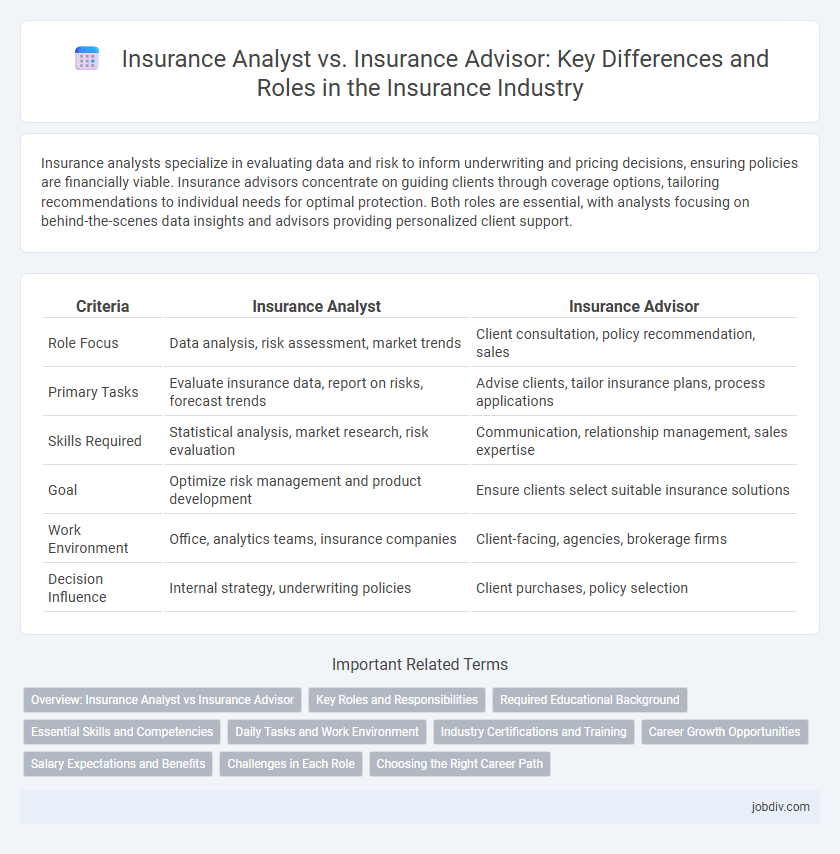

Insurance analysts specialize in evaluating data and risk to inform underwriting and pricing decisions, ensuring policies are financially viable. Insurance advisors concentrate on guiding clients through coverage options, tailoring recommendations to individual needs for optimal protection. Both roles are essential, with analysts focusing on behind-the-scenes data insights and advisors providing personalized client support.

Table of Comparison

| Criteria | Insurance Analyst | Insurance Advisor |

|---|---|---|

| Role Focus | Data analysis, risk assessment, market trends | Client consultation, policy recommendation, sales |

| Primary Tasks | Evaluate insurance data, report on risks, forecast trends | Advise clients, tailor insurance plans, process applications |

| Skills Required | Statistical analysis, market research, risk evaluation | Communication, relationship management, sales expertise |

| Goal | Optimize risk management and product development | Ensure clients select suitable insurance solutions |

| Work Environment | Office, analytics teams, insurance companies | Client-facing, agencies, brokerage firms |

| Decision Influence | Internal strategy, underwriting policies | Client purchases, policy selection |

Overview: Insurance Analyst vs Insurance Advisor

Insurance Analysts primarily evaluate data related to insurance policies, claims, and market trends to assess risk and improve financial outcomes for insurance companies. Insurance Advisors focus on guiding clients through policy selection, offering personalized recommendations based on individual needs and coverage options. Both roles require strong knowledge of insurance products, but Analysts emphasize data-driven insights while Advisors prioritize client relationship management.

