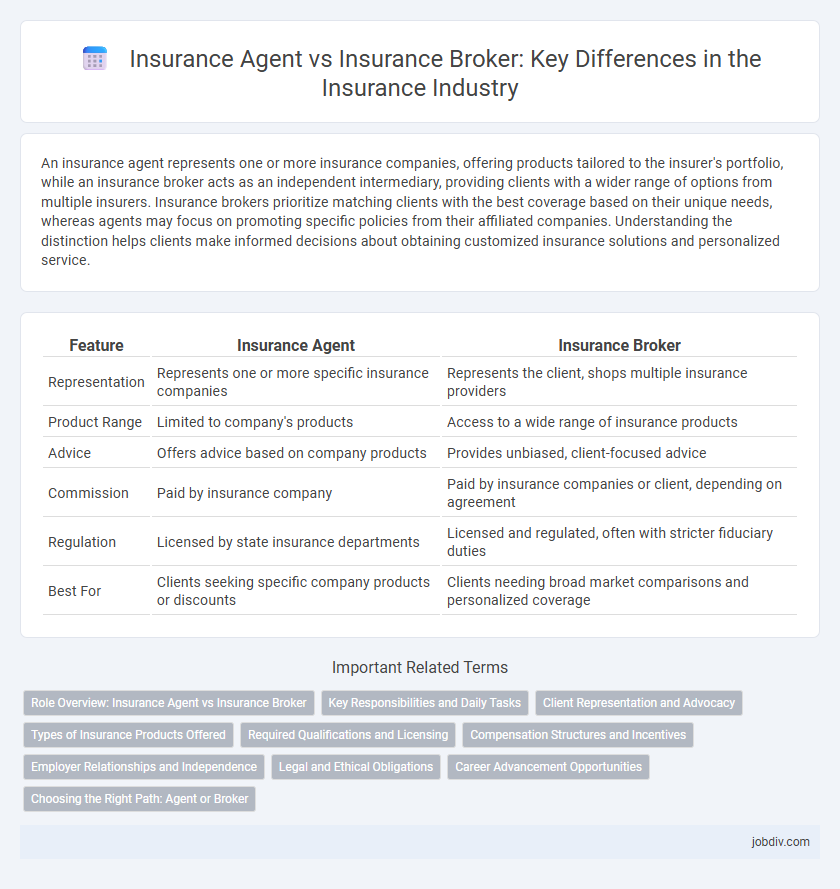

An insurance agent represents one or more insurance companies, offering products tailored to the insurer's portfolio, while an insurance broker acts as an independent intermediary, providing clients with a wider range of options from multiple insurers. Insurance brokers prioritize matching clients with the best coverage based on their unique needs, whereas agents may focus on promoting specific policies from their affiliated companies. Understanding the distinction helps clients make informed decisions about obtaining customized insurance solutions and personalized service.

Table of Comparison

| Feature | Insurance Agent | Insurance Broker |

|---|---|---|

| Representation | Represents one or more specific insurance companies | Represents the client, shops multiple insurance providers |

| Product Range | Limited to company's products | Access to a wide range of insurance products |

| Advice | Offers advice based on company products | Provides unbiased, client-focused advice |

| Commission | Paid by insurance company | Paid by insurance companies or client, depending on agreement |

| Regulation | Licensed by state insurance departments | Licensed and regulated, often with stricter fiduciary duties |

| Best For | Clients seeking specific company products or discounts | Clients needing broad market comparisons and personalized coverage |

Role Overview: Insurance Agent vs Insurance Broker

An insurance agent represents one or more insurance companies and sells policies on their behalf, offering products tailored to the insurer's portfolio. An insurance broker works independently to find the best insurance coverage for clients by comparing multiple insurers, prioritizing the client's needs over any single company's offerings. Both play critical roles in the insurance market, but agents focus on product-specific sales, while brokers provide personalized, unbiased insurance advice.

