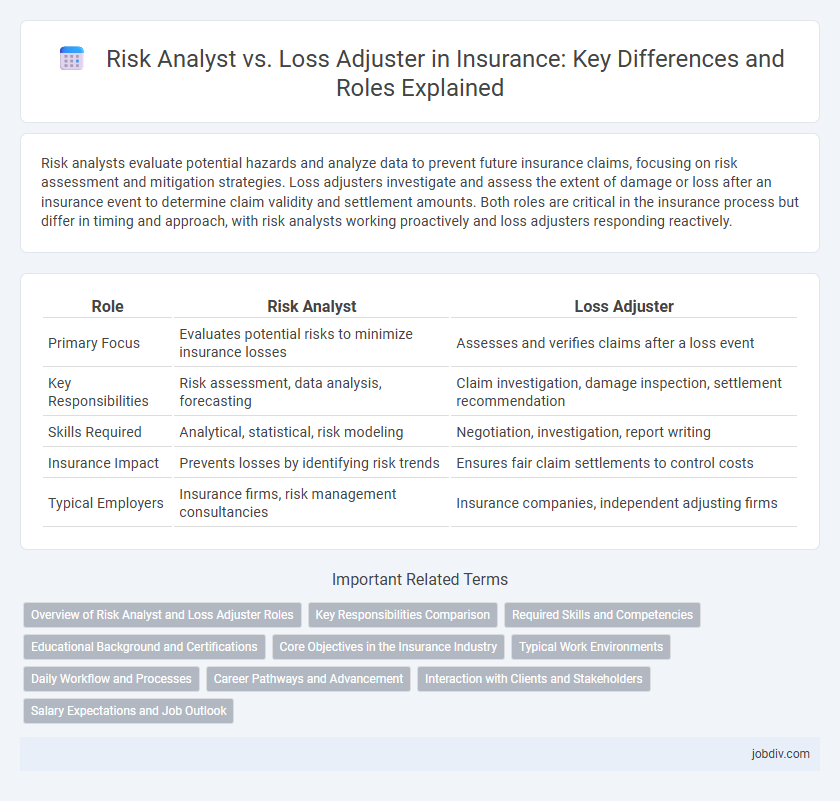

Risk analysts evaluate potential hazards and analyze data to prevent future insurance claims, focusing on risk assessment and mitigation strategies. Loss adjusters investigate and assess the extent of damage or loss after an insurance event to determine claim validity and settlement amounts. Both roles are critical in the insurance process but differ in timing and approach, with risk analysts working proactively and loss adjusters responding reactively.

Table of Comparison

| Role | Risk Analyst | Loss Adjuster |

|---|---|---|

| Primary Focus | Evaluates potential risks to minimize insurance losses | Assesses and verifies claims after a loss event |

| Key Responsibilities | Risk assessment, data analysis, forecasting | Claim investigation, damage inspection, settlement recommendation |

| Skills Required | Analytical, statistical, risk modeling | Negotiation, investigation, report writing |

| Insurance Impact | Prevents losses by identifying risk trends | Ensures fair claim settlements to control costs |

| Typical Employers | Insurance firms, risk management consultancies | Insurance companies, independent adjusting firms |

Overview of Risk Analyst and Loss Adjuster Roles

Risk analysts evaluate potential financial risks by analyzing data, market trends, and insurance policies to help companies mitigate losses. Loss adjusters investigate insurance claims, assess damage, and determine the amount payable to policyholders after an incident occurs. Both roles are crucial in the insurance industry, with risk analysts focusing on prevention and loss adjusters on claim resolution.

Key Responsibilities Comparison

Risk analysts assess potential risks by analyzing data trends and financial implications to develop effective risk mitigation strategies, while loss adjusters investigate insurance claims to evaluate the extent of the insurer's liability. Risk analysts focus on forecasting and preventing losses through risk modeling and policy recommendations, whereas loss adjusters concentrate on claim validation, damage assessment, and negotiation with claimants. Both roles require strong analytical skills, but risk analysts emphasize proactive risk management, and loss adjusters specialize in reactive claim evaluation.

Required Skills and Competencies

Risk Analysts require strong analytical abilities, proficiency in data modeling, and expertise in statistical software to assess potential insurance risks accurately. Loss Adjusters need excellent investigative skills, attention to detail, and effective communication to evaluate claims and negotiate settlements. Both roles demand a solid understanding of insurance policies, regulatory compliance, and industry-specific knowledge to ensure precise risk assessment and claims management.

Educational Background and Certifications

Risk analysts typically possess degrees in finance, economics, statistics, or actuarial science, with certifications such as CFA, FRM, or CAS enhancing their expertise. Loss adjusters often hold backgrounds in insurance, law, or claims management, obtaining certifications like AIC or CPCU to validate their skills. Both roles require continuous professional development to stay current with industry regulations and risk assessment methodologies.

Core Objectives in the Insurance Industry

Risk analysts concentrate on evaluating potential hazards and quantifying risk exposure to inform underwriting decisions and prevent financial loss. Loss adjusters focus on investigating and verifying insurance claims to assess the extent of liability and ensure accurate claim settlements. Both roles are crucial for maintaining financial stability and trust within the insurance industry.

Typical Work Environments

Risk analysts primarily work in corporate offices, insurance companies, and financial institutions where they assess potential risks to minimize losses. Loss adjusters are often found on-site at accident locations, disaster zones, and client properties to investigate, evaluate claims, and negotiate settlements. Both roles require collaboration with underwriters, claims processors, and legal teams but differ significantly in their on-site presence and fieldwork intensity.

Daily Workflow and Processes

Risk analysts primarily evaluate potential risks and develop risk management strategies by analyzing data, market trends, and historical loss information to minimize exposure for insurance companies. Loss adjusters investigate insurance claims by inspecting damages, interviewing claimants, and assessing policy coverage to determine the validity and settlement amounts. While risk analysts focus on preventing losses through predictive assessment, loss adjusters concentrate on verifying and processing claims after incidents occur.

Career Pathways and Advancement

Risk Analysts typically advance by deepening expertise in data analytics, risk modeling, and regulatory compliance, often moving into senior risk management or underwriting roles. Loss Adjusters progress by gaining extensive field experience, building negotiation skills, and developing expertise in claims investigation, enabling transitions into senior claims management or insurance consultancy positions. Both careers offer opportunities for specialization and leadership within insurance companies, with growth linked to certifications like CPCU or AIC.

Interaction with Clients and Stakeholders

Risk analysts collaborate closely with underwriters, brokers, and clients to evaluate potential hazards and define risk exposure, using data-driven assessments to inform insurance terms. Loss adjusters interact directly with policyholders, claimants, and service providers to investigate claims, determine coverage validity, and negotiate settlements. Both roles require strong communication skills, but risk analysts focus on preventative analysis while loss adjusters emphasize post-incident resolution.

Salary Expectations and Job Outlook

Risk analysts in the insurance sector typically earn an average salary ranging from $65,000 to $95,000 annually, reflecting their role in assessing potential risks to minimize financial loss. Loss adjusters, responsible for evaluating insurance claims, tend to have a salary range between $55,000 and $85,000 per year, influenced by experience and location. Job outlook for risk analysts is projected to grow by 7% over the next decade due to increasing demand for risk management, whereas loss adjusters face a moderate growth rate of about 3%, affected by advances in claims automation technology.

Risk Analyst vs Loss Adjuster Infographic

jobdiv.com

jobdiv.com