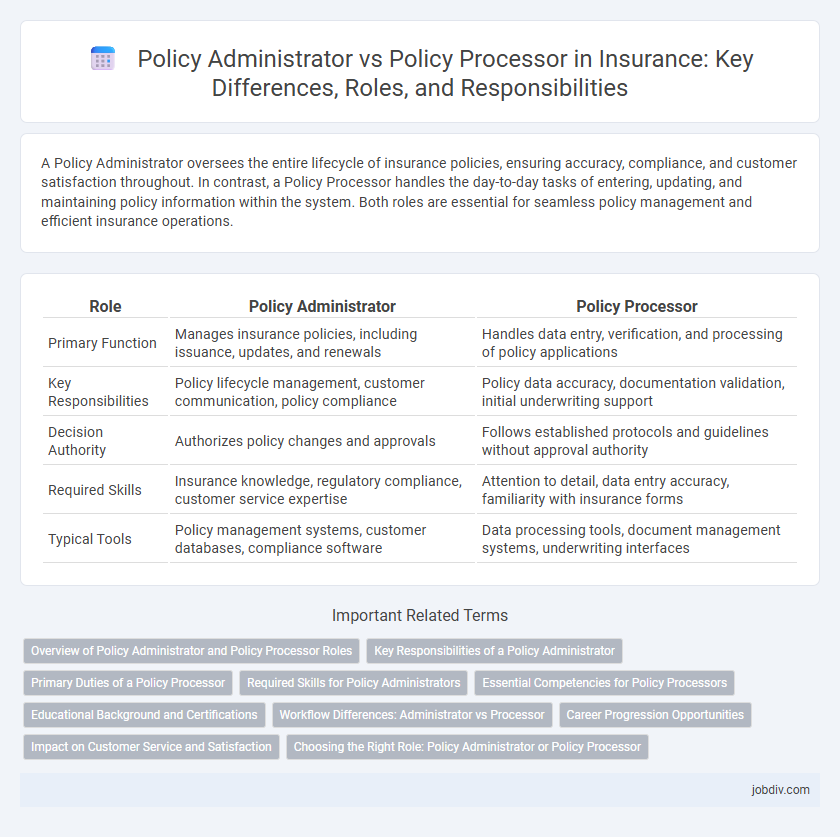

A Policy Administrator oversees the entire lifecycle of insurance policies, ensuring accuracy, compliance, and customer satisfaction throughout. In contrast, a Policy Processor handles the day-to-day tasks of entering, updating, and maintaining policy information within the system. Both roles are essential for seamless policy management and efficient insurance operations.

Table of Comparison

| Role | Policy Administrator | Policy Processor |

|---|---|---|

| Primary Function | Manages insurance policies, including issuance, updates, and renewals | Handles data entry, verification, and processing of policy applications |

| Key Responsibilities | Policy lifecycle management, customer communication, policy compliance | Policy data accuracy, documentation validation, initial underwriting support |

| Decision Authority | Authorizes policy changes and approvals | Follows established protocols and guidelines without approval authority |

| Required Skills | Insurance knowledge, regulatory compliance, customer service expertise | Attention to detail, data entry accuracy, familiarity with insurance forms |

| Typical Tools | Policy management systems, customer databases, compliance software | Data processing tools, document management systems, underwriting interfaces |

Overview of Policy Administrator and Policy Processor Roles

Policy administrators oversee the entire lifecycle of insurance policies, ensuring accuracy in documentation, compliance with regulations, and customer service management. Policy processors handle the technical aspects of policy issuance, including data entry, policy endorsements, and processing claims requests efficiently. Both roles are essential for maintaining smooth insurance operations, with administrators focusing on strategic management and processors on detailed execution.