Key Responsibilities and Daily Tasks

Insurance agents represent specific insurance companies, focusing on selling their products and providing policyholders with coverage details and claims assistance. Insurance brokers work independently, comparing offers from multiple insurers to find the best policies tailored to clients' needs, while handling risk assessment and policy customization. Both roles involve client consultations, policy evaluations, and ongoing support, but brokers offer broader market access compared to agents.

Client Representation and Advocacy

Insurance agents represent specific insurance companies and have a contractual obligation to promote the products of those insurers, which may limit their ability to offer impartial advice. Insurance brokers act on behalf of clients, providing unbiased recommendations by accessing multiple insurance providers to find the best coverage tailored to the client's needs. Brokers advocate for clients during claims and policy negotiations, ensuring a higher level of client representation and personalized service.

Types of Insurance Products Offered

Insurance agents typically represent one or more specific insurance companies and predominantly offer products such as life, health, auto, and home insurance policies that align with their affiliated insurers' portfolios. Insurance brokers operate independently and provide a broader range of insurance products from multiple carriers, allowing clients to access diverse options like commercial liability, specialty lines, and niche insurance policies tailored to unique risks. The variety of insurance offerings available through brokers often enables more customized coverage solutions compared to the more limited, company-specific products sold by agents.

Required Qualifications and Licensing

Insurance agents must obtain state-specific licensing by passing exams that cover insurance laws and product knowledge, often requiring continuing education to maintain certification. Insurance brokers also require state licensing but typically undergo more extensive education, as they represent multiple insurers and must demonstrate expertise in navigating varied policy offerings for clients. Both roles demand background checks and adherence to state insurance regulations to ensure compliance and ethical standards.

Compensation Structures and Incentives

Insurance agents typically receive commissions directly from insurance companies based on the volume and type of policies sold, aligning their incentives with the insurer's product offerings. Insurance brokers, on the other hand, often earn commissions from multiple insurers or charge clients fees, fostering a compensation structure that prioritizes clients' diverse needs and policy comparisons. This distinction in compensation influences the level of product independence and customer-centric service each provides within the insurance market.

Employer Relationships and Independence

Insurance agents typically work directly for an insurance company, maintaining a contractual relationship that aligns their responsibilities with the employer's products and policies. In contrast, insurance brokers operate independently, representing multiple insurers to provide clients with a broader range of options without employer-imposed limitations. The independence of brokers allows greater flexibility and personalized service, while agents benefit from company support and exclusive product access.

Legal and Ethical Obligations

Insurance agents are legally bound to represent the insurer's interests, adhering to specific regulatory standards and fiduciary duties that prioritize the insurer's products. Insurance brokers have an ethical and legal obligation to act in the best interest of the client, offering unbiased advice and a wider range of policy options. Both roles require compliance with licensing requirements, transparency, and the disclosure of conflicts of interest to maintain trust and integrity in the insurance transaction process.

Career Advancement Opportunities

Insurance agents typically work for one company, offering exclusive products that can limit their career flexibility but provide deep expertise and potential for advancement within that company. Insurance brokers represent multiple insurers, granting broader market knowledge and diverse client exposure, which can accelerate career growth through varied experience and networking. Professionals in both roles can advance by obtaining industry certifications such as the Chartered Property Casualty Underwriter (CPCU) or Certified Insurance Counselor (CIC), enhancing credibility and opening leadership or specialized career paths.

Choosing the Right Path: Agent or Broker

Choosing between an insurance agent and an insurance broker depends on your need for personalized options and product access; insurance agents typically represent one company offering predetermined policies, while brokers work independently to find tailored coverage from multiple insurers. Understanding that agents may provide exclusive company benefits and brokers offer broader market comparisons can help you align your insurance goals with the right professional. Assessing factors like policy variety, cost transparency, and personalized service ensures an informed decision when selecting insurance representation.

Insurance Agent vs Insurance Broker Infographic

jobdiv.com

jobdiv.com