Insurance auditors evaluate financial records and risk management processes to ensure accuracy and regulatory adherence within insurance companies. Compliance officers develop and enforce policies that guarantee the organization follows industry laws and internal standards. Both roles are critical in maintaining transparency, mitigating risks, and protecting the company from legal and financial penalties.

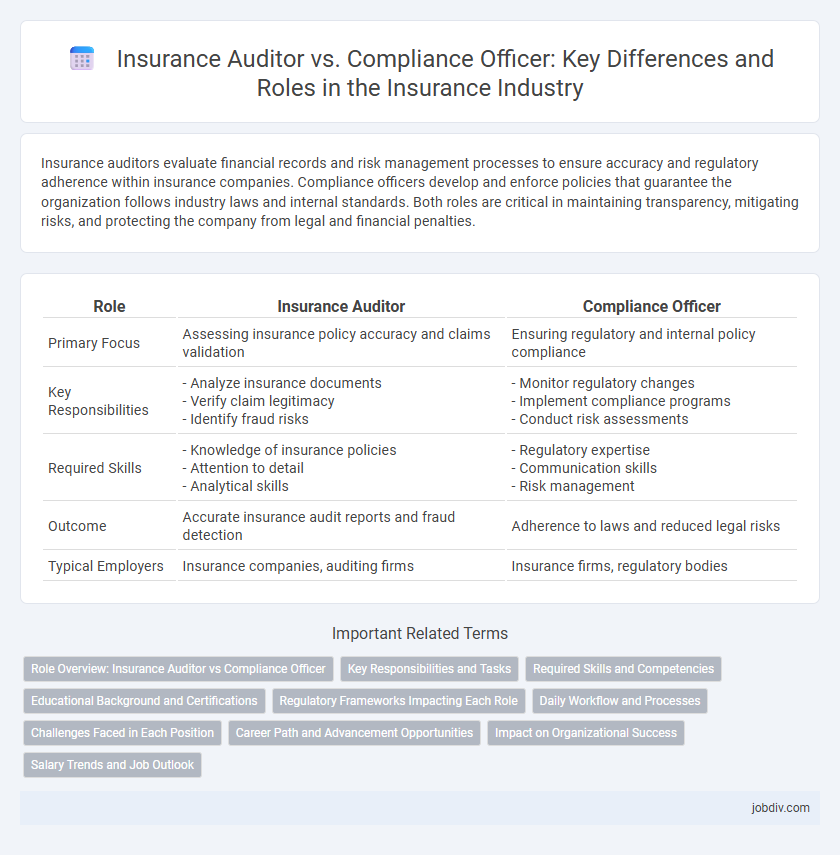

Table of Comparison

| Role | Insurance Auditor | Compliance Officer |

|---|---|---|

| Primary Focus | Assessing insurance policy accuracy and claims validation | Ensuring regulatory and internal policy compliance |

| Key Responsibilities |

- Analyze insurance documents - Verify claim legitimacy - Identify fraud risks |

- Monitor regulatory changes - Implement compliance programs - Conduct risk assessments |

| Required Skills |

- Knowledge of insurance policies - Attention to detail - Analytical skills |

- Regulatory expertise - Communication skills - Risk management |

| Outcome | Accurate insurance audit reports and fraud detection | Adherence to laws and reduced legal risks |

| Typical Employers | Insurance companies, auditing firms | Insurance firms, regulatory bodies |

Role Overview: Insurance Auditor vs Compliance Officer

An Insurance Auditor evaluates insurance policies, claims, and financial records to ensure accuracy and identify fraud or discrepancies, playing a critical role in risk management and financial integrity. A Compliance Officer ensures that insurance companies adhere to legal standards and regulatory requirements, implementing internal policies to prevent violations and maintain ethical business practices. Both roles collaborate to safeguard the company's operations but focus respectively on financial accuracy and regulatory adherence.

