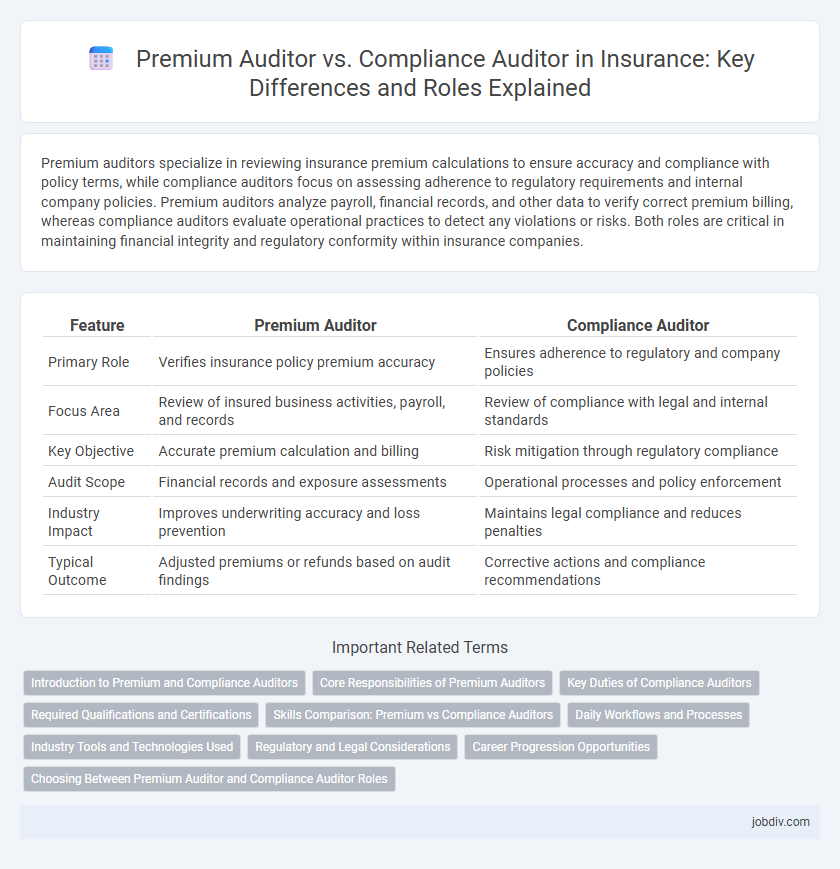

Premium auditors specialize in reviewing insurance premium calculations to ensure accuracy and compliance with policy terms, while compliance auditors focus on assessing adherence to regulatory requirements and internal company policies. Premium auditors analyze payroll, financial records, and other data to verify correct premium billing, whereas compliance auditors evaluate operational practices to detect any violations or risks. Both roles are critical in maintaining financial integrity and regulatory conformity within insurance companies.

Table of Comparison

| Feature | Premium Auditor | Compliance Auditor |

|---|---|---|

| Primary Role | Verifies insurance policy premium accuracy | Ensures adherence to regulatory and company policies |

| Focus Area | Review of insured business activities, payroll, and records | Review of compliance with legal and internal standards |

| Key Objective | Accurate premium calculation and billing | Risk mitigation through regulatory compliance |

| Audit Scope | Financial records and exposure assessments | Operational processes and policy enforcement |

| Industry Impact | Improves underwriting accuracy and loss prevention | Maintains legal compliance and reduces penalties |

| Typical Outcome | Adjusted premiums or refunds based on audit findings | Corrective actions and compliance recommendations |

Introduction to Premium and Compliance Auditors

Premium auditors specialize in verifying the accuracy of insurance policy premiums by examining payroll records, financial statements, and risk exposures to ensure correct premium calculations. Compliance auditors focus on evaluating an insurance company's adherence to regulatory requirements, internal policies, and industry standards to mitigate legal and operational risks. Both roles are essential for maintaining financial integrity and regulatory compliance within the insurance sector.

