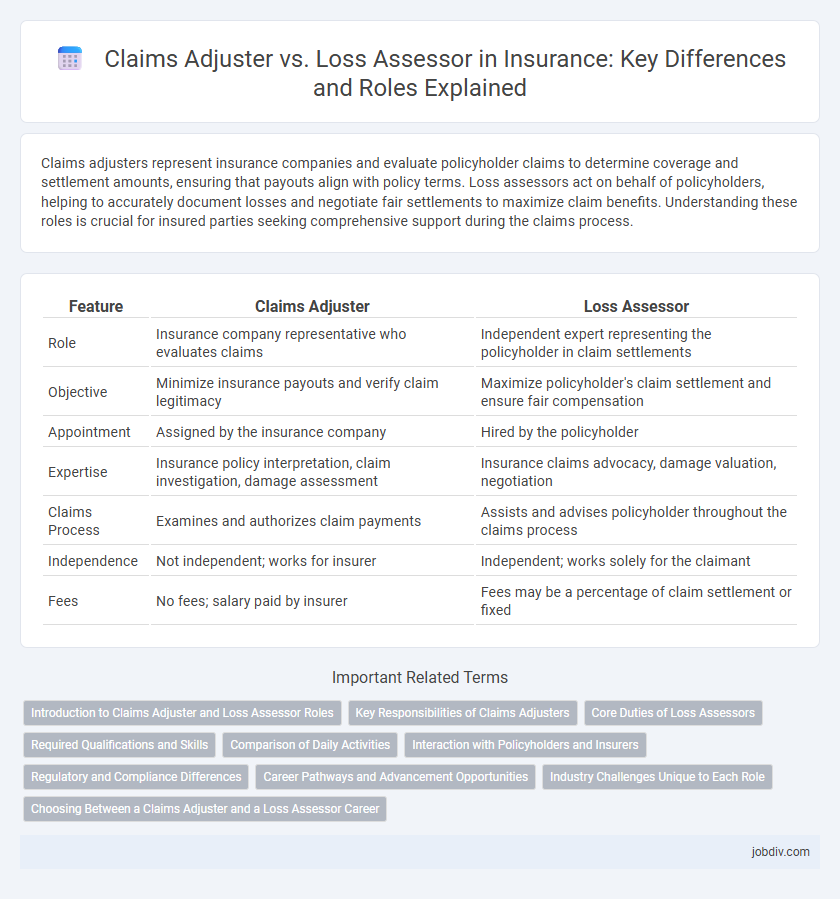

Claims adjusters represent insurance companies and evaluate policyholder claims to determine coverage and settlement amounts, ensuring that payouts align with policy terms. Loss assessors act on behalf of policyholders, helping to accurately document losses and negotiate fair settlements to maximize claim benefits. Understanding these roles is crucial for insured parties seeking comprehensive support during the claims process.

Table of Comparison

| Feature | Claims Adjuster | Loss Assessor |

|---|---|---|

| Role | Insurance company representative who evaluates claims | Independent expert representing the policyholder in claim settlements |

| Objective | Minimize insurance payouts and verify claim legitimacy | Maximize policyholder's claim settlement and ensure fair compensation |

| Appointment | Assigned by the insurance company | Hired by the policyholder |

| Expertise | Insurance policy interpretation, claim investigation, damage assessment | Insurance claims advocacy, damage valuation, negotiation |

| Claims Process | Examines and authorizes claim payments | Assists and advises policyholder throughout the claims process |

| Independence | Not independent; works for insurer | Independent; works solely for the claimant |

| Fees | No fees; salary paid by insurer | Fees may be a percentage of claim settlement or fixed |

Introduction to Claims Adjuster and Loss Assessor Roles

Claims adjusters evaluate insurance claims by investigating damages, reviewing policy terms, and determining the insurer's liability to ensure fair settlements. Loss assessors work independently on behalf of policyholders, providing expert advice and negotiating claim settlements to maximize reimbursement. Both roles require in-depth knowledge of insurance policies, damage assessment, and claim procedures.

