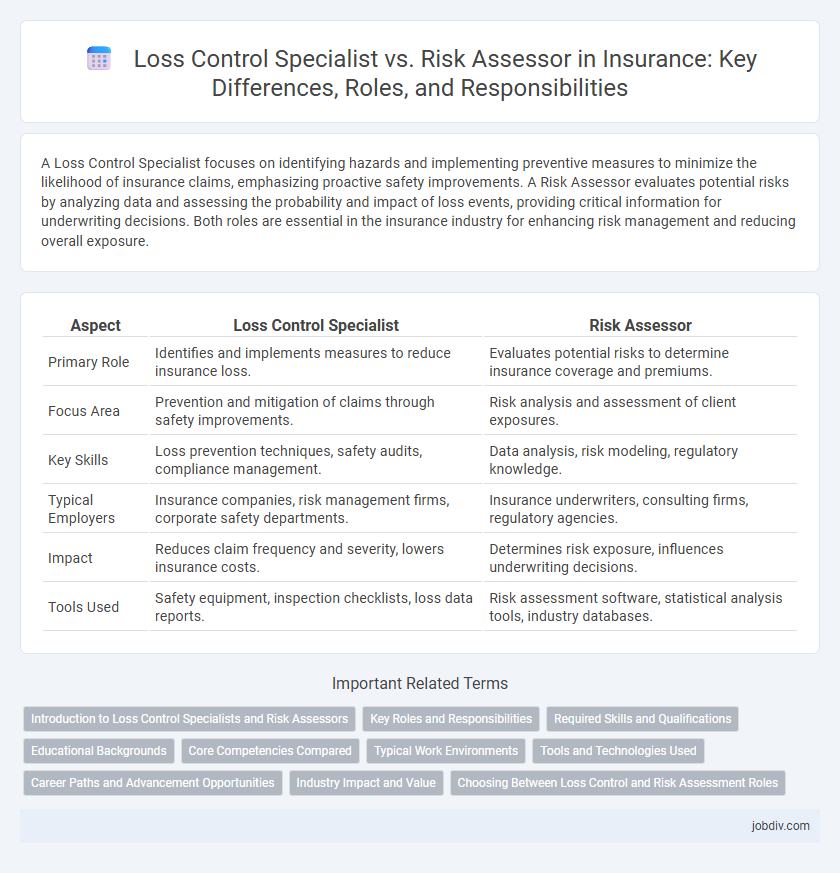

A Loss Control Specialist focuses on identifying hazards and implementing preventive measures to minimize the likelihood of insurance claims, emphasizing proactive safety improvements. A Risk Assessor evaluates potential risks by analyzing data and assessing the probability and impact of loss events, providing critical information for underwriting decisions. Both roles are essential in the insurance industry for enhancing risk management and reducing overall exposure.

Table of Comparison

| Aspect | Loss Control Specialist | Risk Assessor |

|---|---|---|

| Primary Role | Identifies and implements measures to reduce insurance loss. | Evaluates potential risks to determine insurance coverage and premiums. |

| Focus Area | Prevention and mitigation of claims through safety improvements. | Risk analysis and assessment of client exposures. |

| Key Skills | Loss prevention techniques, safety audits, compliance management. | Data analysis, risk modeling, regulatory knowledge. |

| Typical Employers | Insurance companies, risk management firms, corporate safety departments. | Insurance underwriters, consulting firms, regulatory agencies. |

| Impact | Reduces claim frequency and severity, lowers insurance costs. | Determines risk exposure, influences underwriting decisions. |

| Tools Used | Safety equipment, inspection checklists, loss data reports. | Risk assessment software, statistical analysis tools, industry databases. |

Introduction to Loss Control Specialists and Risk Assessors

Loss Control Specialists analyze insurance policies and workplace environments to identify hazards and implement safety measures that prevent accidents, thereby reducing potential claims. Risk Assessors evaluate the likelihood and impact of various risks, quantifying exposures to help insurers set premiums and policy terms based on data-driven risk profiles. Both roles are crucial in the insurance industry for minimizing financial losses and enhancing overall risk management strategies.

