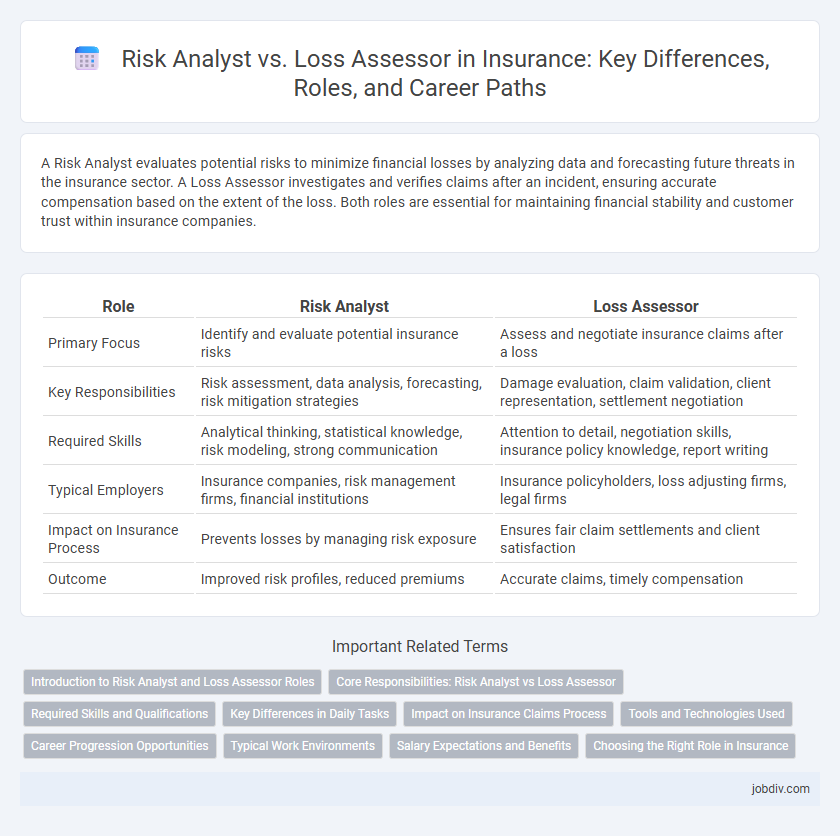

A Risk Analyst evaluates potential risks to minimize financial losses by analyzing data and forecasting future threats in the insurance sector. A Loss Assessor investigates and verifies claims after an incident, ensuring accurate compensation based on the extent of the loss. Both roles are essential for maintaining financial stability and customer trust within insurance companies.

Table of Comparison

| Role | Risk Analyst | Loss Assessor |

|---|---|---|

| Primary Focus | Identify and evaluate potential insurance risks | Assess and negotiate insurance claims after a loss |

| Key Responsibilities | Risk assessment, data analysis, forecasting, risk mitigation strategies | Damage evaluation, claim validation, client representation, settlement negotiation |

| Required Skills | Analytical thinking, statistical knowledge, risk modeling, strong communication | Attention to detail, negotiation skills, insurance policy knowledge, report writing |

| Typical Employers | Insurance companies, risk management firms, financial institutions | Insurance policyholders, loss adjusting firms, legal firms |

| Impact on Insurance Process | Prevents losses by managing risk exposure | Ensures fair claim settlements and client satisfaction |

| Outcome | Improved risk profiles, reduced premiums | Accurate claims, timely compensation |

Introduction to Risk Analyst and Loss Assessor Roles

Risk analysts evaluate potential financial risks and uncertainties within insurance portfolios by analyzing data trends and market conditions to develop risk mitigation strategies. Loss assessors investigate insurance claims by inspecting damages, verifying policy coverage, and estimating repair or replacement costs to ensure accurate claim settlements. Both roles require expertise in risk evaluation but focus respectively on risk prevention and post-incident assessment.

Core Responsibilities: Risk Analyst vs Loss Assessor

Risk analysts specialize in evaluating potential hazards by analyzing data trends, financial reports, and market conditions to forecast and mitigate risks for insurance companies. Loss assessors focus on investigating insurance claims by inspecting damages, verifying policy coverage, and collaborating with claimants to determine fair compensation. While risk analysts prioritize prevention through risk evaluation, loss assessors handle post-event evaluations to ensure accurate claim settlements.

Required Skills and Qualifications

Risk analysts require strong analytical skills, proficiency in statistical software, and expertise in risk assessment methodologies to evaluate potential insurance risks accurately. Loss assessors must have a thorough understanding of insurance policies, excellent negotiation skills, and hands-on experience in damage evaluation to determine claim validity and settlement amounts. Both roles demand solid communication abilities and relevant industry certifications such as CPCU or AIC.

Key Differences in Daily Tasks

Risk Analysts primarily evaluate potential risks by analyzing data trends, forecasting uncertainties, and recommending preventive strategies to minimize insurance claims. Loss Assessors focus on investigating and validating claims by assessing damages, estimating financial losses, and negotiating settlements between insurers and policyholders. While Risk Analysts work proactively to prevent losses, Loss Assessors deal reactively with claims after incidents occur.

Impact on Insurance Claims Process

Risk Analysts evaluate potential insurance claims by assessing the probability and severity of risks before policy issuance, enabling insurers to set accurate premiums and minimize unforeseen losses. Loss Assessors intervene post-incident to investigate, validate, and quantify claim amounts, ensuring fair and timely settlements based on policy terms. Their combined expertise enhances the efficiency of the insurance claims process by balancing proactive risk management with precise claim evaluation.

Tools and Technologies Used

Risk analysts utilize advanced predictive modeling software, data analytics platforms, and machine learning algorithms to evaluate potential risks and forecast claim probabilities. Loss assessors employ damage assessment tools, digital imaging technologies, and specialized claims management systems to accurately evaluate and document insured losses. Both professionals rely on integrated risk management software to streamline communication and ensure precise risk mitigation and claim resolution processes.

Career Progression Opportunities

Risk Analysts advance by developing expertise in data modeling, predictive analytics, and regulatory compliance, paving the way toward roles like Risk Manager or Chief Risk Officer. Loss Assessors enhance their claims evaluation skills and negotiation expertise, often progressing to Senior Loss Assessor or Claims Manager positions. Both career paths offer opportunities for specialization in underwriting, fraud investigation, or insurance consultancy, driven by industry demand and professional certifications.

Typical Work Environments

Risk analysts typically work in corporate offices, insurance companies, and financial institutions where they evaluate potential risks and develop mitigation strategies. Loss assessors often operate on-site at accident scenes, property damage locations, or within insurance claims departments to assess and quantify losses. Both roles require interaction with clients and collaboration with underwriters, adjusters, and legal teams in diverse professional settings.

Salary Expectations and Benefits

Risk Analysts typically earn a median salary ranging from $65,000 to $85,000 annually, with benefits including performance bonuses, health insurance, and retirement plans. Loss Assessors generally receive slightly lower compensation, averaging $55,000 to $75,000 per year, but benefit packages often emphasize travel allowances and comprehensive claim-related professional development. Salary expectations vary based on region, experience, and company size, with Risk Analysts positioned higher due to their strategic role in risk mitigation and financial forecasting.

Choosing the Right Role in Insurance

Risk Analysts evaluate potential hazards and analyze data to forecast insurance risks, guiding premium setting and policy conditions. Loss Assessors specialize in investigating claims to determine the extent of damage and validate the insurer's liability. Choosing the right role depends on whether you prefer predictive data analysis or hands-on claims evaluation within the insurance industry.

Risk Analyst vs Loss Assessor Infographic

jobdiv.com

jobdiv.com