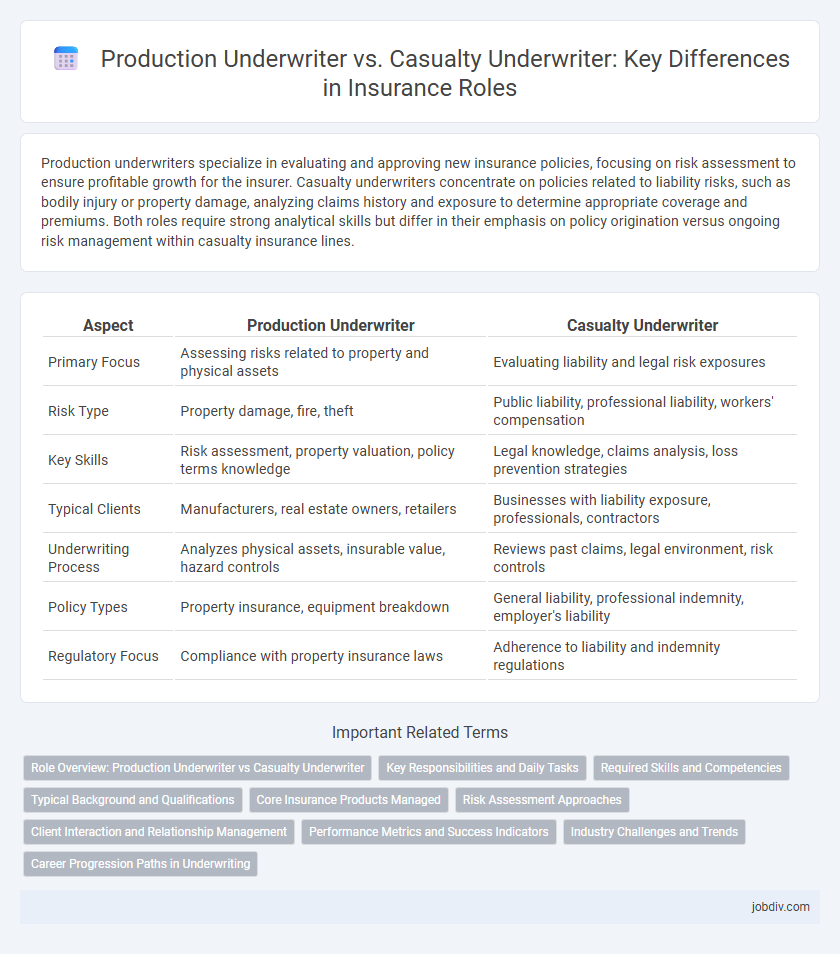

Production underwriters specialize in evaluating and approving new insurance policies, focusing on risk assessment to ensure profitable growth for the insurer. Casualty underwriters concentrate on policies related to liability risks, such as bodily injury or property damage, analyzing claims history and exposure to determine appropriate coverage and premiums. Both roles require strong analytical skills but differ in their emphasis on policy origination versus ongoing risk management within casualty insurance lines.

Table of Comparison

| Aspect | Production Underwriter | Casualty Underwriter |

|---|---|---|

| Primary Focus | Assessing risks related to property and physical assets | Evaluating liability and legal risk exposures |

| Risk Type | Property damage, fire, theft | Public liability, professional liability, workers' compensation |

| Key Skills | Risk assessment, property valuation, policy terms knowledge | Legal knowledge, claims analysis, loss prevention strategies |

| Typical Clients | Manufacturers, real estate owners, retailers | Businesses with liability exposure, professionals, contractors |

| Underwriting Process | Analyzes physical assets, insurable value, hazard controls | Reviews past claims, legal environment, risk controls |

| Policy Types | Property insurance, equipment breakdown | General liability, professional indemnity, employer's liability |

| Regulatory Focus | Compliance with property insurance laws | Adherence to liability and indemnity regulations |

Role Overview: Production Underwriter vs Casualty Underwriter

Production Underwriters manage the evaluation and approval of new insurance applications, focusing on policy issuance and risk assessment for various coverage types, including property and casualty. Casualty Underwriters specialize in assessing risks related to liability insurance, such as bodily injury, property damage, and legal responsibility exposures, to determine appropriate coverage terms and premiums. Both roles require proficiency in risk analysis and adherence to underwriting guidelines but differ in specialization scope and client engagement levels.

