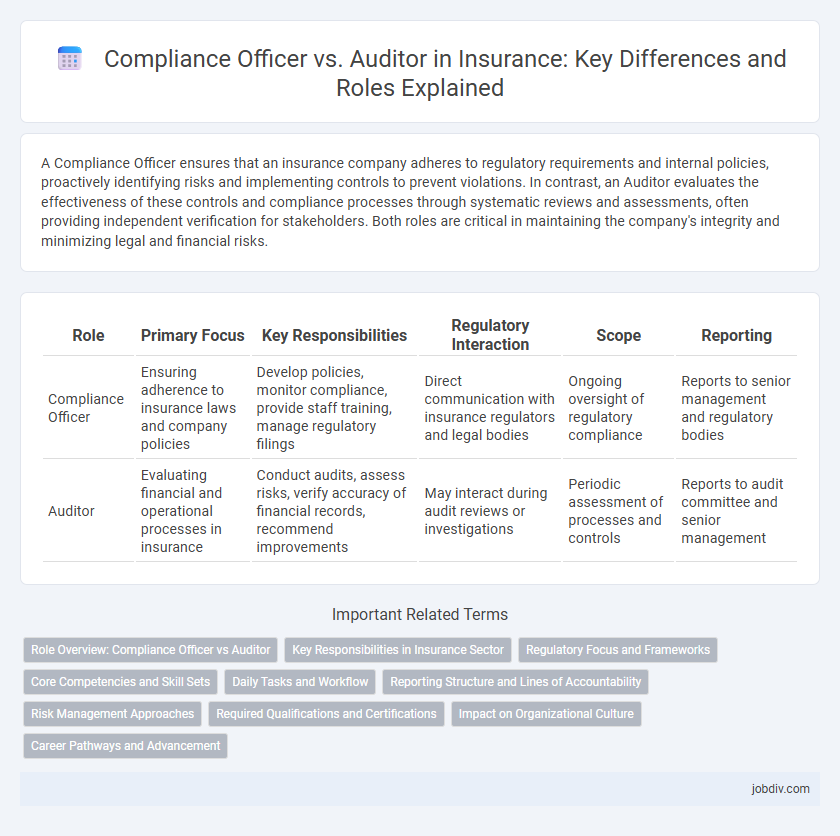

A Compliance Officer ensures that an insurance company adheres to regulatory requirements and internal policies, proactively identifying risks and implementing controls to prevent violations. In contrast, an Auditor evaluates the effectiveness of these controls and compliance processes through systematic reviews and assessments, often providing independent verification for stakeholders. Both roles are critical in maintaining the company's integrity and minimizing legal and financial risks.

Table of Comparison

| Role | Primary Focus | Key Responsibilities | Regulatory Interaction | Scope | Reporting |

|---|---|---|---|---|---|

| Compliance Officer | Ensuring adherence to insurance laws and company policies | Develop policies, monitor compliance, provide staff training, manage regulatory filings | Direct communication with insurance regulators and legal bodies | Ongoing oversight of regulatory compliance | Reports to senior management and regulatory bodies |

| Auditor | Evaluating financial and operational processes in insurance | Conduct audits, assess risks, verify accuracy of financial records, recommend improvements | May interact during audit reviews or investigations | Periodic assessment of processes and controls | Reports to audit committee and senior management |

Role Overview: Compliance Officer vs Auditor

Compliance Officers in insurance ensure adherence to regulatory requirements, internal policies, and risk management protocols to prevent legal violations and safeguard company reputation. Auditors systematically evaluate financial records, operational processes, and internal controls to identify discrepancies, ensure accuracy, and promote transparency in insurance operations. Both roles are pivotal in maintaining regulatory compliance and operational integrity within insurance companies.

Key Responsibilities in Insurance Sector

Compliance Officers in the insurance sector ensure adherence to regulatory requirements by developing and implementing compliance programs, monitoring company policies, and conducting employee training to mitigate legal risks. Auditors focus on independently evaluating financial records, processes, and internal controls to verify accuracy and detect fraud or inefficiencies within insurance operations. Both roles collaborate to uphold regulatory standards, but Compliance Officers emphasize proactive policy enforcement while Auditors specialize in retrospective assessment and validation.