Key Roles and Responsibilities

Insurance Analysts evaluate risk data and financial reports to support underwriting decisions, develop pricing strategies, and forecast policy profitability. Insurance Advisors provide personalized policy recommendations, assist clients in selecting appropriate coverage, and ensure compliance with regulatory requirements while addressing client needs. Both roles require strong analytical skills, but Analysts focus on data-driven risk assessment, whereas Advisors emphasize client relationship management and tailored insurance solutions.

Required Educational Background

An Insurance Analyst typically requires a bachelor's degree in finance, economics, or business administration, with strong analytical and statistical skills to evaluate risk and market trends. An Insurance Advisor generally needs a background in finance, business, or insurance, often supplemented by industry-specific certifications such as the Chartered Insurance Professional (CIP) designation. Both roles benefit from continuing education and specialized training to stay current with regulatory changes and insurance products.

Essential Skills and Competencies

Insurance analysts require strong analytical skills, proficiency in data interpretation, and expertise in risk assessment to evaluate insurance policies and forecast trends accurately. Insurance advisors must possess excellent communication skills, client-focused problem-solving abilities, and in-depth knowledge of insurance products to tailor recommendations to individual client needs. Both roles demand a solid understanding of insurance regulations, market dynamics, and attention to detail for ensuring compliance and optimal policy management.

Daily Tasks and Work Environment

Insurance analysts evaluate data to assess risk, develop pricing models, and produce reports that guide underwriting decisions, often working in office settings with access to extensive databases and analytical software. Insurance advisors interact directly with clients, providing personalized policy recommendations, explaining coverage options, and managing client relationships, typically in both office environments and field settings. While analysts focus on quantitative risk assessment and market research, advisors prioritize communication, customer service, and sales within the insurance industry.

Industry Certifications and Training

Insurance Analysts typically hold certifications such as the Chartered Property Casualty Underwriter (CPCU) and Certified Insurance Counselor (CIC), emphasizing risk assessment and data analysis skills. Insurance Advisors often pursue credentials like the Certified Financial Planner (CFP) or Life Underwriter Training Council Fellow (LUTCF), focusing on client consultation and financial planning expertise. Both roles require ongoing training to stay current with regulatory changes, underwriting principles, and market trends in the insurance industry.

Career Growth Opportunities

Insurance Analysts specialize in data interpretation and risk assessment, leveraging statistical tools to support underwriting and claims decisions, which opens paths to advanced roles in actuarial science or risk management. Insurance Advisors focus on client relationships and personalized policy recommendations, with career growth often progressing toward senior advisory positions or management in sales and client services. Both roles offer distinct trajectories, with Analysts advancing through technical expertise and Advisors developing leadership and client engagement skills.

Salary Expectations and Benefits

Insurance Analysts typically earn a median salary ranging from $60,000 to $85,000 annually, reflecting their expertise in data analysis and risk assessment, while Insurance Advisors usually have a broader salary range from $50,000 to $100,000, influenced by commission-based earnings and client portfolios. Benefits for Insurance Analysts often emphasize professional development, health insurance, and retirement plans, whereas Insurance Advisors may receive performance bonuses, flexible work schedules, and client incentive programs. Salary expectations vary significantly with experience, location, and specific roles, making both positions potentially lucrative within the insurance industry.

Challenges in Each Role

Insurance analysts face challenges in interpreting complex data sets and predicting market risks to inform underwriting decisions, requiring strong analytical skills and industry knowledge. Insurance advisors struggle with understanding diverse client needs and navigating regulatory changes while providing personalized policy recommendations, demanding exceptional interpersonal and compliance expertise. Both roles must continuously adapt to evolving insurance products and fluctuating economic conditions to remain effective.

Choosing the Right Career Path

Insurance analysts focus on evaluating risks, analyzing data trends, and assessing policy performance to support underwriting and claims decisions. Insurance advisors prioritize client engagement, offering personalized coverage recommendations and helping customers navigate policy options to meet their financial protection needs. Choosing the right career path depends on whether you prefer data-driven analysis and risk assessment or direct client interaction and advisory services within the insurance sector.

Insurance Analyst vs Insurance Advisor Infographic

jobdiv.com

jobdiv.com