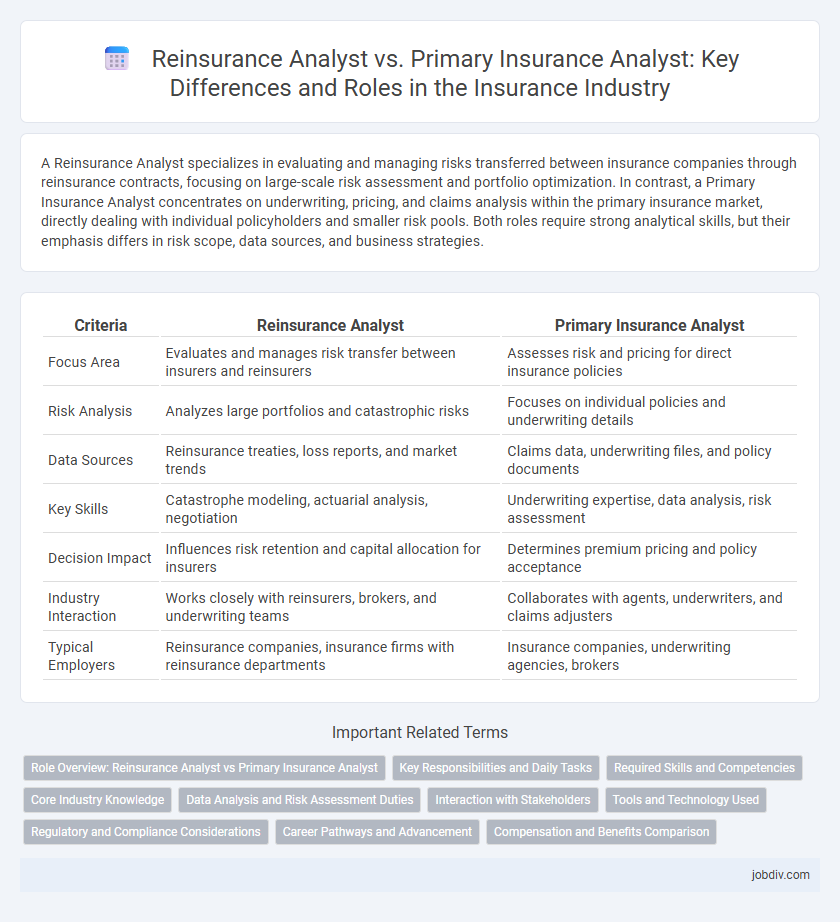

A Reinsurance Analyst specializes in evaluating and managing risks transferred between insurance companies through reinsurance contracts, focusing on large-scale risk assessment and portfolio optimization. In contrast, a Primary Insurance Analyst concentrates on underwriting, pricing, and claims analysis within the primary insurance market, directly dealing with individual policyholders and smaller risk pools. Both roles require strong analytical skills, but their emphasis differs in risk scope, data sources, and business strategies.

Table of Comparison

| Criteria | Reinsurance Analyst | Primary Insurance Analyst |

|---|---|---|

| Focus Area | Evaluates and manages risk transfer between insurers and reinsurers | Assesses risk and pricing for direct insurance policies |

| Risk Analysis | Analyzes large portfolios and catastrophic risks | Focuses on individual policies and underwriting details |

| Data Sources | Reinsurance treaties, loss reports, and market trends | Claims data, underwriting files, and policy documents |

| Key Skills | Catastrophe modeling, actuarial analysis, negotiation | Underwriting expertise, data analysis, risk assessment |

| Decision Impact | Influences risk retention and capital allocation for insurers | Determines premium pricing and policy acceptance |

| Industry Interaction | Works closely with reinsurers, brokers, and underwriting teams | Collaborates with agents, underwriters, and claims adjusters |

| Typical Employers | Reinsurance companies, insurance firms with reinsurance departments | Insurance companies, underwriting agencies, brokers |

Role Overview: Reinsurance Analyst vs Primary Insurance Analyst

Reinsurance Analysts specialize in assessing and managing risks transferred between insurance companies, focusing on treaty and facultative reinsurance agreements to ensure optimal risk distribution and financial stability. Primary Insurance Analysts concentrate on evaluating policies, underwriting risks, and pricing for direct insurance contracts, providing critical insights for policy issuance and claims management. Both roles require strong analytical skills and expertise in risk assessment, but they differ in scope, with reinsurance analysts operating on a macro-level of risk transfer and primary insurance analysts managing direct client-level policies.

