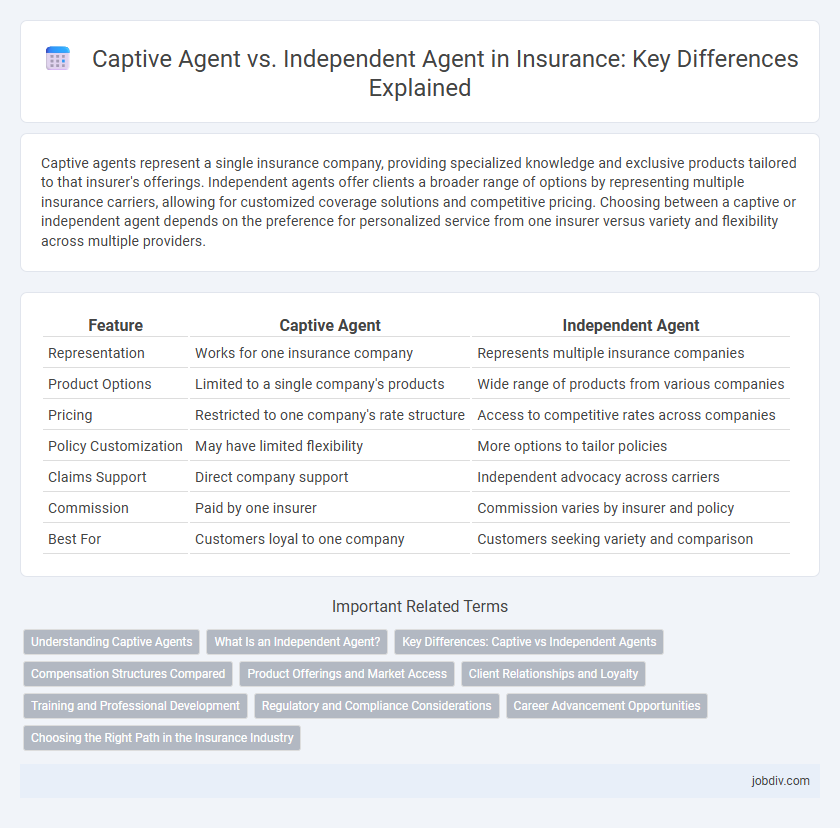

Captive agents represent a single insurance company, providing specialized knowledge and exclusive products tailored to that insurer's offerings. Independent agents offer clients a broader range of options by representing multiple insurance carriers, allowing for customized coverage solutions and competitive pricing. Choosing between a captive or independent agent depends on the preference for personalized service from one insurer versus variety and flexibility across multiple providers.

Table of Comparison

| Feature | Captive Agent | Independent Agent |

|---|---|---|

| Representation | Works for one insurance company | Represents multiple insurance companies |

| Product Options | Limited to a single company's products | Wide range of products from various companies |

| Pricing | Restricted to one company's rate structure | Access to competitive rates across companies |

| Policy Customization | May have limited flexibility | More options to tailor policies |

| Claims Support | Direct company support | Independent advocacy across carriers |

| Commission | Paid by one insurer | Commission varies by insurer and policy |

| Best For | Customers loyal to one company | Customers seeking variety and comparison |

Understanding Captive Agents

Captive agents exclusively represent one insurance company, offering tailored policies that align closely with the insurer's guidelines and product offerings. This exclusive relationship allows captive agents to provide specialized expertise and streamlined claims processing for their company's products. Clients benefit from focused advice but may have limited access to alternative quotes compared to independent agents.

What Is an Independent Agent?

An independent agent is an insurance professional who represents multiple insurance companies, offering clients a variety of policy options tailored to their needs. Unlike captive agents who work exclusively for one insurer, independent agents provide unbiased advice and competitive pricing across carriers. Their ability to access multiple markets enhances client choice and flexibility in coverage.

Key Differences: Captive vs Independent Agents

Captive agents exclusively represent one insurance company, limiting clients to products from that single provider, while independent agents offer policies from multiple carriers, providing a wider range of options and competitive pricing. Captive agents receive training and support directly from their parent company, ensuring specialized product knowledge, whereas independent agents maintain relationships with various insurers, enabling tailored coverage solutions based on client needs. Commission structures differ, with captive agents typically earning fixed rates from their insurer and independent agents often benefiting from variable commissions linked to diverse carrier partnerships.

Compensation Structures Compared

Captive agents receive compensation primarily through commissions and bonuses tied to sales of policies from a single insurance company, often with a base salary structure. Independent agents earn commissions from multiple insurers, allowing for potentially higher earnings through diverse product offerings but with less salary stability. The commission rates for independent agents tend to be more competitive, reflecting their role in providing clients with broader insurance choices.

Product Offerings and Market Access

Captive agents represent a single insurance company, offering a specialized range of products limited to that company's portfolio, which can streamline customer choices but restrict variety. Independent agents provide access to multiple insurers and a broader spectrum of insurance products, enabling tailored coverage solutions that better suit diverse client needs. Market access for independent agents is typically wider, allowing competitive pricing and flexible policy options across life, health, auto, and property insurance sectors.

Client Relationships and Loyalty

Captive agents build strong client loyalty through exclusive representation of one insurance company, offering specialized knowledge and tailored policy options that foster trust. Independent agents enhance client relationships by providing access to multiple insurers, enabling personalized comparisons and flexible coverage plans that address diverse needs. Client retention often depends on the agent's ability to deliver customized service, transparency, and ongoing support within these distinct frameworks.

Training and Professional Development

Captive agents receive specialized training focused exclusively on products from a single insurance company, ensuring deep knowledge of that insurer's offerings and sales techniques. Independent agents access a broader range of professional development opportunities, learning to navigate and compare multiple carriers to tailor solutions for diverse client needs. Continuous education for independent agents often emphasizes market trends and regulatory updates across various insurers, enhancing their adaptability and client advisory skills.

Regulatory and Compliance Considerations

Captive agents operate under the regulatory framework of a single insurance company, ensuring strict compliance with that company's policies and state-specific licensing requirements. Independent agents must navigate a broader regulatory environment, adhering to multiple insurance companies' standards and diverse state regulations, which often demands more comprehensive record-keeping and disclosure practices. Understanding these compliance differences is critical for risk management and maintaining good standing with state insurance departments.

Career Advancement Opportunities

Captive agents often benefit from structured training programs and direct support from their parent insurance companies, which can lead to clear promotional paths within the organization. Independent agents have greater flexibility to build diverse client portfolios and partnerships, enabling entrepreneurial growth and the potential to expand their own agency. Career advancement for independent agents is largely self-driven, relying on personal business acumen and networking skills to scale operations.

Choosing the Right Path in the Insurance Industry

Choosing the right path in the insurance industry depends on whether you prefer the direct support and exclusive product offerings of a captive agent or the broader market access and variety of options available through an independent agent. Captive agents typically align with one insurance company, providing in-depth knowledge of their products and focused sales strategies, while independent agents offer clients multiple carriers, fostering competitive pricing and personalized coverage solutions. Understanding these distinctions helps professionals and clients optimize insurance plans to best meet their needs and financial goals.

Captive Agent vs Independent Agent Infographic

jobdiv.com

jobdiv.com