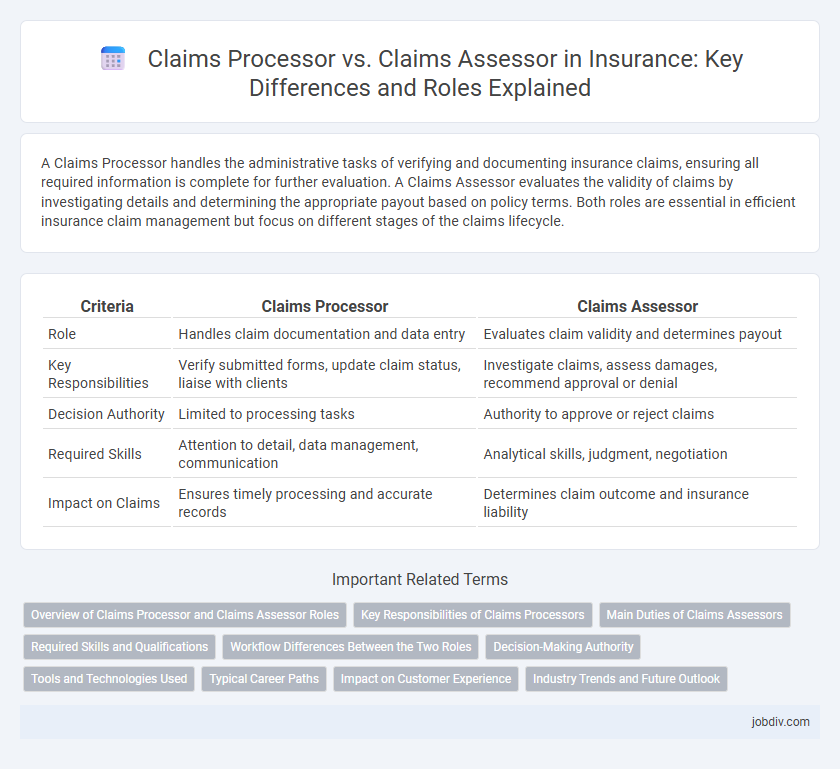

A Claims Processor handles the administrative tasks of verifying and documenting insurance claims, ensuring all required information is complete for further evaluation. A Claims Assessor evaluates the validity of claims by investigating details and determining the appropriate payout based on policy terms. Both roles are essential in efficient insurance claim management but focus on different stages of the claims lifecycle.

Table of Comparison

| Criteria | Claims Processor | Claims Assessor |

|---|---|---|

| Role | Handles claim documentation and data entry | Evaluates claim validity and determines payout |

| Key Responsibilities | Verify submitted forms, update claim status, liaise with clients | Investigate claims, assess damages, recommend approval or denial |

| Decision Authority | Limited to processing tasks | Authority to approve or reject claims |

| Required Skills | Attention to detail, data management, communication | Analytical skills, judgment, negotiation |

| Impact on Claims | Ensures timely processing and accurate records | Determines claim outcome and insurance liability |

Overview of Claims Processor and Claims Assessor Roles

Claims Processors handle the administrative tasks of insurance claims, including data entry, document validation, and ensuring claims comply with policy requirements to facilitate timely payment. Claims Assessors evaluate the validity and value of claims by conducting detailed investigations, analyzing evidence, and determining liability and compensation amounts. Both roles collaborate closely to ensure accurate, efficient, and fair claims management within the insurance industry.

Key Responsibilities of Claims Processors

Claims Processors handle the initial intake and verification of insurance claims, ensuring all required documentation is accurate and complete. They review claim forms, check policy details, and verify claimant information to facilitate prompt and efficient processing. Their role includes data entry, coordination with adjusters or assessors, and maintaining compliance with company policies and regulatory standards.

Main Duties of Claims Assessors

Claims assessors primarily evaluate insurance claims by thoroughly examining policy details and verifying the legitimacy of claims to determine appropriate settlements. They conduct investigations, consult medical or accident reports, and collaborate with clients and experts to assess damages accurately. Their role ensures claims are processed fairly and efficiently while minimizing fraudulent activities in insurance operations.

Required Skills and Qualifications

Claims processors require strong organizational skills, attention to detail, and proficiency in data entry software to efficiently handle and verify claim documentation. Claims assessors need in-depth knowledge of insurance policies, risk evaluation expertise, and analytical skills to accurately determine claim validity and settlement amounts. Both roles demand excellent communication abilities, but assessors typically require advanced qualifications such as certifications in insurance claims or risk management.

Workflow Differences Between the Two Roles

Claims processors primarily focus on the initial intake and verification of insurance claims, ensuring all required documentation is complete and accurate before moving the claim forward. Claims assessors conduct in-depth evaluations by analyzing policy coverage, investigating claim validity, and determining the appropriate settlement based on detailed evidence and damage assessments. The workflow of claims processors emphasizes administrative tasks and data entry, while claims assessors engage in analytical decision-making and risk assessment to finalize claim outcomes.

Decision-Making Authority

Claims processors handle initial claim documentation and data entry, ensuring accuracy and completeness but typically lack decision-making authority on claim approval or denial. Claims assessors evaluate the validity and extent of claims, possessing the authority to make informed decisions on approvals, rejections, or settlements based on policy terms and evidence. The distinction in decision-making authority directly impacts the claims workflow efficiency and customer resolution timelines.

Tools and Technologies Used

Claims processors primarily use automated claims management systems and software like Guidewire and SAP Claims Management to handle vast volumes of data efficiently, ensuring accurate data entry and workflow automation. Claims assessors utilize advanced analytical tools, including AI-powered damage assessment platforms and digital imaging technologies, to evaluate claim validity and estimate repair costs precisely. Both roles increasingly rely on cloud-based solutions and integrated databases to enhance collaboration and streamline insurance claim resolution processes.

Typical Career Paths

Claims processors typically begin their careers in entry-level roles, advancing to senior processor or claims coordinator positions with experience in documentation and data management. Claims assessors often start as claims processors or insurance adjusters, progressing to specialist roles involving risk assessment, damage evaluation, and settlement decisions. Career growth in both paths can lead to managerial roles such as claims supervisor, risk manager, or underwriting manager within insurance companies.

Impact on Customer Experience

Claims processors streamline the administrative handling of insurance claims, ensuring quick verification and data entry that reduces processing time and enhances customer satisfaction. Claims assessors evaluate the validity and extent of claims by conducting thorough investigations, providing accurate decisions that build trust and transparency for policyholders. Efficient collaboration between claims processors and assessors minimizes delays and errors, significantly improving the overall customer experience in insurance claims handling.

Industry Trends and Future Outlook

Claims processors are increasingly adopting automation and AI technologies to enhance efficiency in handling high volumes of insurance claims, reducing processing time and minimizing errors. Claims assessors are leveraging advanced analytics and remote inspection tools to improve accuracy in damage evaluations and fraud detection, aligning with rising customer expectations for faster and transparent claim resolutions. Industry trends indicate a shift towards integrated digital platforms combining both roles to streamline workflows and support data-driven decision-making in the evolving insurance landscape.

Claims Processor vs Claims Assessor Infographic

jobdiv.com

jobdiv.com