Key Roles and Responsibilities

A Loss Control Specialist focuses on identifying potential hazards and implementing safety measures to minimize insurance claims by conducting site inspections and employee training. A Risk Assessor evaluates the likelihood and financial impact of potential risks to develop risk management strategies and ensure compliance with regulatory requirements. Both roles collaborate to enhance organizational safety and reduce overall insurance exposure, but the Loss Control Specialist is more proactive in hazard prevention while the Risk Assessor emphasizes risk evaluation and mitigation planning.

Required Skills and Qualifications

Loss Control Specialists require expertise in hazard identification, safety inspections, and regulatory compliance, often coupled with certifications such as Certified Safety Professional (CSP) or Associate in Risk Management (ARM). Risk Assessors prioritize skills in data analysis, risk modeling, and financial acumen, frequently holding qualifications like Chartered Property Casualty Underwriter (CPCU) or certifications in risk management frameworks. Both roles demand strong communication and problem-solving abilities, but Loss Control Specialists emphasize on-site evaluation skills while Risk Assessors focus on analytical proficiency and risk quantification.

Educational Backgrounds

Loss Control Specialists typically hold degrees in safety management, industrial engineering, or occupational health, emphasizing practical knowledge in hazard identification and mitigation techniques. Risk Assessors often possess backgrounds in actuarial science, finance, or statistics, focusing on quantitative risk analysis and probability modeling. Both roles require certifications such as Certified Safety Professional (CSP) for Loss Control Specialists and Associate in Risk Management (ARM) for Risk Assessors to enhance industry-specific expertise.

Core Competencies Compared

Loss Control Specialists excel in hazard identification, safety inspections, and implementing preventive measures to reduce claims frequency and severity. Risk Assessors specialize in evaluating potential risks through data analysis, risk modeling, and compliance assessment to inform underwriting decisions. Both roles require expertise in regulatory knowledge and risk mitigation, but Loss Control focuses more on operational risk reduction while Risk Assessors emphasize quantitative risk evaluation and strategic planning.

Typical Work Environments

Loss Control Specialists typically work within manufacturing plants, construction sites, and large commercial facilities to implement safety programs and reduce hazards on-site. Risk Assessors often operate in corporate offices, insurance companies, and consulting firms, analyzing data and evaluating potential risks to inform strategic decision-making. Both roles may require field visits, but Loss Control Specialists are more frequently present in dynamic, physical work environments.

Tools and Technologies Used

Loss Control Specialists utilize specialized inspection devices, such as thermal imaging cameras and moisture meters, alongside software for hazard identification and safety compliance tracking to minimize potential losses. Risk Assessors rely on advanced data analytics platforms, geographic information systems (GIS), and predictive modeling tools to evaluate risk levels and forecast potential claims. Both roles increasingly employ artificial intelligence and machine learning technologies to enhance accuracy and efficiency in risk mitigation strategies.

Career Paths and Advancement Opportunities

Loss Control Specialists primarily focus on identifying and mitigating hazards to prevent insurance claims, offering career advancement through specialization in safety protocols and regulatory compliance. Risk Assessors analyze potential risks and financial impacts to develop comprehensive risk management strategies, opening opportunities for roles in underwriting, risk management, and senior analytical positions. Both career paths provide a foundation for advancement into managerial roles within insurance companies and consulting firms, emphasizing expertise in risk reduction and financial analysis.

Industry Impact and Value

Loss Control Specialists play a critical role in minimizing insurance claims by implementing proactive safety measures and reducing workplace hazards across industries, directly lowering premiums and enhancing operational efficiency. Risk Assessors evaluate potential risks by analyzing data and identifying vulnerabilities, enabling insurers and businesses to make informed decisions that strategically manage exposure and financial loss. Both professionals contribute significantly to sustaining industry stability, but Loss Control Specialists drive immediate prevention, while Risk Assessors focus on long-term risk mitigation and underwriting accuracy.

Choosing Between Loss Control and Risk Assessment Roles

Choosing between Loss Control Specialist and Risk Assessor roles depends on organizational needs and individual skills. Loss Control Specialists focus on identifying hazards and implementing preventive measures to reduce insurance claims and losses. Risk Assessors analyze potential risks using data and models to evaluate financial exposure and guide underwriting decisions.

Loss Control Specialist vs Risk Assessor Infographic

jobdiv.com

jobdiv.com