A loss assessor represents the policyholder, providing expert advice and negotiation support to maximize claim settlements after property damage or loss. A loss adjuster works on behalf of the insurance company, investigating claims to determine the extent of the insurer's liability and ensuring the payout aligns with policy terms. Understanding the distinct roles helps policyholders make informed decisions when navigating the claims process.

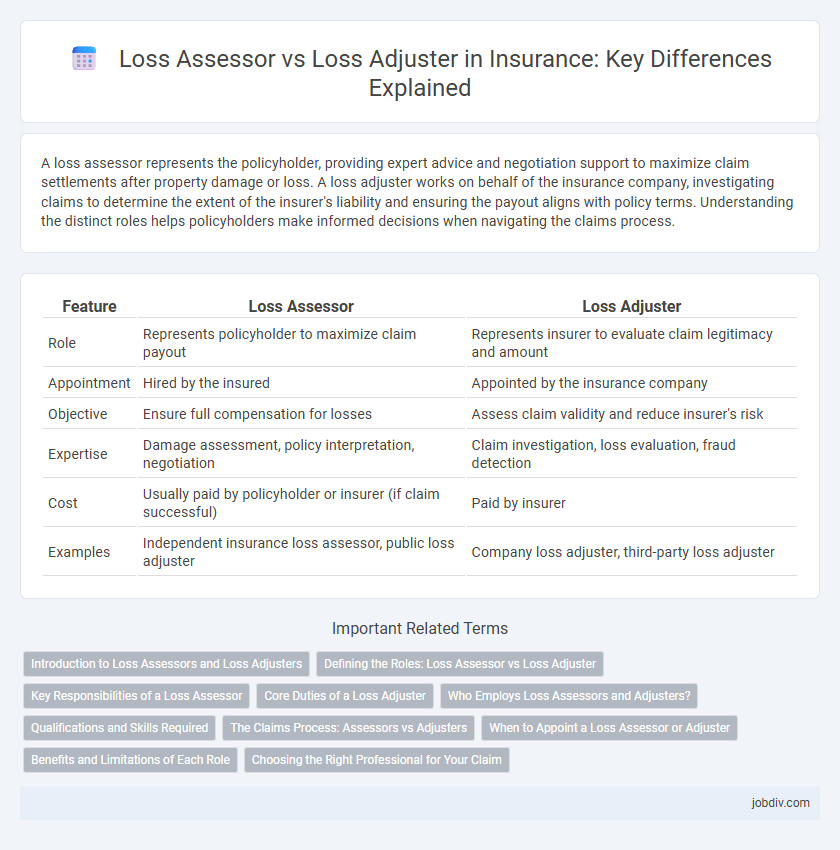

Table of Comparison

| Feature | Loss Assessor | Loss Adjuster |

|---|---|---|

| Role | Represents policyholder to maximize claim payout | Represents insurer to evaluate claim legitimacy and amount |

| Appointment | Hired by the insured | Appointed by the insurance company |

| Objective | Ensure full compensation for losses | Assess claim validity and reduce insurer's risk |

| Expertise | Damage assessment, policy interpretation, negotiation | Claim investigation, loss evaluation, fraud detection |

| Cost | Usually paid by policyholder or insurer (if claim successful) | Paid by insurer |

| Examples | Independent insurance loss assessor, public loss adjuster | Company loss adjuster, third-party loss adjuster |

Introduction to Loss Assessors and Loss Adjusters

Loss assessors are professional experts who represent policyholders during the insurance claims process, helping to assess and negotiate the settlement of claims. Loss adjusters work on behalf of insurance companies to investigate and evaluate claims, ensuring the validity and extent of losses reported. Both play crucial but distinct roles in claim resolution, with assessors focusing on maximizing policyholder compensation and adjusters concentrating on fair claim assessment for insurers.

