A life insurance advisor specializes in policies that provide financial protection to beneficiaries after the insured individual's death, focusing on long-term planning and wealth transfer. In contrast, a health insurance advisor concentrates on coverage related to medical expenses, helping clients navigate health plans, premiums, and benefits for immediate healthcare needs. Both advisors offer vital expertise but cater to distinct aspects of risk management and financial security.

Table of Comparison

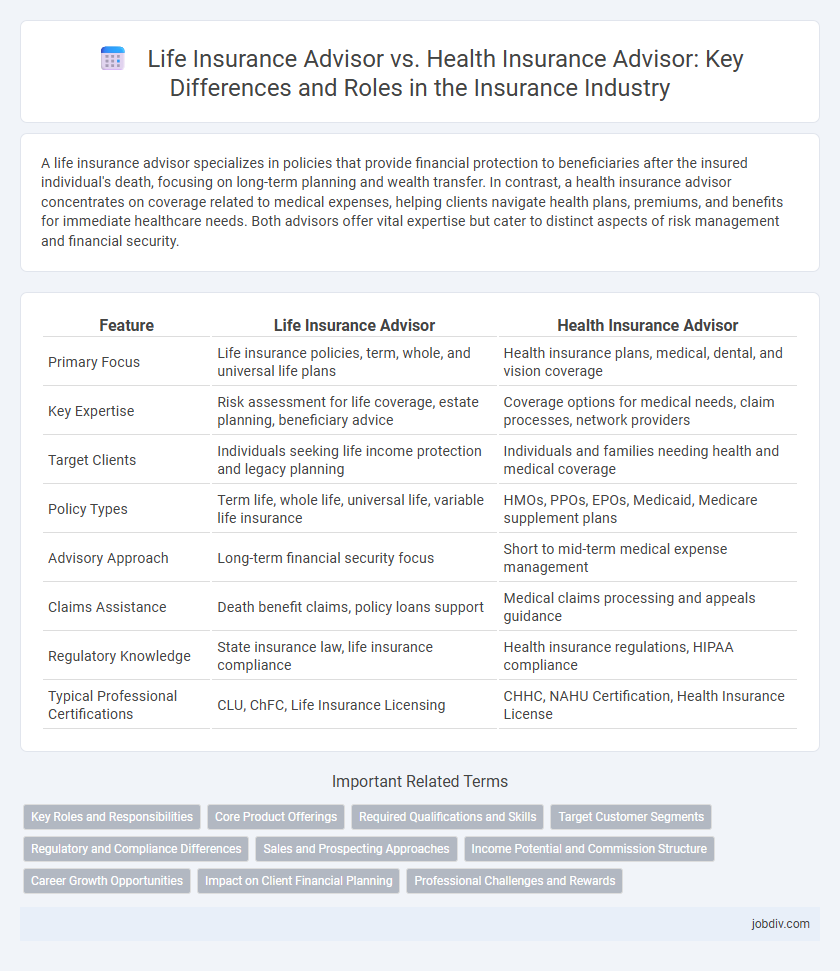

| Feature | Life Insurance Advisor | Health Insurance Advisor |

|---|---|---|

| Primary Focus | Life insurance policies, term, whole, and universal life plans | Health insurance plans, medical, dental, and vision coverage |

| Key Expertise | Risk assessment for life coverage, estate planning, beneficiary advice | Coverage options for medical needs, claim processes, network providers |

| Target Clients | Individuals seeking life income protection and legacy planning | Individuals and families needing health and medical coverage |

| Policy Types | Term life, whole life, universal life, variable life insurance | HMOs, PPOs, EPOs, Medicaid, Medicare supplement plans |

| Advisory Approach | Long-term financial security focus | Short to mid-term medical expense management |

| Claims Assistance | Death benefit claims, policy loans support | Medical claims processing and appeals guidance |

| Regulatory Knowledge | State insurance law, life insurance compliance | Health insurance regulations, HIPAA compliance |

| Typical Professional Certifications | CLU, ChFC, Life Insurance Licensing | CHHC, NAHU Certification, Health Insurance License |

Key Roles and Responsibilities

A Life Insurance Advisor specializes in assessing clients' financial goals to recommend policies that provide financial security to beneficiaries after the policyholder's death, focusing on retirement planning, estate preservation, and income replacement. A Health Insurance Advisor concentrates on helping clients navigate health plan options, ensuring coverage for medical expenses, hospitalization, and preventive care while considering policy exclusions and benefits. Both advisors conduct risk assessments, provide policy comparisons, and offer personalized advice but differ primarily in the coverage scope and client needs they address.

