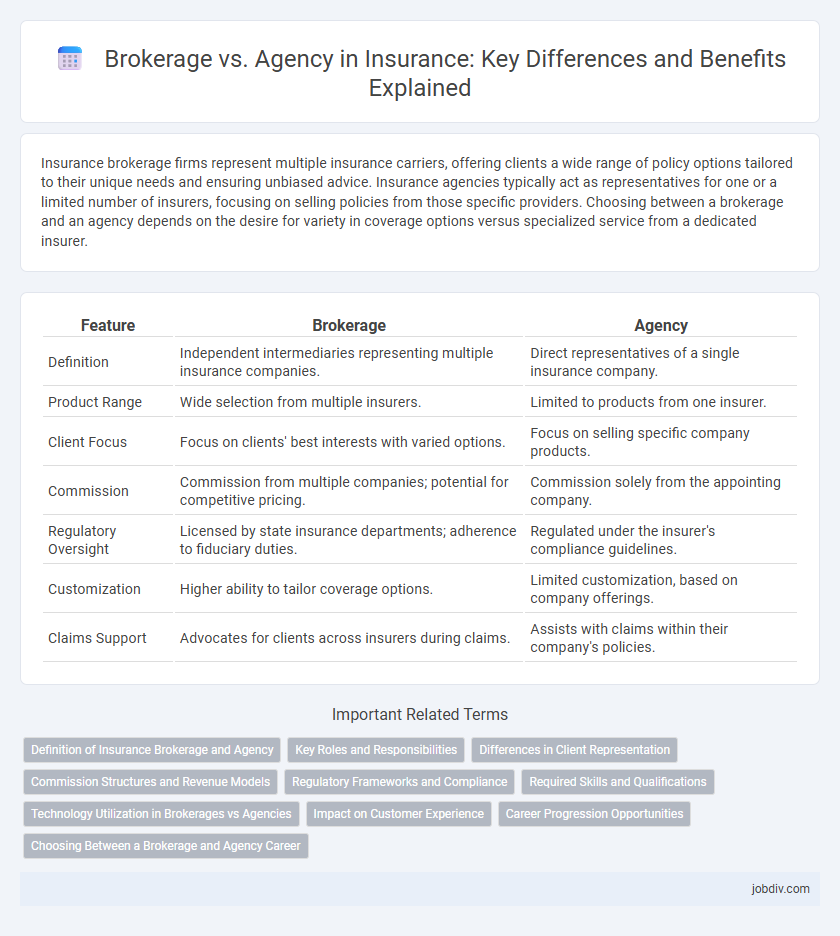

Insurance brokerage firms represent multiple insurance carriers, offering clients a wide range of policy options tailored to their unique needs and ensuring unbiased advice. Insurance agencies typically act as representatives for one or a limited number of insurers, focusing on selling policies from those specific providers. Choosing between a brokerage and an agency depends on the desire for variety in coverage options versus specialized service from a dedicated insurer.

Table of Comparison

| Feature | Brokerage | Agency |

|---|---|---|

| Definition | Independent intermediaries representing multiple insurance companies. | Direct representatives of a single insurance company. |

| Product Range | Wide selection from multiple insurers. | Limited to products from one insurer. |

| Client Focus | Focus on clients' best interests with varied options. | Focus on selling specific company products. |

| Commission | Commission from multiple companies; potential for competitive pricing. | Commission solely from the appointing company. |

| Regulatory Oversight | Licensed by state insurance departments; adherence to fiduciary duties. | Regulated under the insurer's compliance guidelines. |

| Customization | Higher ability to tailor coverage options. | Limited customization, based on company offerings. |

| Claims Support | Advocates for clients across insurers during claims. | Assists with claims within their company's policies. |

Definition of Insurance Brokerage and Agency

An insurance brokerage is an independent firm that acts as an intermediary between clients and multiple insurance companies, offering a variety of coverage options tailored to the client's needs. Insurance agencies typically represent one or more insurance companies and primarily sell policies on behalf of those insurers, often providing specialized products aligned with the principals' offerings. Both brokerages and agencies facilitate the insurance purchasing process but differ in their relationships with insurers and the scope of policy options they provide.

