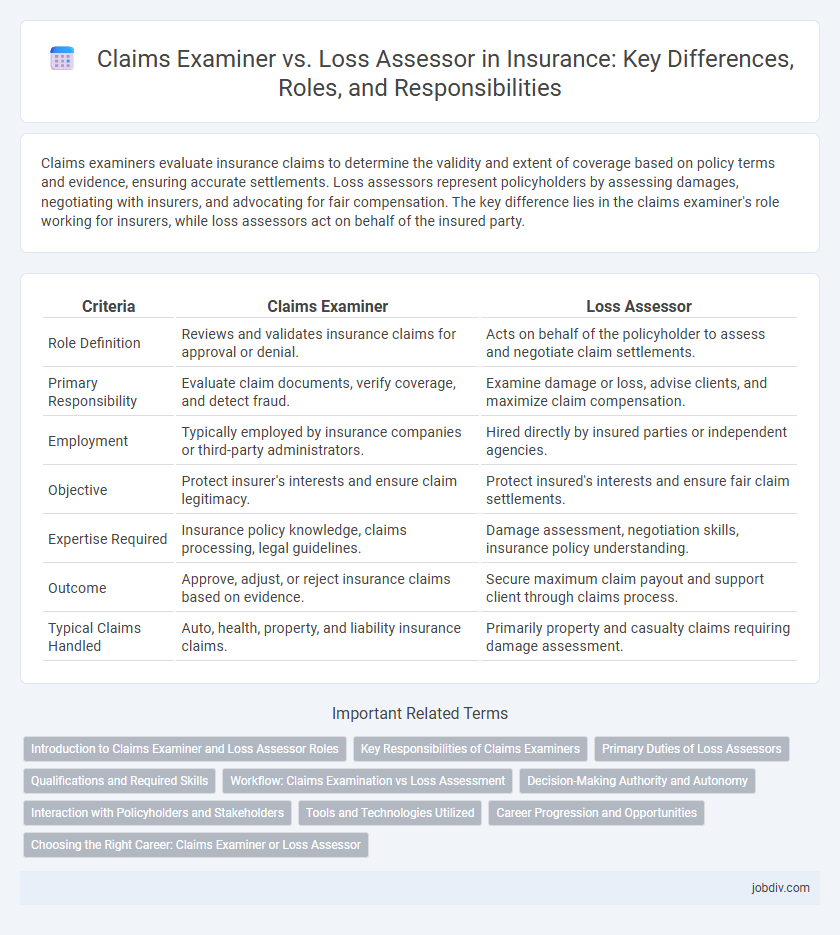

Claims examiners evaluate insurance claims to determine the validity and extent of coverage based on policy terms and evidence, ensuring accurate settlements. Loss assessors represent policyholders by assessing damages, negotiating with insurers, and advocating for fair compensation. The key difference lies in the claims examiner's role working for insurers, while loss assessors act on behalf of the insured party.

Table of Comparison

| Criteria | Claims Examiner | Loss Assessor |

|---|---|---|

| Role Definition | Reviews and validates insurance claims for approval or denial. | Acts on behalf of the policyholder to assess and negotiate claim settlements. |

| Primary Responsibility | Evaluate claim documents, verify coverage, and detect fraud. | Examine damage or loss, advise clients, and maximize claim compensation. |

| Employment | Typically employed by insurance companies or third-party administrators. | Hired directly by insured parties or independent agencies. |

| Objective | Protect insurer's interests and ensure claim legitimacy. | Protect insured's interests and ensure fair claim settlements. |

| Expertise Required | Insurance policy knowledge, claims processing, legal guidelines. | Damage assessment, negotiation skills, insurance policy understanding. |

| Outcome | Approve, adjust, or reject insurance claims based on evidence. | Secure maximum claim payout and support client through claims process. |

| Typical Claims Handled | Auto, health, property, and liability insurance claims. | Primarily property and casualty claims requiring damage assessment. |

Introduction to Claims Examiner and Loss Assessor Roles

Claims Examiners evaluate insurance claims by reviewing policy details and supporting documents to determine the legitimacy and extent of coverage. Loss Assessors act on behalf of policyholders to assess property damage, negotiate settlements, and ensure fair compensation from insurance companies. Both roles require expertise in insurance policies, risk assessment, and regulatory compliance but serve different perspectives within the claims process.

