both roles require deep industry knowledge but focus on different aspects of risk management and financial strategy within the insurance ecosystem.

Table of Comparison

| Feature | Captive Manager | Reinsurance Manager |

|---|---|---|

| Primary Role | Oversees captive insurance company operations | Manages reinsurance agreements and risk transfer |

| Risk Management | Focuses on internal risk retention and control | Handles risk spreading and external risk mitigation |

| Policy Administration | Manages underwriting, claims, and premium collection | Coordinates reinsurance terms and claims recovery |

| Regulatory Compliance | Ensures captive meets insurance regulations | Maintains compliance with reinsurance industry standards |

| Financial Oversight | Controls captive's financial reporting and reserves | Monitors reinsurance premiums and recoverables |

| Client Focus | Corporations owning captive insurance entities | Insurance companies seeking risk diversification |

Overview of Captive Manager and Reinsurance Manager Roles

Captive Managers oversee the formation, administration, and regulatory compliance of captive insurance companies, ensuring tailored risk management solutions for parent organizations. Reinsurance Managers handle the negotiation, placement, and management of reinsurance contracts to mitigate risk exposure and optimize capital efficiency for primary insurers. Both roles require in-depth knowledge of insurance regulations, risk assessment, and financial analysis to support effective risk transfer strategies.

Key Responsibilities of a Captive Manager

A Captive Manager oversees the establishment, operation, and regulatory compliance of captive insurance companies, ensuring alignment with corporate risk management strategies. They handle underwriting, claims management, financial reporting, and coordinate with auditors and regulators to maintain the captive's financial health and legal standing. Their role also includes optimizing captive insurance structures to maximize tax efficiency and risk retention benefits for parent organizations.

Core Duties of a Reinsurance Manager

A Reinsurance Manager primarily oversees the negotiation, placement, and administration of reinsurance contracts to mitigate risk exposure for the insurance company. Core duties include evaluating reinsurance programs, managing relationships with reinsurers, assessing pricing and coverage terms, and ensuring compliance with regulatory requirements. They also monitor claims recoveries, analyze risk transfer effectiveness, and collaborate with underwriting and actuarial teams to optimize capital efficiency.

Required Skills and Competencies

Captive Managers must possess strong financial analysis skills, expertise in risk management, and knowledge of regulatory compliance to oversee self-insurance programs effectively. Reinsurance Managers require advanced negotiation abilities, deep understanding of reinsurance contracts, and proficiency in actuarial modeling to optimize risk transfer strategies. Both roles demand excellent communication and strategic planning competencies to manage complex insurance portfolios and stakeholder relationships efficiently.

Educational Background and Certifications

Captive Managers typically hold degrees in finance, insurance, or business administration, often complemented by certifications such as CPCU (Chartered Property Casualty Underwriter) or AIC (Associate in Claims). Reinsurance Managers generally possess advanced knowledge in actuarial science, risk management, or economics, with professional credentials like ARM (Associate in Risk Management) or ACAS (Associate of the Casualty Actuarial Society) enhancing their expertise. Both roles require specialized training to navigate complex insurance structures, but the emphasis on certifications aligns with their distinct operational responsibilities within insurance risk management.

Risk Management Strategies in Both Roles

Captive Managers focus on designing and administering self-insurance programs tailored to specific corporate risk profiles, enhancing control over underwriting and claims management. Reinsurance Managers specialize in transferring risk to third parties, optimizing portfolio stability and capital efficiency through strategic placement and negotiation of reinsurance contracts. Both roles employ advanced risk modeling and regulatory compliance to mitigate financial exposure and ensure sustainable insurance operations.

Regulatory and Compliance Considerations

Captive managers oversee the formation and ongoing administration of captive insurance companies, ensuring compliance with captive-specific regulations such as domicile licensing requirements and statutory capital mandates. Reinsurance managers focus on managing reinsurance contracts and obligations, emphasizing adherence to regulatory frameworks governing risk transfer, solvency margins, and insurer credit ratings. Both roles require rigorous regulatory reporting and alignment with jurisdictional compliance standards to mitigate legal risks and maintain operational integrity.

Career Pathways and Advancement Opportunities

Captive managers typically specialize in overseeing the formation and administration of captive insurance companies, offering career advancement through roles such as risk manager and CFO within the captive or parent organization. Reinsurance managers focus on the evaluation and management of reinsurance contracts, with pathways often leading to senior underwriting, actuarial, or portfolio management positions in reinsurance firms or insurance carriers. Both career tracks demand strong analytical skills but cater to distinct market segments, influencing professional development and specialization opportunities.

Salary Expectations and Benefits Comparison

Captive managers typically earn between $90,000 and $150,000 annually, with benefits often including performance bonuses, health insurance, and retirement plans tailored to specialized risk management roles. Reinsurance managers usually command higher salaries ranging from $110,000 to $180,000, reflecting the complexity of underwriting and negotiation skills required, alongside comprehensive benefits such as profit-sharing, executive perks, and enhanced professional development opportunities. Salary expectations for both roles vary by region, company size, and industry expertise, with reinsurance managers generally receiving more competitive compensation packages due to their critical role in risk distribution and capital efficiency.

Industry Trends Impacting Both Positions

The insurance industry increasingly emphasizes data analytics and regulatory compliance, profoundly impacting both Captive Managers and Reinsurance Managers by demanding enhanced risk assessment and reporting capabilities. Emerging trends like the rise of alternative risk transfer solutions and the integration of blockchain technology drive these roles toward more sophisticated capital management and transparency requirements. Market volatility and climate-related risks further necessitate adaptive strategies, making expertise in predictive modeling and reinsurance treaties critical for both positions.

Captive Manager vs Reinsurance Manager Infographic

jobdiv.com

jobdiv.com