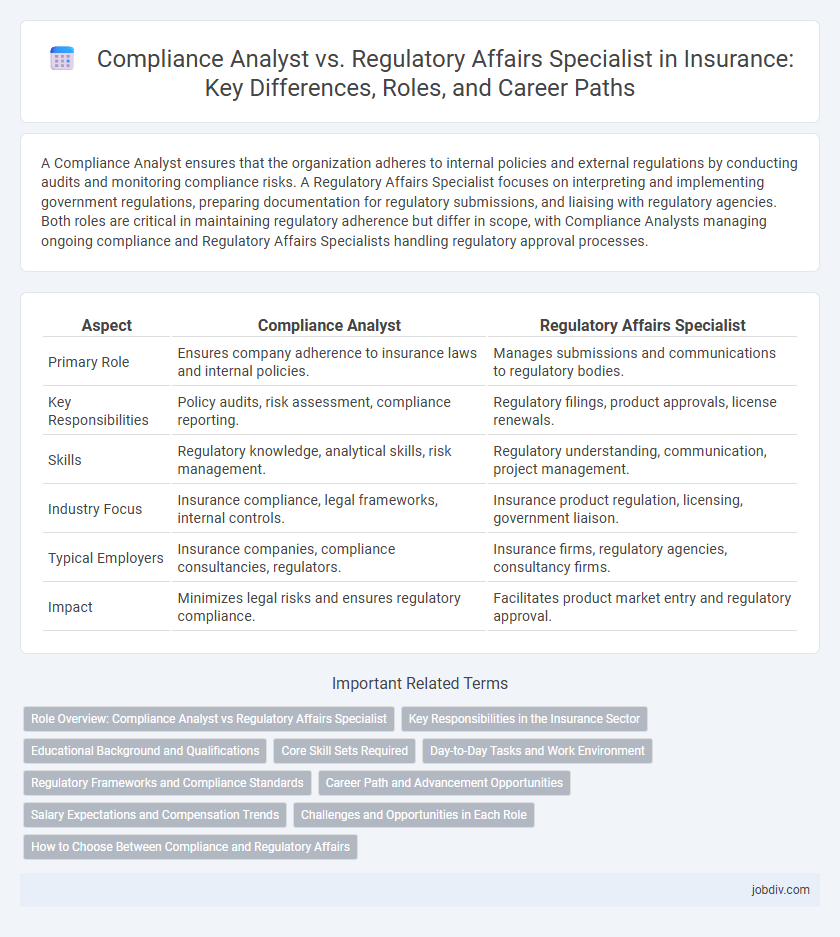

A Compliance Analyst ensures that the organization adheres to internal policies and external regulations by conducting audits and monitoring compliance risks. A Regulatory Affairs Specialist focuses on interpreting and implementing government regulations, preparing documentation for regulatory submissions, and liaising with regulatory agencies. Both roles are critical in maintaining regulatory adherence but differ in scope, with Compliance Analysts managing ongoing compliance and Regulatory Affairs Specialists handling regulatory approval processes.

Table of Comparison

| Aspect | Compliance Analyst | Regulatory Affairs Specialist |

|---|---|---|

| Primary Role | Ensures company adherence to insurance laws and internal policies. | Manages submissions and communications to regulatory bodies. |

| Key Responsibilities | Policy audits, risk assessment, compliance reporting. | Regulatory filings, product approvals, license renewals. |

| Skills | Regulatory knowledge, analytical skills, risk management. | Regulatory understanding, communication, project management. |

| Industry Focus | Insurance compliance, legal frameworks, internal controls. | Insurance product regulation, licensing, government liaison. |

| Typical Employers | Insurance companies, compliance consultancies, regulators. | Insurance firms, regulatory agencies, consultancy firms. |

| Impact | Minimizes legal risks and ensures regulatory compliance. | Facilitates product market entry and regulatory approval. |

Role Overview: Compliance Analyst vs Regulatory Affairs Specialist

A Compliance Analyst monitors and enforces adherence to internal policies and external legal requirements within the insurance industry to mitigate risks and ensure operational integrity. A Regulatory Affairs Specialist focuses on managing submissions, communications, and compliance with government regulations to facilitate product approvals and ongoing regulatory adherence. Both roles require expertise in regulatory frameworks but differ in scope, with Compliance Analysts emphasizing organizational compliance and Regulatory Affairs Specialists prioritizing interactions with regulatory bodies.

Key Responsibilities in the Insurance Sector

Compliance Analysts in the insurance sector focus on monitoring policies and procedures to ensure adherence to regulatory requirements, conducting risk assessments, and implementing internal controls to prevent violations. Regulatory Affairs Specialists manage submissions for regulatory approvals, maintain up-to-date knowledge of evolving insurance laws, and liaise with regulatory bodies to facilitate compliance and reporting. Both roles are essential for maintaining organizational integrity and avoiding penalties, but Compliance Analysts emphasize internal processes while Regulatory Affairs Specialists concentrate on external regulatory communication.

