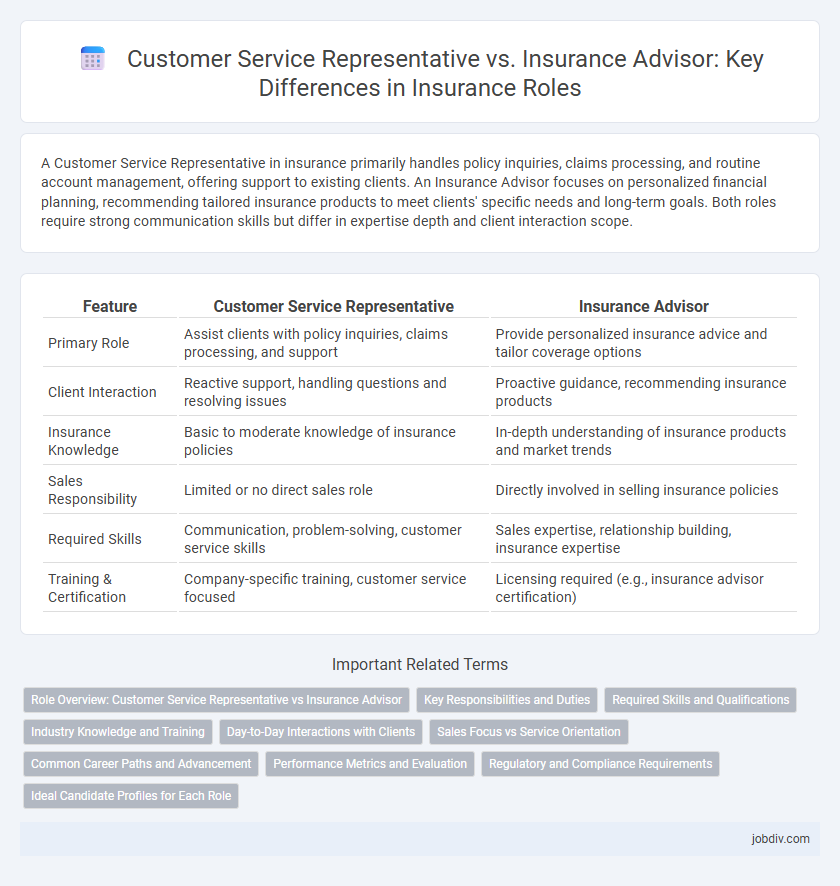

A Customer Service Representative in insurance primarily handles policy inquiries, claims processing, and routine account management, offering support to existing clients. An Insurance Advisor focuses on personalized financial planning, recommending tailored insurance products to meet clients' specific needs and long-term goals. Both roles require strong communication skills but differ in expertise depth and client interaction scope.

Table of Comparison

| Feature | Customer Service Representative | Insurance Advisor |

|---|---|---|

| Primary Role | Assist clients with policy inquiries, claims processing, and support | Provide personalized insurance advice and tailor coverage options |

| Client Interaction | Reactive support, handling questions and resolving issues | Proactive guidance, recommending insurance products |

| Insurance Knowledge | Basic to moderate knowledge of insurance policies | In-depth understanding of insurance products and market trends |

| Sales Responsibility | Limited or no direct sales role | Directly involved in selling insurance policies |

| Required Skills | Communication, problem-solving, customer service skills | Sales expertise, relationship building, insurance expertise |

| Training & Certification | Company-specific training, customer service focused | Licensing required (e.g., insurance advisor certification) |

Role Overview: Customer Service Representative vs Insurance Advisor

Customer Service Representatives in insurance primarily handle inquiries, process claims, and provide policy information to clients, ensuring smooth day-to-day operations. Insurance Advisors focus on evaluating clients' needs, recommending suitable insurance products, and tailoring coverage plans to individual financial goals. The former emphasizes transactional support and customer satisfaction, while the latter offers personalized advice and strategic financial protection solutions.