Key Responsibilities of Claims Examiners

Claims Examiners are responsible for reviewing insurance claims to determine their validity and ensuring they comply with policy terms and regulations. They investigate claim details, analyze policy coverage, and authorize payments or denials based on evidence and company guidelines. Their role includes collaborating with policyholders, medical professionals, and legal experts to verify information and resolve discrepancies efficiently.

Primary Duties of Loss Assessors

Loss Assessors primarily evaluate insurance claims by thoroughly investigating damages and compiling detailed reports to support accurate claim settlements. They act as independent advocates for policyholders, ensuring fair compensation and guiding clients through the claims process. Their expertise involves assessing property damage, valuing losses, and negotiating with insurance companies to protect the insured's interests.

Qualifications and Required Skills

Claims examiners typically require a background in insurance, finance, or risk management, along with strong analytical and investigative skills to evaluate policy coverage and determine claim validity. Loss assessors often possess qualifications in loss adjusting or surveying, with expertise in damage assessment, negotiation, and client advocacy to ensure fair claim settlements. Both roles demand attention to detail, excellent communication abilities, and knowledge of relevant insurance laws and regulations.

Workflow: Claims Examination vs Loss Assessment

Claims examiners review and verify insurance claims by analyzing policy details, accident reports, and medical documents to determine coverage eligibility. Loss assessors evaluate the extent of property or casualty damage, estimating repair costs and negotiating settlements with both policyholders and insurers. The workflow of claims examination centers on validating claim legitimacy, while loss assessment focuses on quantifying financial losses for accurate compensation.

Decision-Making Authority and Autonomy

Claims Examiners possess greater decision-making authority and autonomy, as they evaluate insurance claims, determine coverage eligibility, and approve or deny claims based on policy terms and regulations. Loss Assessors primarily function as advocates for policyholders, assessing property damage and estimating repair costs while providing recommendations, but their final decisions typically require insurer approval. The distinction in authority impacts the claims process efficiency, with Claims Examiners holding the power to finalize claim settlements independently.

Interaction with Policyholders and Stakeholders

Claims examiners analyze insurance claims to determine coverage eligibility and liaise directly with policyholders to gather necessary documentation and clarify claim details. Loss assessors independently evaluate property damage and consult with policyholders, insurers, and contractors to estimate repair costs and facilitate fair settlements. Both roles require clear communication with stakeholders to ensure accurate claim processing and resolution.

Tools and Technologies Utilized

Claims Examiners utilize advanced claims management software and data analytics tools to evaluate insurance claims efficiently, focusing on accuracy and fraud detection. Loss Assessors rely on specialized damage assessment technologies, such as drone surveys, 3D imaging, and mobile apps, to provide detailed property or casualty evaluations. Both roles integrate industry-specific databases and digital communication platforms to streamline the claims process and improve customer service outcomes.

Career Progression and Opportunities

Claims Examiners typically progress by gaining expertise in claim analysis, advancing to senior examiner or claims manager roles with opportunities to specialize in complex claims or regulatory compliance. Loss Assessors build career growth through experience in damage evaluation and negotiation skills, often moving into senior assessor, risk management, or consultancy positions within insurance firms or independent agencies. Both career paths offer upward mobility, with Claims Examiners focusing more on claim validation processes and Loss Assessors on on-site damage assessment, influencing their unique progression and specialization opportunities.

Choosing the Right Career: Claims Examiner or Loss Assessor

Claims Examiners investigate insurance claims to verify coverage, assess damages, and determine claim validity, often requiring strong analytical and communication skills to interact with claimants and insurance companies. Loss Assessors work on behalf of policyholders, providing expert advice, evaluating losses, and negotiating settlements to maximize claim payouts, which demands detailed knowledge of insurance policies and strong negotiation abilities. Choosing between a Claims Examiner and a Loss Assessor depends on whether you prefer working directly for insurance companies or advocating for clients, alongside your interest in investigative analysis versus client representation.

Claims Examiner vs Loss Assessor Infographic

jobdiv.com

jobdiv.com