Key Responsibilities and Daily Tasks

Production underwriters primarily focus on evaluating and approving new insurance applications, ensuring risks meet company guidelines while maximizing premium income. Casualty underwriters specialize in assessing liability risks, such as bodily injury and property damage, analyzing claims data to set appropriate coverage limits and pricing. Both roles require collaboration with agents and claims teams to refine policies and manage risk exposure effectively.

Required Skills and Competencies

Production underwriters require strong analytical skills to evaluate risks accurately, proficiency in policy issuance, and the ability to manage client relationships efficiently. Casualty underwriters need in-depth knowledge of liability risks, exceptional attention to detail for assessing complex claims, and expertise in interpreting legal and regulatory frameworks. Both roles demand solid communication abilities, but casualty underwriters often prioritize negotiation skills for handling high-stakes coverage decisions.

Typical Background and Qualifications

Production underwriters typically possess a background in business, finance, or insurance, with strong analytical skills and experience in risk assessment and client relations to drive policy sales and portfolio growth. Casualty underwriters often have specialized education in risk management, actuarial science, or related fields, focusing on understanding liability risks and claims to evaluate and price casualty insurance policies accurately. Professional certifications like CPCU (Chartered Property Casualty Underwriter) or ARM (Associate in Risk Management) enhance qualifications for both roles, improving expertise in underwriting principles and industry regulations.

Core Insurance Products Managed

Production underwriters primarily manage core insurance products such as property, auto, and homeowner policies, focusing on new business acquisition and policy issuance. Casualty underwriters specialize in liability insurance lines, including commercial general liability, workers' compensation, and professional liability, assessing risk exposure and determining coverage terms. Both roles require detailed risk evaluation but differ by the specific insurance products they underwrite and manage.

Risk Assessment Approaches

Production underwriters emphasize customer acquisition and revenue by evaluating risk through streamlined criteria and often leverage automated tools for efficiency. Casualty underwriters adopt a comprehensive risk assessment approach that involves detailed analysis of liability exposures, claims history, and regulatory compliance to ensure accurate premium pricing and coverage terms. Both rely on actuaries for statistical data, but casualty underwriters integrate more qualitative factors to manage complex liability risks effectively.

Client Interaction and Relationship Management

Production Underwriters focus on client acquisition and maintaining strong relationships by assessing risk and offering tailored insurance solutions, ensuring client satisfaction and retention. Casualty Underwriters engage deeply with clients to evaluate liability exposures, provide risk mitigation advice, and manage claims-related communications, fostering trust and long-term partnerships. Effective client interaction by both roles drives policy customization and enhances overall portfolio quality in the insurance sector.

Performance Metrics and Success Indicators

Production underwriters excel by consistently surpassing premium volume targets and achieving high policy retention rates, reflecting strong client acquisition and loyalty. Casualty underwriters demonstrate success through low loss ratios and effective risk assessment accuracy, minimizing claims and underwriting losses. Key performance metrics for both include turnaround time on quotes and endorsements, alongside adherence to regulatory compliance and internal risk guidelines.

Industry Challenges and Trends

Production underwriters face challenges in balancing rapid policy issuance with accurate risk assessment amid increasing regulatory scrutiny and customer demand for digital solutions. Casualty underwriters encounter rising claims frequency and severity due to evolving liability risks, including workplace safety concerns and emerging legal precedents. Both roles must adapt to industry trends such as artificial intelligence integration, predictive analytics, and shifts in regulatory frameworks impacting underwriting guidelines.

Career Progression Paths in Underwriting

Production underwriters typically focus on generating new business and managing client relationships, often advancing towards roles such as Senior Underwriter or Branch Manager with enhanced responsibilities in sales strategy and portfolio growth. Casualty underwriters specialize in assessing risk and pricing policies related to liability insurance, frequently progressing to positions like Risk Manager or Underwriting Team Leader, where expertise in complex claims and regulatory compliance is critical. Both career paths offer opportunities for specialization and leadership within insurance firms, driven by performance in risk assessment, client management, and regulatory knowledge.

Production Underwriter vs Casualty Underwriter Infographic

jobdiv.com

jobdiv.com