Key Responsibilities and Duties

Customer Service Representatives in insurance handle client inquiries, process claims, and update policy information to ensure smooth communication and customer satisfaction. Insurance Advisors specialize in assessing client needs, recommending suitable insurance products, and providing tailored financial advice to optimize coverage. While Customer Service Representatives focus on administrative support, Insurance Advisors prioritize strategic consultation and personalized policy planning.

Required Skills and Qualifications

Customer Service Representatives in insurance typically require strong communication skills, problem-solving abilities, and a high school diploma or equivalent, with on-the-job training for policy details and claims processing. Insurance Advisors demand advanced knowledge of insurance products, sales expertise, and often a bachelor's degree or relevant certifications such as the Certified Insurance Counselor (CIC) or Chartered Property Casualty Underwriter (CPCU) designation. Both roles benefit from proficiency in customer relationship management (CRM) software and regulatory compliance understanding specific to insurance laws.

Industry Knowledge and Training

Customer Service Representatives in insurance primarily handle policy inquiries, claims processing, and basic customer support, requiring foundational industry knowledge and training in communication and administrative tasks. Insurance Advisors possess advanced expertise in insurance products, risk assessment, and regulatory compliance, often holding certifications such as CISR or LUTCF to tailor coverage solutions for clients. Comprehensive training programs for advisors emphasize in-depth market analysis and personalized financial planning, distinguishing their role from the more operational focus of Customer Service Representatives.

Day-to-Day Interactions with Clients

Customer Service Representatives in insurance handle routine inquiries, policy updates, and claims processing, ensuring clients receive timely and accurate information. Insurance Advisors focus on personalized risk assessment, policy recommendations, and long-term financial planning tailored to individual client needs. Both roles require strong communication skills, but Advisors engage in in-depth consultations while Representatives typically manage standardized service requests and problem resolution.

Sales Focus vs Service Orientation

Customer Service Representatives in insurance primarily emphasize service orientation by addressing policyholder inquiries, processing claims, and ensuring client satisfaction. Insurance Advisors focus on sales by identifying client needs, recommending suitable insurance products, and driving new business growth. The distinction lies in customer service representatives maintaining existing client relationships, while insurance advisors actively pursue policy sales and portfolio expansion.

Common Career Paths and Advancement

Customer Service Representatives in insurance often start by handling client inquiries, claims processing, and policy management, gaining foundational knowledge of company products. Insurance Advisors typically advance by developing expertise in risk assessment and personalized policy recommendations, leading to roles such as senior advisor or sales manager. Both career paths offer opportunities for specialization in areas like underwriting or claims adjustment, with progression dependent on certifications and industry experience.

Performance Metrics and Evaluation

Customer Service Representatives in insurance are primarily evaluated based on metrics such as call resolution time, customer satisfaction scores, and adherence to communication protocols. Insurance Advisors face performance assessments centered on policy sales conversions, client retention rates, and the accuracy of coverage recommendations. Both roles rely on quantitative and qualitative data to measure effectiveness, but advisors have a stronger focus on financial impact and personalized client outcomes.

Regulatory and Compliance Requirements

Customer Service Representatives in insurance primarily handle client inquiries and process claims while strictly adhering to regulatory guidelines to ensure accurate documentation and data privacy. Insurance Advisors must possess detailed knowledge of compliance standards such as the Insurance Distribution Directive (IDD) or state-specific licensing laws to provide tailored advice legally and ethically. Both roles require ongoing training on regulatory updates to maintain certifications and avoid penalties related to non-compliance.

Ideal Candidate Profiles for Each Role

Customer Service Representatives in insurance excel with strong communication skills, problem-solving abilities, and a patient, empathetic demeanor to handle policy inquiries and claims efficiently. Ideal candidates for Insurance Advisor roles demonstrate deep industry knowledge, persuasive sales skills, and the capability to tailor financial protection solutions to diverse client needs. Both roles require attention to detail and regulatory compliance awareness, but Advisors benefit from advanced certifications such as CIC or LUTCF to build client trust and credibility.

Customer Service Representative vs Insurance Advisor Infographic

jobdiv.com

jobdiv.com