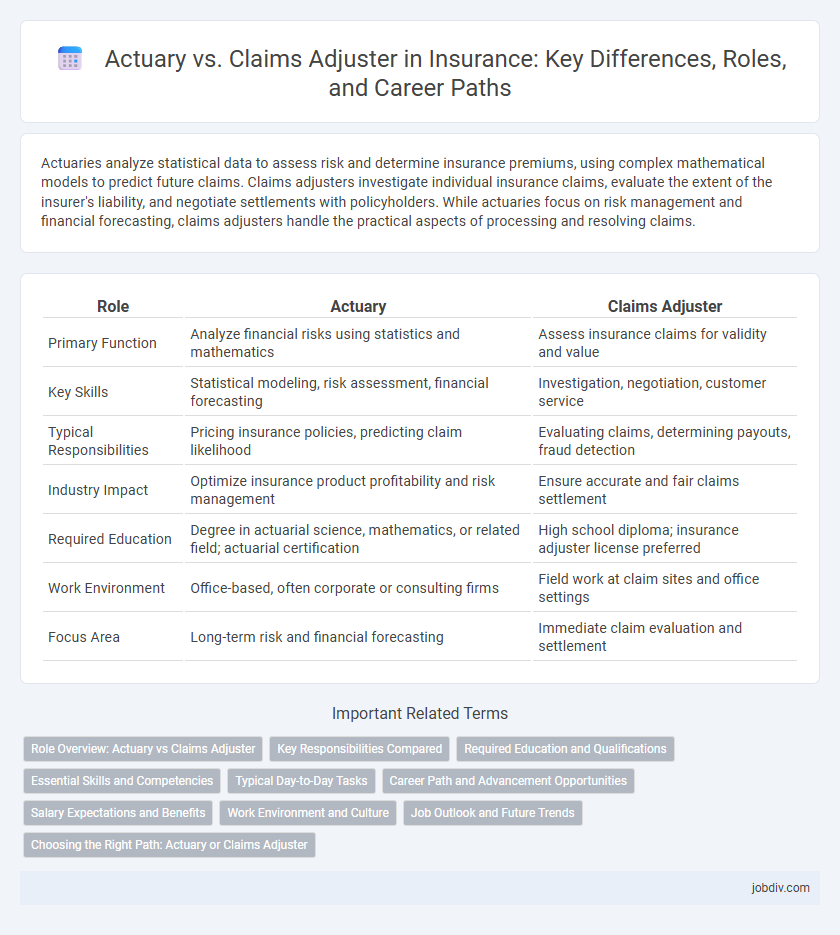

Actuaries analyze statistical data to assess risk and determine insurance premiums, using complex mathematical models to predict future claims. Claims adjusters investigate individual insurance claims, evaluate the extent of the insurer's liability, and negotiate settlements with policyholders. While actuaries focus on risk management and financial forecasting, claims adjusters handle the practical aspects of processing and resolving claims.

Table of Comparison

| Role | Actuary | Claims Adjuster |

|---|---|---|

| Primary Function | Analyze financial risks using statistics and mathematics | Assess insurance claims for validity and value |

| Key Skills | Statistical modeling, risk assessment, financial forecasting | Investigation, negotiation, customer service |

| Typical Responsibilities | Pricing insurance policies, predicting claim likelihood | Evaluating claims, determining payouts, fraud detection |

| Industry Impact | Optimize insurance product profitability and risk management | Ensure accurate and fair claims settlement |

| Required Education | Degree in actuarial science, mathematics, or related field; actuarial certification | High school diploma; insurance adjuster license preferred |

| Work Environment | Office-based, often corporate or consulting firms | Field work at claim sites and office settings |

| Focus Area | Long-term risk and financial forecasting | Immediate claim evaluation and settlement |

Role Overview: Actuary vs Claims Adjuster

Actuaries analyze statistical data to assess risk and determine insurance premiums using mathematical models and financial theory. Claims adjusters investigate, evaluate, and settle insurance claims by verifying coverage and estimating losses. While actuaries focus on risk assessment and policy pricing, claims adjusters concentrate on claim validation and payout decisions.