Core Product Offerings

Life insurance advisors specialize in policies that provide financial protection to beneficiaries through term life, whole life, and universal life insurance products. Health insurance advisors focus on coverage plans like individual and group health insurance, Medicare, and critical illness policies. Both advisor types tailor solutions to client needs but emphasize different core products affecting long-term financial security and medical expense management.

Required Qualifications and Skills

Life insurance advisors must possess strong financial knowledge, expertise in risk assessment, and certification such as the Series 6 or 7 license along with state-specific life insurance licenses. Health insurance advisors require a deep understanding of healthcare policies, medical terminology proficiency, and certifications like the Health Insurance Portability and Accountability Act (HIPAA) training and state health insurance license. Both roles demand excellent communication skills, client relationship management, and the ability to analyze policy options to tailor coverage to individual needs.

Target Customer Segments

Life insurance advisors primarily target individuals seeking financial security for their dependents, such as young families and middle-aged professionals looking to protect their loved ones against untimely death. Health insurance advisors focus on individuals and groups concerned with medical expenses, including seniors, people with chronic conditions, and employers providing health benefits to employees. Life insurance appeals to those prioritizing long-term wealth transfer and income replacement, while health insurance attracts customers prioritizing coverage for healthcare costs and preventive services.

Regulatory and Compliance Differences

Life insurance advisors primarily navigate regulations set by state insurance departments focusing on policy underwriting, beneficiary designations, and long-term financial planning compliance. Health insurance advisors must comply with the Affordable Care Act provisions, HIPAA privacy rules, and frequently updated federal and state health mandates. Both roles require adherence to licensing requirements and continuing education, but health insurance advisors often face more complex, dynamic regulatory environments due to evolving healthcare laws.

Sales and Prospecting Approaches

Life insurance advisors prioritize long-term relationship building and financial planning when prospecting, often targeting individuals seeking security for beneficiaries and estate planning benefits. Health insurance advisors emphasize understanding clients' current medical needs and policy coverage gaps, leveraging detailed benefit comparisons and urgent health concerns to drive sales. Both advisors use personalized consultations but tailor their messaging to highlight either future financial protection or immediate healthcare cost management.

Income Potential and Commission Structure

Life insurance advisors typically earn commissions based on policy face value and premium amounts, often benefiting from higher upfront payouts and potential renewal commissions, which drives significant income potential over time. Health insurance advisors usually receive commissions tied to the number of enrolled members or policy volume, with ongoing renewal commissions but generally lower initial commission rates compared to life insurance. Income potential varies widely depending on market demand, product complexity, and client retention strategies within each advisory specialization.

Career Growth Opportunities

Life insurance advisors benefit from expanding markets driven by increasing awareness of retirement planning and wealth transfer, offering robust career growth and specialization in estate planning and annuities. Health insurance advisors experience rising demand due to evolving healthcare regulations and an aging population, with opportunities to specialize in Medicare and employer-based plans. Both roles require continuous education and adaptability, but life insurance advisors often achieve higher commission structures linked to long-term policy sales.

Impact on Client Financial Planning

A Life Insurance Advisor primarily focuses on long-term financial security by offering policies that provide death benefits and investment opportunities, which directly influence estate planning and wealth transfer strategies. In contrast, a Health Insurance Advisor addresses immediate healthcare cost management, helping clients select plans that minimize out-of-pocket expenses and protect against volatile medical costs, thus preserving liquid assets. Both advisors play crucial roles in comprehensive financial planning by balancing risk management with future financial goals.

Professional Challenges and Rewards

Life insurance advisors face challenges in accurately assessing long-term financial risks and tailoring policies to clients' evolving life stages, while health insurance advisors navigate complex medical underwriting and frequent policy changes due to healthcare regulations. The rewards for life insurance advisors include building lasting client relationships through financial security planning, whereas health insurance advisors gain satisfaction from helping clients access critical medical coverage and manage health expenses. Both roles demand deep knowledge of insurance products and strong communication skills to address client concerns and regulatory compliance effectively.

Life Insurance Advisor vs Health Insurance Advisor Infographic

jobdiv.com

jobdiv.com