Core Responsibilities of Premium Auditors

Premium auditors primarily ensure accurate premium calculations by examining insured entities' financial records, payroll, and operational data to verify policyholder compliance with underwriting requirements. They analyze exposure bases, classify risks correctly, and identify discrepancies to adjust premiums fairly. Their core responsibility lies in validating that the insurance premiums charged reflect the true level of risk and exposure, supporting both insurers' revenue integrity and policyholder fairness.

Key Duties of Compliance Auditors

Compliance auditors ensure that insurance companies adhere strictly to regulatory standards and internal policies by reviewing documentation and operational procedures. They assess the effectiveness of controls designed to prevent fraud, money laundering, and unethical practices, safeguarding both the insurer and policyholders. Their key duties include evaluating compliance with legal requirements, conducting risk assessments, and reporting findings to regulatory bodies to support continuous improvement and accountability.

Required Qualifications and Certifications

Premium auditors typically require knowledge in insurance policies, risk assessment, and accounting, often holding certifications such as Certified Insurance Premium Auditor (CIPA) or Certified Public Accountant (CPA). Compliance auditors must be well-versed in regulatory standards, corporate governance, and risk management, with certifications like Certified Internal Auditor (CIA) or Certified Compliance and Ethics Professional (CCEP) enhancing their qualifications. Both roles demand strong analytical skills and a thorough understanding of industry-specific laws and financial principles to ensure accurate auditing and adherence to compliance standards.

Skills Comparison: Premium vs Compliance Auditors

Premium auditors excel in analytical skills and attention to detail, focusing on evaluating insurance premiums by reviewing financial records and risk exposure. Compliance auditors possess strong knowledge of regulatory standards and legal frameworks, specializing in ensuring adherence to industry regulations and internal policies. Both roles require proficiency in data analysis and report generation, but premium auditors emphasize financial accuracy while compliance auditors prioritize regulatory conformity.

Daily Workflows and Processes

Premium auditors primarily focus on verifying payroll records, employee classifications, and financial documents to accurately determine insurance premiums, conducting on-site visits and detailed data analysis. Compliance auditors review adherence to regulatory standards, company policies, and internal controls by examining documentation, risk assessments, and operational procedures to mitigate legal and financial risks. Both roles require extensive interaction with client data, but premium auditors emphasize financial accuracy while compliance auditors emphasize regulatory conformity.

Industry Tools and Technologies Used

Premium auditors utilize industry tools such as automated audit software, data analytics platforms, and specialized accounting systems to accurately assess insurance premiums based on payroll, sales, and exposure data. Compliance auditors rely on regulatory compliance management software, risk assessment tools, and electronic document management systems to ensure adherence to insurance laws and company policies. Both roles increasingly incorporate AI-driven analytics and cloud-based platforms to enhance accuracy and streamline audit processes.

Regulatory and Legal Considerations

Premium auditors focus on verifying payroll records and financial documents to ensure accurate insurance premium calculations, aligning with state insurance regulations and minimizing underwriting risks. Compliance auditors evaluate an organization's adherence to legal and regulatory requirements, such as OSHA standards and industry-specific mandates, ensuring comprehensive risk management and legal accountability. Both roles demand thorough knowledge of regulatory frameworks to prevent penalties and promote transparent insurance practices.

Career Progression Opportunities

Premium auditors often advance into roles such as senior premium auditor, underwriting analyst, or risk manager, leveraging expertise in analyzing insurance premiums and policy accuracy. Compliance auditors typically progress to senior compliance officer, risk compliance manager, or regulatory affairs specialist, focusing on ensuring adherence to insurance laws and standards. Both career paths offer growth by developing specialized knowledge, with premium auditors emphasizing financial risk assessment and compliance auditors concentrating on regulatory frameworks and internal controls.

Choosing Between Premium Auditor and Compliance Auditor Roles

Choosing between a Premium Auditor and a Compliance Auditor role depends largely on career goals and skillsets within the insurance industry. Premium Auditors specialize in examining and verifying payroll and financial records to calculate accurate insurance premiums, essential for underwriting accuracy. Compliance Auditors focus on ensuring insurance companies adhere to regulatory standards and internal policies, critical for risk management and legal accountability.

Premium Auditor vs Compliance Auditor Infographic

jobdiv.com

jobdiv.com