Defining the Roles: Loss Assessor vs Loss Adjuster

A Loss Assessor represents the policyholder's interests by evaluating insurance claims and negotiating settlements to maximize claim payouts, while a Loss Adjuster acts on behalf of the insurer to investigate, verify, and assess claim validity and the extent of loss. Loss Assessors provide expert advice and support to ensure fair compensation, whereas Loss Adjusters focus on minimizing the insurer's financial exposure by conducting detailed assessments and fraud detection. Understanding the distinct roles is crucial for both insured parties and insurance companies to streamline the claims process and ensure equitable outcomes.

Key Responsibilities of a Loss Assessor

Loss assessors evaluate insurance claims on behalf of policyholders, ensuring fair settlement by thoroughly assessing property damage, loss extent, and relevant policy coverage. They negotiate with insurance companies to maximize claim payouts while providing expert guidance throughout the claims process. Their key responsibilities include detailed damage inspection, accurate loss valuation, claim documentation, and advocating for the insured party's best interests.

Core Duties of a Loss Adjuster

Loss adjusters evaluate insurance claims by investigating policy coverage, assessing damages, and estimating repair or replacement costs to ensure accurate settlements. They liaise with claimants, insurers, and contractors, coordinating inspections and gathering evidence to verify the legitimacy and extent of claims. Their core duty centers on impartial damage assessment and facilitating fair compensation while preventing fraud and minimizing unnecessary payouts.

Who Employs Loss Assessors and Adjusters?

Loss assessors are typically employed by policyholders to represent their interests and ensure fair claim settlements, while loss adjusters work on behalf of insurance companies to investigate and evaluate claims objectively. Loss assessors offer independent expertise to clients, helping navigate complex insurance policies and maximize claim outcomes. Insurance firms rely on loss adjusters to verify claim validity, assess damage, and recommend appropriate claim payments.

Qualifications and Skills Required

Loss assessors typically possess qualifications in insurance claims management, risk assessment, or surveying, often holding certifications from recognized bodies like RICS or ACII. Essential skills include detailed knowledge of policy terms, strong negotiation ability, and expertise in accurately evaluating property damage or loss. In contrast, loss adjusters usually require formal training in insurance law and claims investigation, combined with skills in damage assessment, report writing, and impartial claims evaluation to determine insurer liability.

The Claims Process: Assessors vs Adjusters

Loss assessors and loss adjusters play distinct roles in the insurance claims process, with assessors representing the policyholder to evaluate and negotiate claims, while adjusters act on behalf of the insurer to investigate and determine claim validity. Loss assessors focus on maximizing claim settlements for clients by providing detailed damage assessments and compiling supporting documentation. Loss adjusters analyze claim circumstances, verify coverage terms, and recommend appropriate payout amounts to the insurance company, ensuring claims adhere to policy conditions.

When to Appoint a Loss Assessor or Adjuster

Appoint a loss assessor when you need expert representation to negotiate insurance claims and ensure you receive a fair settlement, especially in complex property damage or business interruption cases. Engage a loss adjuster when the insurer requires an independent evaluation of the claim's validity and extent of loss to determine the payout. Choosing between the two depends on whether you seek claimant advocacy or an impartial third-party assessment during the claims process.

Benefits and Limitations of Each Role

Loss assessors provide personalized claim support by advocating for policyholders to maximize settlement amounts, offering detailed damage assessments and expert negotiations; however, their services may involve additional fees and potential bias toward clients. Loss adjusters operate on behalf of insurance companies to objectively evaluate claims, ensuring accurate damage appraisals and fraud prevention, but their focus can lead to less favorable outcomes for claimants and limited transparency during the claims process. Understanding these roles helps policyholders decide between dedicated advocacy with possible costs versus impartial assessment aligned with insurer interests.

Choosing the Right Professional for Your Claim

Choosing between a loss assessor and a loss adjuster depends on who represents your interests during an insurance claim. A loss assessor works on behalf of the policyholder, providing expert guidance and advocating for maximum compensation. In contrast, a loss adjuster is typically appointed by the insurance company to evaluate the claim objectively and determine the payout amount.

Loss Assessor vs Loss Adjuster Infographic

jobdiv.com

jobdiv.com