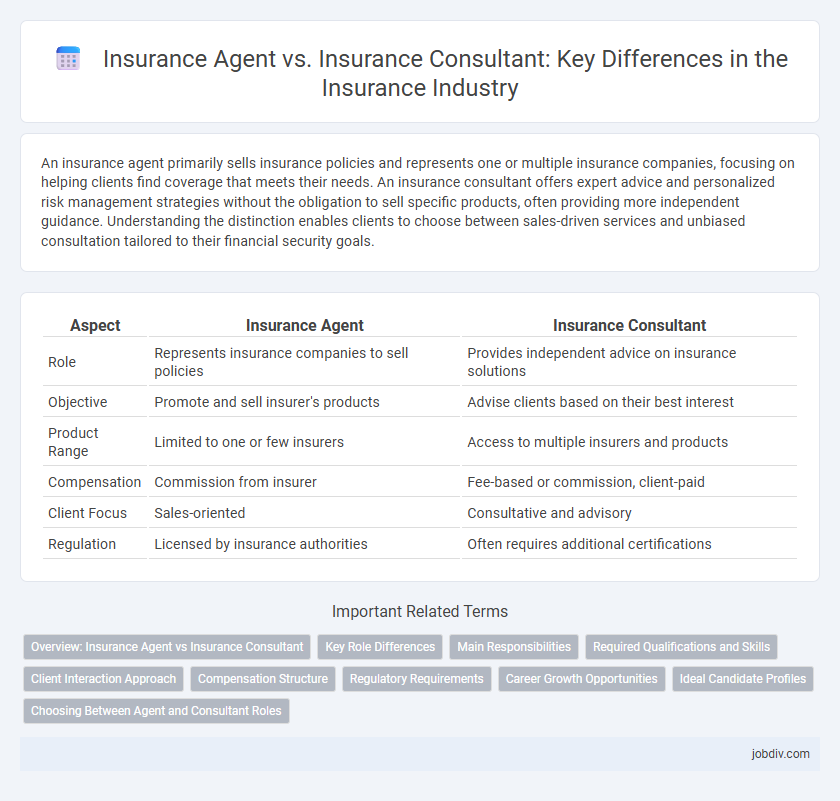

An insurance agent primarily sells insurance policies and represents one or multiple insurance companies, focusing on helping clients find coverage that meets their needs. An insurance consultant offers expert advice and personalized risk management strategies without the obligation to sell specific products, often providing more independent guidance. Understanding the distinction enables clients to choose between sales-driven services and unbiased consultation tailored to their financial security goals.

Table of Comparison

| Aspect | Insurance Agent | Insurance Consultant |

|---|---|---|

| Role | Represents insurance companies to sell policies | Provides independent advice on insurance solutions |

| Objective | Promote and sell insurer's products | Advise clients based on their best interest |

| Product Range | Limited to one or few insurers | Access to multiple insurers and products |

| Compensation | Commission from insurer | Fee-based or commission, client-paid |

| Client Focus | Sales-oriented | Consultative and advisory |

| Regulation | Licensed by insurance authorities | Often requires additional certifications |

Overview: Insurance Agent vs Insurance Consultant

Insurance agents are licensed professionals authorized to sell and service insurance policies on behalf of specific insurance companies, focusing on product sales and policy management, whereas insurance consultants provide unbiased advice and risk assessment tailored to clients' needs without being tied to any insurer. Agents earn commissions based on policy sales, while consultants typically charge fees for their advisory services. The key distinction lies in agents promoting insurer products versus consultants prioritizing independent client guidance.

Key Role Differences

Insurance agents primarily sell insurance policies and represent specific insurance companies, acting as intermediaries between clients and insurers. Insurance consultants provide independent advice tailored to clients' needs without selling products, focusing on risk assessment and personalized insurance strategies. The key difference lies in agents' product-driven role versus consultants' advisory and analytical approach.

Main Responsibilities

Insurance agents primarily focus on selling insurance policies and representing insurance companies by assessing clients' needs and recommending suitable coverage options. Insurance consultants provide expert advice tailored to clients' specific situations, analyzing existing policies to optimize coverage and reduce risks without directly selling insurance products. Both roles require in-depth knowledge of insurance regulations and market trends to ensure clients receive the best protection and value.

Required Qualifications and Skills

Insurance agents must hold state licenses, often requiring pre-licensing courses and passing exams, with strong sales, communication, and customer service skills essential to their role. Insurance consultants typically require advanced certifications such as CPCU (Chartered Property Casualty Underwriter) or CLU (Chartered Life Underwriter), emphasizing analytical abilities, in-depth industry knowledge, and advisory expertise. Both roles demand a thorough understanding of insurance policies, regulatory compliance, and client risk assessment to effectively serve policyholders.

Client Interaction Approach

Insurance agents primarily represent specific insurance companies and focus on selling their products by understanding client needs to recommend suitable policies. Insurance consultants offer independent advice, conducting thorough risk assessments and tailoring solutions without being tied to any insurer. Their client interaction emphasizes personalized financial planning and unbiased guidance to optimize coverage.

Compensation Structure

Insurance agents typically earn commissions based on the premiums of policies they sell, creating an income model directly tied to sales volume. Insurance consultants, however, are often paid through fees or retainers for their advisory services, offering compensation that is independent of policy sales. This distinction influences the motivation and service approach each professional provides within the insurance industry.

Regulatory Requirements

Insurance agents are typically licensed representatives authorized by insurance companies to sell and service policies, adhering strictly to state regulatory requirements including licensing, continuing education, and adherence to sales conduct rules. Insurance consultants, on the other hand, often operate independently, providing advisory services without selling policies directly, and may have different or fewer regulatory obligations depending on jurisdiction, often requiring registration or disclosure but not the same licensing as agents. Regulatory frameworks prioritize consumer protection, mandating agents to comply with more rigorous oversight to ensure ethical sales practices, whereas consultants focus on unbiased advice under less stringent regulations.

Career Growth Opportunities

Insurance agents often experience structured career growth through agency leadership roles, sales management, and commission-based incentives, offering clear progression within established companies. Insurance consultants tend to have broader opportunities for specialization, such as risk assessment, financial planning, or corporate advisory services, which can lead to independent practice or consulting firm partnerships. Both paths provide strong potential for career advancement but differ in focus: agents grow through sales-driven environments, while consultants expand through expertise and advisory capacities.

Ideal Candidate Profiles

Ideal candidates for insurance agents possess strong sales skills, excellent communication, and a results-driven mindset to promote insurance products effectively. Insurance consultants typically require in-depth industry knowledge, analytical abilities, and a client-focused approach to provide tailored risk management solutions. Both roles benefit from licensing and certifications, but agents emphasize business development while consultants prioritize strategic advice.

Choosing Between Agent and Consultant Roles

Choosing between an insurance agent and an insurance consultant depends on your specific needs and level of guidance required. Insurance agents typically represent one or more insurance companies, offering products they are authorized to sell, which can streamline the purchasing process. Insurance consultants provide independent, personalized advice tailored to your unique financial situation, often working on a fee basis without the constraints of product offerings.

Insurance Agent vs Insurance Consultant Infographic

jobdiv.com

jobdiv.com