Key Roles and Responsibilities

Brokerages act as intermediaries representing multiple insurance carriers to find the best policies for clients, offering tailored advice and comparing various options. Agencies typically represent one or more specific insurance companies, focusing on selling those carriers' products and providing customer service. Both entities handle policy administration, claims assistance, and risk assessment, but brokerages emphasize client advocacy, while agencies prioritize carrier relationships.

Differences in Client Representation

Brokerages act as intermediaries representing multiple insurance carriers, offering clients a broad range of policy options tailored to their specific needs. Agencies typically represent one or a limited number of insurers, providing clients with specialized products from those select companies. Client representation in brokerages emphasizes impartial advice and competitive pricing, while agencies focus on in-depth knowledge and loyalty to their affiliated insurers.

Commission Structures and Revenue Models

Brokerage commission structures typically involve fees earned by placing clients with multiple insurance carriers, allowing broader product selection and competitive pricing. Agency revenue models often center on commissions from a limited number of insurers, sometimes supplemented by override commissions and incentive bonuses based on sales volume. Understanding the differences in commission splits, contingent commissions, and the potential for renewals is crucial for evaluating profitability in brokerage versus agency operations.

Regulatory Frameworks and Compliance

Brokerage and agency models in insurance operate under distinct regulatory frameworks impacting compliance obligations. Brokerages typically serve as intermediaries representing multiple insurers, requiring adherence to licensing standards and fiduciary duties that ensure unbiased client representation. Agencies often have contractual ties to specific insurers, subjecting them to insurer-driven compliance mandates and regulatory oversight tailored to protect policyholder interests.

Required Skills and Qualifications

Brokerage professionals must possess strong negotiation skills, in-depth knowledge of diverse insurance products, and the ability to analyze client risks independently, often requiring licensing and certifications such as CPCU or CPA. Agency representatives typically need excellent customer service skills, proficiency in policy management, and familiarity with specific insurance carriers' products, with necessary state licenses to sell insurance. Both roles demand strong communication abilities and compliance knowledge, but brokers often require more advanced analytical and advisory qualifications.

Technology Utilization in Brokerages vs Agencies

Brokerages leverage advanced software platforms and data analytics to offer personalized insurance solutions and optimize client management, enhancing overall operational efficiency. Agencies typically rely on legacy systems with limited integration capabilities, which can restrict real-time data access and automated processes. Embracing technologies like AI-powered risk assessment and automated underwriting in brokerages drives more accurate policy recommendations and faster service delivery compared to traditional agency models.

Impact on Customer Experience

Brokerage models offer customers access to multiple insurance carriers, enabling personalized policy comparisons that enhance decision-making and satisfaction. Agency models typically provide direct service from a single insurer, ensuring consistent communication and streamlined claims handling. The choice between brokerage and agency significantly influences customer experience by balancing customization and relationship depth in insurance services.

Career Progression Opportunities

Brokerage careers offer greater independence and higher earning potential by allowing agents to manage multiple insurance carriers and build their own client base. Agency roles typically provide structured career paths with mentorship, training programs, and potential advancement into managerial or specialized positions. Choosing between brokerage and agency affects growth opportunities, depending on whether entrepreneurial autonomy or organizational support is prioritized.

Choosing Between a Brokerage and Agency Career

Choosing between a brokerage and agency career in insurance hinges on the level of independence and client access desired. Brokerages offer professionals the ability to represent multiple insurance carriers, increasing product variety and client options, while agencies typically represent a single insurer, providing specialized expertise and stronger carrier relationships. Evaluating factors like commission structure, regulatory requirements, and market reach helps determine the best fit for career growth in the insurance industry.

Brokerage vs Agency Infographic

jobdiv.com

jobdiv.com