Key Responsibilities of a Policy Administrator

A Policy Administrator manages the entire lifecycle of insurance policies, including issuing, endorsement processing, renewals, cancellations, and compliance tracking to ensure policy accuracy and regulatory adherence. They maintain detailed records, update policyholder information, and coordinate with underwriters and claims teams to facilitate smooth policy management. Their role emphasizes customer service, resolving policy inquiries, and supporting premium billing and collection processes.

Primary Duties of a Policy Processor

A Policy Processor is primarily responsible for handling the administrative tasks involved in managing insurance policies, including data entry, policy documentation, and updates to policyholder information. They ensure accuracy in policy issuance, endorsements, and renewals while maintaining compliance with regulatory standards. Their role supports underwriting and claims departments by providing precise and timely policy information to facilitate smooth insurance operations.

Required Skills for Policy Administrators

Policy Administrators require strong organizational skills, attention to detail, and proficiency in insurance software to manage policy documentation accurately. Effective communication abilities are essential for handling client inquiries and coordinating between underwriters and claims departments. Analytical skills also play a crucial role in assessing policy compliance and facilitating seamless policy lifecycle management.

Essential Competencies for Policy Processors

Policy processors require strong attention to detail, proficiency in data entry, and thorough understanding of insurance documentation to accurately handle policy transactions. Essential competencies include analytical skills for verifying policy information and compliance knowledge to ensure adherence to regulatory standards. Effective communication and time management are critical for coordinating with underwriters, agents, and clients to facilitate smooth policy administration.

Educational Background and Certifications

Policy Administrators typically hold degrees in business administration, finance, or risk management, coupled with certifications such as CPCU (Chartered Property Casualty Underwriter) or ARM (Associate in Risk Management). Policy Processors generally have a background in insurance or office administration, often supported by certifications like AINS (Associate in General Insurance) or CISR (Certified Insurance Service Representative). The specialized education and advanced certifications of Policy Administrators enable them to manage complex policy portfolios, whereas Policy Processors focus on accurate data entry and documentation processing within insurance operations.

Workflow Differences: Administrator vs Processor

Policy administrators oversee the entire insurance policy lifecycle, including underwriting, issuance, renewals, and compliance monitoring, ensuring policy accuracy and regulatory adherence. Policy processors handle transactional tasks such as data entry, policy updates, endorsements, and claims documentation, focusing on efficient workflow execution. The administrator's workflow emphasizes strategic decision-making and policy management, while the processor concentrates on operational support and process automation.

Career Progression Opportunities

Policy Administrators often have broader career progression opportunities due to their responsibilities in managing client relationships, policy documentation, and compliance oversight, which develop skills applicable to higher-level roles such as risk management or underwriting. Policy Processors typically handle transactional tasks like data entry and policy issuance, offering foundational experience but with fewer upward mobility options without additional training or education. Transitioning from a Policy Processor to a Policy Administrator can enhance career prospects by gaining expertise in policy lifecycle management and regulatory requirements.

Impact on Customer Service and Satisfaction

Policy Administrators play a crucial role in enhancing customer service by managing policy lifecycle events, answering complex queries, and ensuring accurate policy documentation, which leads to higher customer satisfaction. Policy Processors focus on data entry and transaction processing, contributing to quick and error-free policy updates but with limited direct customer interaction. Efficient collaboration between Policy Administrators and Processors ensures faster issue resolution and a seamless customer experience, significantly improving overall customer satisfaction.

Choosing the Right Role: Policy Administrator or Policy Processor

Selecting the appropriate role between a Policy Administrator and a Policy Processor depends on the specific insurance operation needs, as Policy Administrators handle comprehensive policy management including endorsements, renewals, and compliance tracking, while Policy Processors focus on data entry and initial policy setup. Insurance companies benefit from Policy Administrators when requiring detailed oversight and customer interaction, whereas Policy Processors are essential for efficiently processing large volumes of applications and updates. Evaluating workflow complexity, volume of policies, and required expertise ensures optimal alignment with organizational goals in insurance policy management.

Policy Administrator vs Policy Processor Infographic

jobdiv.com

jobdiv.com