Key Responsibilities of Claims Adjusters

Claims Adjusters investigate insurance claims by evaluating damages, verifying policy coverage, and determining appropriate settlement amounts. They conduct on-site inspections, interview claimants and witnesses, and analyze reports to ensure accurate and fair claim resolutions. Their expertise in risk assessment and negotiation is crucial to minimizing insurer losses while addressing claimant needs effectively.

Core Duties of Loss Assessors

Loss assessors specialize in representing policyholders during insurance claims by thoroughly evaluating damages and negotiating with insurers to maximize settlements. Their core duties include assessing the extent of loss or damage, preparing detailed reports to support claims, and advocating on behalf of clients to ensure fair compensation. Unlike claims adjusters who act for insurers, loss assessors work independently to protect the interests of the insured party.

Required Qualifications and Skills

Claims adjusters require a thorough understanding of insurance policy terms, strong analytical skills, and often hold certifications such as the Chartered Property Casualty Underwriter (CPCU). Loss assessors need expertise in property valuation, negotiation skills, and qualifications like accredited loss assessor certifications or relevant degrees in finance or risk management. Both roles demand excellent communication abilities and a detailed knowledge of claims processes to accurately evaluate and negotiate settlements.

Comparison of Daily Activities

Claims adjusters investigate insurance claims by evaluating property damage, interviewing claimants, and determining the payout amount based on policy terms. Loss assessors represent policyholders, inspecting damages, preparing detailed reports, and negotiating with insurers to maximize claim settlements. Daily tasks of claims adjusters emphasize assessment and decision-making, whereas loss assessors focus on advocacy and client support.

Interaction with Policyholders and Insurers

Claims adjusters act on behalf of insurance companies to evaluate policyholder claims, ensuring accurate assessment and fraud prevention, while loss assessors represent policyholders to negotiate fair settlements and advocate for maximum claim recovery. The interaction of claims adjusters centers on verifying policy details and damage extent with insurers, whereas loss assessors communicate directly with both policyholders and insurers to interpret policy coverage and expedite claim resolution. This dynamic influences claim outcomes by balancing insurer interests and policyholder rights through tailored negotiation and expertise.

Regulatory and Compliance Differences

Claims adjusters operate under stringent regulatory frameworks set by state insurance departments, ensuring their assessments comply with legal standards and company policies. Loss assessors, often acting on behalf of policyholders, are subject to different compliance requirements, focusing on advocating for the insured while adhering to consumer protection laws. Regulatory distinctions impact licensing, scope of authority, and reporting obligations between claims adjusters and loss assessors in the insurance claims process.

Career Pathways and Advancement Opportunities

Claims adjusters typically follow a career path involving entry-level positions in insurance companies, progressing to senior adjuster roles and potentially moving into management or specialized investigations. Loss assessors often start by gaining experience in property valuation or financial assessment, advancing to senior assessor roles or independent consultancy, offering detailed loss evaluations for clients. Both careers offer advancement opportunities through certifications, specialized training, and increasing expertise in claims handling and risk management.

Industry Challenges Unique to Each Role

Claims adjusters face challenges in accurately assessing damages while navigating insurer protocols and managing fraud risks, often under tight deadlines. Loss assessors encounter difficulties advocating for policyholders with complex claims, ensuring fair settlements amid policy limitations and insurer resistance. Both roles must adapt to evolving regulations, technological advancements, and increasing claim volumes that reshape the insurance landscape.

Choosing Between a Claims Adjuster and a Loss Assessor Career

Choosing between a claims adjuster and a loss assessor career depends on your preference for working directly with insurance companies or representing policyholders. Claims adjusters evaluate insurance claims for companies, ensuring fair settlements based on policy terms, while loss assessors advocate for clients to maximize their claim payouts. Understanding industry regulations, negotiation skills, and customer service are crucial for success in both roles within the insurance sector.

Claims Adjuster vs Loss Assessor Infographic

jobdiv.com

jobdiv.com