Key Responsibilities and Daily Tasks

Reinsurance Analysts focus on evaluating risk portfolios transferred between insurers, analyzing treaty and facultative reinsurance contracts, and modeling loss reserves to support risk mitigation strategies. Primary Insurance Analysts concentrate on underwriting policies, assessing client risk profiles, and managing claims processing to optimize policy profitability and compliance. Both roles require data analysis and reporting, but Reinsurance Analysts specialize in intercompany risk transfer while Primary Analysts handle direct customer-facing insurance operations.

Required Skills and Competencies

Reinsurance Analysts require advanced skills in risk assessment, contract negotiation, and modeling of complex reinsurance treaties, with strong competencies in statistical analysis and regulatory compliance. Primary Insurance Analysts focus on underwriting expertise, portfolio analysis, and claims evaluation, emphasizing proficiency in market trends and pricing strategies. Both roles demand excellent communication, analytical thinking, and proficiency in industry software, but reinsurance analysts typically need deeper knowledge of global risk transfer mechanisms and capital management.

Core Industry Knowledge

Reinsurance Analysts specialize in assessing risks transferred between insurance companies, requiring expertise in treaty structures, risk mitigation strategies, and catastrophe modeling. Primary Insurance Analysts focus on underwriting and evaluating risks directly from policyholders, emphasizing claims analysis, regulatory compliance, and market trends. Core industry knowledge for both roles includes understanding insurance principles, but reinsurance demands deeper insights into risk distribution and capital management.

Data Analysis and Risk Assessment Duties

Reinsurance Analysts specialize in evaluating large-scale risk portfolios and analyzing complex data from multiple primary insurers to determine risk transfer strategies and pricing models. Primary Insurance Analysts focus on direct policyholder data, assessing individual risk factors and claims data to optimize underwriting decisions and policy pricing. Both roles require advanced data analysis skills, but Reinsurance Analysts emphasize broader risk aggregation while Primary Analysts concentrate on granular risk evaluation.

Interaction with Stakeholders

Reinsurance analysts collaborate closely with cedents, brokers, and reinsurers to assess risk transfer agreements and optimize portfolio balances. Primary insurance analysts engage directly with underwriters, claims adjusters, and policyholders to evaluate insurance policies and ensure accurate risk assessment. Effective communication with these distinct stakeholder groups enhances decision-making and risk management in both reinsurance and primary insurance contexts.

Tools and Technology Used

Reinsurance analysts primarily utilize specialized catastrophe modeling software and risk assessment platforms like RMS and AIR to evaluate and manage aggregated risks from multiple primary insurers, while primary insurance analysts rely heavily on underwriting software and claims management systems such as Guidewire and Duck Creek to assess individual policy risks and process claims efficiently. Both roles increasingly integrate data analytics tools like SAS and Python for predictive modeling, but reinsurance analysts emphasize portfolio optimization and exposure analysis, whereas primary insurance analysts focus on policy pricing and customer risk profiling. Advanced automation tools and machine learning algorithms enhance risk evaluation accuracy across both positions, reflecting the growing importance of technology in the insurance sector.

Regulatory and Compliance Considerations

Reinsurance analysts navigate complex regulatory frameworks that govern risk transfer agreements and capital requirements, ensuring compliance with standards set by bodies like the National Association of Insurance Commissioners (NAIC) and Solvency II directives. Primary insurance analysts focus on adherence to underwriting regulations, policyholder protection laws, and local insurance mandates, assessing the impact of compliance on product design and pricing. Both roles require expertise in regulatory reporting and the ability to interpret evolving legislative environments influencing risk assessment and financial solvency.

Career Pathways and Advancement

Reinsurance Analysts primarily evaluate risks transferred between insurance companies, specializing in complex risk assessment and contract negotiation, which often leads to advancement into senior underwriting or portfolio management roles within large insurance firms or reinsurance companies. Primary Insurance Analysts focus on direct risk evaluation for individual or commercial policyholders, progressing towards positions in underwriting leadership, claims management, or product development in primary insurance carriers. Both career paths offer opportunities for specialization, with reinsurance analysts typically gaining exposure to global markets and large-scale risk, while primary insurance analysts develop deep expertise in customer-centric risk solutions and regulatory compliance.

Compensation and Benefits Comparison

Reinsurance analysts typically earn higher salaries than primary insurance analysts due to the specialized risk assessment and complex contract evaluation involved in reinsurance. Benefits for reinsurance analysts often include performance bonuses, comprehensive health plans, and retirement packages that reflect their advanced expertise and industry demand. Primary insurance analysts receive competitive compensation with additional incentives tied to underwriting efficiency and client retention metrics.

Reinsurance Analyst vs Primary Insurance Analyst Infographic

jobdiv.com

jobdiv.com