Key Responsibilities and Tasks

Insurance auditors primarily assess the accuracy of insurance policies, claims, and underwriting processes to ensure financial integrity and detect fraud. Compliance officers enforce regulatory requirements by developing policies, conducting internal audits, and monitoring adherence to insurance laws and standards. Both roles collaborate to mitigate risks and uphold corporate governance within insurance companies.

Required Skills and Competencies

Insurance auditors require strong analytical skills, attention to detail, and proficiency in evaluating financial records and risk management practices to ensure accurate policy adherence and claims processing. Compliance officers must possess in-depth knowledge of regulatory frameworks, excellent communication skills, and the ability to develop and implement policies that mitigate legal risks and ensure organizational compliance. Both roles demand critical thinking, ethical judgment, and expertise in industry-specific laws and standards to protect the company from financial and reputational harm.

Educational Background and Certifications

Insurance auditors typically possess a degree in accounting, finance, or business administration, with certifications such as Certified Internal Auditor (CIA) or Certified Public Accountant (CPA) enhancing their qualifications. Compliance officers often hold degrees in law, business, or risk management, complemented by certifications like Certified Compliance and Ethics Professional (CCEP) or Certified Regulatory Compliance Manager (CRCM). Both roles require specialized knowledge, but auditors focus more on financial accuracy and controls, while compliance officers emphasize regulatory adherence and ethical standards.

Regulatory Frameworks Impacting Each Role

Insurance auditors operate within regulatory frameworks such as the Sarbanes-Oxley Act (SOX) and the National Association of Insurance Commissioners (NAIC) model laws, ensuring accurate financial reporting and internal controls. Compliance officers navigate complex regulations including the Insurance Distribution Directive (IDD) in Europe and the Dodd-Frank Act in the US, focusing on adherence to legal standards and ethical practices. Both roles require detailed knowledge of state-specific insurance laws and federal regulations to mitigate risk and maintain organizational integrity.

Daily Workflow and Processes

Insurance auditors conduct detailed reviews of financial records and claims, ensuring accuracy and detecting fraud within insurance companies. Compliance officers monitor adherence to regulatory standards, develop internal policies, and train staff to mitigate legal risks. Both roles involve regular documentation and reporting but diverge as auditors focus on validating data integrity while compliance officers emphasize regulatory conformity and risk management.

Challenges Faced in Each Position

Insurance auditors face challenges such as scrutinizing complex financial records to detect fraud, ensuring compliance with evolving regulatory standards, and managing tight deadlines during audit cycles. Compliance officers encounter difficulties in interpreting and applying multifaceted insurance regulations, overseeing internal policy adherence, and mitigating risks associated with non-compliance penalties. Both roles demand continuous updates on legal frameworks and rigorous attention to detail to protect the insurance company's integrity and financial stability.

Career Path and Advancement Opportunities

Insurance auditors typically focus on evaluating financial records and assessing risk management practices within insurance companies, with career advancement avenues leading to senior audit roles or risk management positions. Compliance officers concentrate on ensuring adherence to legal and regulatory standards, often progressing into regulatory affairs management or chief compliance officer roles. Both careers offer specialized growth opportunities, with auditors more aligned to financial oversight and compliance officers geared toward regulatory governance and corporate ethics.

Impact on Organizational Success

Insurance auditors ensure the accuracy of financial records and adherence to regulatory standards, reducing risks of fraud and financial discrepancies. Compliance officers implement policies and monitor procedures to guarantee regulatory compliance, minimizing legal penalties and enhancing organizational reputation. Together, their roles strengthen internal controls, promote transparency, and drive overall organizational success in the insurance industry.

Salary Trends and Job Outlook

Insurance auditors typically earn between $60,000 and $85,000 annually, with demand driven by regulatory changes and the need for financial accuracy in underwriting processes. Compliance officers in insurance firms command salaries ranging from $70,000 to $95,000, reflecting increased emphasis on regulatory adherence and risk management in the evolving insurance landscape. Both roles exhibit strong job growth projections, with compliance officer positions expected to grow faster due to escalating regulatory requirements and the complexity of insurance laws.

Insurance Auditor vs Compliance Officer Infographic

jobdiv.com

jobdiv.com