Regulatory Focus and Frameworks

Compliance Officers in insurance primarily ensure adherence to regulatory requirements such as the Solvency II Directive and the Insurance Distribution Directive by developing and implementing internal policies aligned with these frameworks. Auditors focus on independently evaluating the effectiveness of these compliance measures and financial reporting accuracy against standards like IFRS 17 and local insurance regulatory mandates. Regulatory focus for Compliance Officers centers on ongoing risk management and prevention, while Auditors emphasize verification and assurance within the regulatory compliance framework.

Core Competencies and Skill Sets

Compliance Officers in insurance specialize in regulatory knowledge, risk assessment, and policy enforcement to ensure adherence to industry laws and standards, with strong skills in legal interpretation and ethical judgment. Auditors focus on financial accuracy, internal controls, and operational efficiency, leveraging expertise in data analysis, accounting principles, and systematic review processes. Both roles require attention to detail and communication skills, but Compliance Officers prioritize compliance frameworks while Auditors emphasize financial integrity and procedural correctness.

Daily Tasks and Workflow

Compliance Officers in insurance oversee regulatory adherence by developing internal policies, conducting risk assessments, and ensuring staff training aligns with legal standards. Auditors focus on evaluating the accuracy of financial records, verifying transactions, and identifying discrepancies through systematic reviews and testing. Daily workflows involve Compliance Officers monitoring regulatory changes and implementing controls, while Auditors perform detailed audits and prepare reports for management review.

Reporting Structure and Lines of Accountability

A Compliance Officer in insurance typically reports to the Chief Compliance Officer or directly to the Board to ensure adherence to regulatory standards and internal policies. An Auditor, especially in internal audit, often reports to the Audit Committee or Chief Audit Executive, maintaining independence to objectively assess compliance and risk management. The lines of accountability for Compliance Officers focus on ongoing monitoring and prevention, while Auditors are accountable for independent evaluation and verification of compliance effectiveness.

Risk Management Approaches

Compliance Officers in insurance focus on ensuring adherence to regulatory requirements and internal policies, implementing risk management approaches that prioritize prevention of legal and ethical violations. Auditors assess the effectiveness of these risk management strategies by conducting independent evaluations, identifying weaknesses in controls, and recommending improvements. Together, they create a comprehensive risk management framework by combining proactive compliance oversight with retrospective auditing analysis.

Required Qualifications and Certifications

Compliance Officers in insurance typically require certifications such as Certified Compliance & Ethics Professional (CCEP) or Certified Regulatory Compliance Manager (CRCM), emphasizing knowledge of industry regulations and ethical standards. Auditors usually hold certifications like Certified Internal Auditor (CIA) or Certified Information Systems Auditor (CISA), with a strong background in audit principles, risk assessment, and financial controls. Both roles demand a bachelor's degree in finance, law, or business, but Compliance Officers focus more on regulatory frameworks, whereas Auditors prioritize evaluation of internal processes and accuracy.

Impact on Organizational Culture

A Compliance Officer fosters a risk-aware organizational culture by developing and enforcing policies that ensure adherence to regulatory requirements, thereby promoting ethical behavior and accountability across all levels. An Auditor contributes by independently evaluating and verifying compliance processes, identifying gaps that influence improvements and transparency in operations. Together, these roles reinforce a culture prioritizing integrity, trust, and continuous regulatory alignment within the insurance industry.

Career Pathways and Advancement

Compliance Officers in insurance focus on ensuring regulatory adherence, which demands expertise in risk management and legal frameworks, making their career advancement typically lead to senior roles like Compliance Manager or Chief Compliance Officer. Auditors concentrate on evaluating financial accuracy and internal controls, with career pathways often progressing toward Senior Auditor, Audit Manager, or Internal Audit Director positions. Both roles offer distinct advancement opportunities, with Compliance Officers leaning towards policy development and risk mitigation, while Auditors advance through technical financial oversight and assurance leadership.

Compliance Officer vs Auditor Infographic

jobdiv.com

jobdiv.com