Key Responsibilities Compared

Actuaries analyze statistical data to assess risk and determine insurance premium rates, using mathematical models to predict future claims and financial outcomes. Claims adjusters investigate insurance claims by evaluating damages, interviewing claimants, and negotiating settlements to ensure fair and accurate compensation. While actuaries focus on risk assessment and financial forecasting, claims adjusters handle the practical evaluation and resolution of individual claims.

Required Education and Qualifications

Actuaries typically require a strong foundation in mathematics, statistics, and economics, often holding a bachelor's degree in actuarial science, mathematics, or related fields, and must pass a series of rigorous professional exams administered by organizations such as the Society of Actuaries (SOA) or Casualty Actuarial Society (CAS). Claims adjusters generally need a high school diploma or equivalent, but many employers prefer candidates with a bachelor's degree in insurance, finance, or business, along with on-the-job training and state licensing where applicable. Professional certifications for claims adjusters, like the Associate in Claims (AIC) designation, enhance qualifications but are less exam-intensive compared to actuarial credentials.

Essential Skills and Competencies

Actuaries require strong analytical skills, proficiency in mathematics, statistics, and financial theory to evaluate risk and forecast future events accurately. Claims adjusters must excel in negotiation, attention to detail, and knowledge of insurance policies to assess claims efficiently and ensure fair settlements. Both roles demand critical thinking, effective communication, and a thorough understanding of insurance regulations and industry standards.

Typical Day-to-Day Tasks

Actuaries analyze statistical data to calculate insurance risks and premiums, using mathematics, statistics, and financial theory to develop models that predict future claim occurrences. Claims adjusters investigate insurance claims, evaluate damages, interview claimants and witnesses, and negotiate settlements to ensure fair compensation. While actuaries focus on risk assessment and policy pricing, claims adjusters manage the practical aspects of claim resolution and customer service.

Career Path and Advancement Opportunities

Actuaries typically advance through roles like senior actuary, actuarial manager, and chief risk officer, leveraging strong analytical and mathematical skills to influence company strategy and pricing models. Claims adjusters progress by gaining expertise in claims investigation, moving into senior adjuster, claims supervisor, and eventually claims manager positions, emphasizing negotiation and customer service skills. Both careers offer growth but actuaries often see faster advancement and higher earning potential due to their specialized expertise and certification requirements.

Salary Expectations and Benefits

Actuaries in the insurance industry typically earn higher salaries, with median annual wages around $110,000, reflecting their specialized expertise in risk assessment and statistical analysis. Claims adjusters receive average salaries near $65,000, benefiting from performance bonuses and commissions based on claims resolution. Both professions offer comprehensive benefits including health insurance, retirement plans, and paid time off, but actuaries often have access to additional incentives such as profit-sharing and advanced education reimbursement.

Work Environment and Culture

Actuaries primarily work in office settings, often collaborating with teams of analysts and executives in insurance companies or consulting firms, where a data-driven and analytical culture prevails. Claims adjusters tend to spend significant time both in offices and on-site inspections, engaging directly with clients and third parties, which fosters a dynamic, field-oriented culture focused on problem-solving and negotiation. The work environment for actuaries emphasizes long-term risk assessment and strategic planning, while claims adjusters operate under time-sensitive conditions requiring strong interpersonal skills and adaptability.

Job Outlook and Future Trends

Actuaries are projected to experience strong job growth of around 24% through 2031 due to increasing demand for risk assessment in complex insurance markets. Claims adjusters face slower growth, approximately 3%, as automation and AI streamline claim processing tasks. Future trends indicate actuaries will leverage advanced analytics and machine learning, whereas claims adjusters will increasingly adopt digital tools to enhance efficiency.

Choosing the Right Path: Actuary or Claims Adjuster

Choosing the right path between an actuary and a claims adjuster depends on career goals and skill sets; actuaries specialize in risk assessment through statistical analysis, while claims adjusters focus on evaluating insurance claims and determining payouts. Actuaries require strong mathematical expertise and often pursue certifications like the Society of Actuaries exams, whereas claims adjusters benefit from keen investigative skills and knowledge of insurance policies. Understanding the distinct responsibilities and qualifications of each role helps professionals align their career trajectory with industry demands.

Actuary vs Claims Adjuster Infographic

jobdiv.com

jobdiv.com