Educational Background and Qualifications

A Compliance Analyst in insurance typically holds a bachelor's degree in finance, business administration, or law, often supplemented by certifications such as Certified Regulatory Compliance Manager (CRCM) or Certified Compliance and Ethics Professional (CCEP). Regulatory Affairs Specialists usually possess degrees in law, public policy, or healthcare administration, with qualifications like Regulatory Affairs Certification (RAC) or specialized training in insurance regulations. Both roles demand strong analytical skills and a deep understanding of industry-specific laws and regulatory frameworks.

Core Skill Sets Required

Compliance analysts in insurance require strong expertise in risk assessment, regulatory frameworks, and data analysis to ensure adherence to industry standards and internal policies. Regulatory affairs specialists demand in-depth knowledge of government regulations, policy interpretation, and stakeholder communication to effectively manage regulatory submissions and maintain compliance. Both roles benefit from proficiency in legal research, attention to detail, and the ability to navigate complex regulatory environments.

Day-to-Day Tasks and Work Environment

Compliance Analysts in insurance monitor internal policies and legal regulations to ensure company adherence, conducting regular audits and preparing detailed reports on compliance status. Regulatory Affairs Specialists focus on interacting with government agencies, reviewing regulatory changes, and preparing documentation required for product approvals and licensing. Both roles typically work in office settings with frequent collaboration across departments, but Compliance Analysts often engage more in data analysis whereas Regulatory Affairs Specialists emphasize communication with external regulatory bodies.

Regulatory Frameworks and Compliance Standards

Compliance Analysts systematically evaluate insurance operations to ensure adherence to regulatory frameworks like GDPR, HIPAA, and state-specific insurance laws, emphasizing risk mitigation and internal controls. Regulatory Affairs Specialists specialize in interpreting and implementing compliance standards set by bodies such as NAIC and OSHA, focusing on policy development and regulatory submissions. Both roles demand comprehensive knowledge of insurance regulations, but Compliance Analysts prioritize ongoing compliance monitoring, while Regulatory Affairs Specialists drive proactive regulatory engagement and strategy.

Career Path and Advancement Opportunities

Compliance Analysts in insurance focus on monitoring internal policies and ensuring adherence to industry regulations, often advancing to roles such as Compliance Manager or Risk Manager. Regulatory Affairs Specialists prioritize managing communication with regulatory bodies and interpreting regulatory changes, with career progression toward Senior Regulatory Affairs Manager or Director of Regulatory Compliance. Both roles offer pathways to executive positions like Chief Compliance Officer, but Compliance Analysts typically advance through risk and audit functions, while Regulatory Affairs Specialists move through policy and strategic regulatory roles.

Salary Expectations and Compensation Trends

Compliance Analysts in insurance typically earn between $60,000 and $85,000 annually, reflecting their role in monitoring adherence to laws and internal policies, while Regulatory Affairs Specialists command higher salaries ranging from $75,000 to $110,000 due to their expertise in navigating complex regulatory frameworks and managing submissions. Compensation trends indicate increasing demand for professionals with specialized knowledge in federal and state insurance regulations, driving salary growth in both roles, but especially for Regulatory Affairs Specialists as insurers face evolving legal challenges. Bonus structures and benefits packages also vary, with Regulatory Affairs Specialists often receiving higher performance-based incentives linked to successful regulatory compliance and approval milestones.

Challenges and Opportunities in Each Role

Compliance Analysts face challenges in interpreting complex insurance regulations and ensuring internal policies align with evolving legal requirements, offering opportunities to enhance risk management frameworks. Regulatory Affairs Specialists navigate intricate government protocols and submission processes, presenting chances to influence policy development and maintain regulatory approval. Both roles demand continuous learning and adaptability to shifting insurance laws, driving career growth through specialized expertise.

How to Choose Between Compliance and Regulatory Affairs

Choosing between a Compliance Analyst and a Regulatory Affairs Specialist in insurance revolves around career focus: Compliance Analysts monitor and enforce internal policies to ensure adherence to legal and industry standards, while Regulatory Affairs Specialists manage submissions and communications with regulatory agencies to maintain product and operational approval. Candidates should evaluate their strengths in analytical auditing and risk management versus skills in regulatory interpretation and strategic regulatory planning. Job growth in compliance roles is driven by increasing regulatory scrutiny, whereas regulatory affairs positions demand expertise in navigating complex approval processes and regulatory landscapes.

Compliance Analyst vs Regulatory Affairs Specialist Infographic

jobdiv.com

jobdiv.com